-

×

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00 -

×

Gann’s Scientific Methods Unveiled (Vol I, II)

1 × $6.00

Gann’s Scientific Methods Unveiled (Vol I, II)

1 × $6.00 -

×

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

Acclimation Course with Base Camp Trading

1 × $10.00

Acclimation Course with Base Camp Trading

1 × $10.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00 -

×

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Binary Trigger (Video, Books) with John Piper

1 × $6.00

The Binary Trigger (Video, Books) with John Piper

1 × $6.00 -

×

TraderSumo Academy Course

1 × $13.00

TraderSumo Academy Course

1 × $13.00 -

×

Superstructure Trading - 5 DVDs + Manual + 1 BONUS DVD 2010 Live Trading Webinars with Ken Chow

1 × $6.00

Superstructure Trading - 5 DVDs + Manual + 1 BONUS DVD 2010 Live Trading Webinars with Ken Chow

1 × $6.00 -

×

Forex Project Advanced Course with Tyler Crowell

1 × $5.00

Forex Project Advanced Course with Tyler Crowell

1 × $5.00 -

×

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Sure Fire Forex Trading with Mark McRae

1 × $6.00

Sure Fire Forex Trading with Mark McRae

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00 -

×

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

European Members - March 2023 with Stockbee

1 × $5.00

European Members - March 2023 with Stockbee

1 × $5.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00 -

×

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00 -

×

The Trading Masterclass with Chris Capre

1 × $23.00

The Trading Masterclass with Chris Capre

1 × $23.00 -

×

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

The Master Trader Bundle with Gareth Soloway

1 × $39.00

The Master Trader Bundle with Gareth Soloway

1 × $39.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Trade the OEX with Arthur Darack

1 × $6.00

Trade the OEX with Arthur Darack

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00 -

×

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00 -

×

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00 -

×

Fast Start Barter System with Bob Meyer

1 × $31.00

Fast Start Barter System with Bob Meyer

1 × $31.00 -

×

Staying Out of Trouble Trading Currency with Channels - Barbara Rockefeller

1 × $6.00

Staying Out of Trouble Trading Currency with Channels - Barbara Rockefeller

1 × $6.00 -

×

Japanese Trading Systems with Tradesmart University

1 × $9.00

Japanese Trading Systems with Tradesmart University

1 × $9.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Fibonacci Analysis with Constance Brown

1 × $6.00

Fibonacci Analysis with Constance Brown

1 × $6.00 -

×

The Complete Turtle Trader with Michael Covel

1 × $6.00

The Complete Turtle Trader with Michael Covel

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

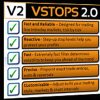

VSTOPS ProTrader Strategy (Nov 2013)

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

SKU: Ttz- 10346HPgJAj9t

Category: Forex Trading

VSTOPS ProTrader Strategy (Nov 2013): Mastering Market Movements

The VSTOPS ProTrader Strategy released in November 2013 is a powerful tool for traders aiming to maximize their market efficiency. This strategy combines advanced technical indicators and risk management principles to offer a robust trading approach. In this article, we delve into the key components of the VSTOPS ProTrader Strategy, providing insights on how to implement it effectively for enhanced trading performance.

Introduction to VSTOPS ProTrader Strategy

What is VSTOPS ProTrader Strategy?

The VSTOPS ProTrader Strategy is a trading method that uses Volatility Stop (VSTOP) indicators to help traders identify optimal entry and exit points in the market. It is designed to adapt to changing market conditions, making it a versatile tool for traders.

Why Use VSTOPS ProTrader Strategy?

- Precision: Offers precise signals for market entries and exits.

- Adaptability: Adjusts to market volatility, ensuring relevance in different market conditions.

- Risk Management: Incorporates risk management techniques to protect capital.

Core Components of VSTOPS ProTrader Strategy

Volatility Stops (VSTOP) Indicator

Understanding VSTOP

- Definition: VSTOP is a dynamic indicator that adjusts stop-loss levels based on market volatility.

- Calculation: It uses the Average True Range (ATR) to determine the volatility and adjusts the stop-loss accordingly.

Benefits of VSTOP

- Dynamic Adjustment: Automatically adapts to market conditions.

- Enhanced Protection: Helps in setting effective stop-losses to protect against market reversals.

Technical Analysis Tools

Moving Averages

- Simple Moving Average (SMA): Smooths out price data to identify trends.

- Exponential Moving Average (EMA): Gives more weight to recent prices for a more responsive indicator.

Oscillators

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- Moving Average Convergence Divergence (MACD): Indicates potential buy and sell signals through trend-following momentum.

Risk Management Principles

Position Sizing

- Importance: Determines the size of a trade based on risk tolerance and capital.

- Method: Use fixed percentage or fixed dollar amount per trade.

Stop-Loss Orders

- Setting Stop-Loss: Place stop-loss orders based on VSTOP levels to limit potential losses.

- Adjusting Stop-Loss: Modify stop-loss levels as the trade progresses to lock in profits.

Implementing VSTOPS ProTrader Strategy

Step-by-Step Guide

Step 1: Set Up Your Trading Platform

- Select a Platform: Use a trading platform that supports VSTOP and other technical indicators.

- Configure Indicators: Add VSTOP, SMA, EMA, RSI, and MACD to your charts.

Step 2: Identify Entry Points

- Trend Confirmation: Use moving averages to confirm the market trend.

- Signal Generation: Wait for VSTOP to signal an entry point aligned with the trend direction.

Step 3: Execute Trades

- Place Orders: Execute buy or sell orders based on the VSTOP signals.

- Set Stop-Loss: Place stop-loss orders at the VSTOP levels.

Step 4: Monitor and Adjust

- Track Performance: Continuously monitor trades and adjust stop-loss levels.

- Exit Strategy: Use VSTOP signals and other indicators to determine exit points.

Advantages of VSTOPS ProTrader Strategy

Consistency

- Regular Updates: Adapts to market changes, providing consistent performance.

- Reliable Signals: Generates dependable buy and sell signals.

Flexibility

- Various Markets: Applicable to different markets including stocks, forex, and commodities.

- Different Timeframes: Suitable for various trading timeframes from intraday to long-term.

Enhanced Risk Management

- Controlled Risk: Effective stop-loss management helps in controlling risk.

- Capital Protection: Focus on protecting capital while seeking growth.

Common Challenges and Solutions

Overtrading

- Avoidance: Stick to the strategy rules and avoid trading based on emotions or hunches.

Ignoring Stop-Loss

- Discipline: Always adhere to the stop-loss levels set by the VSTOP to prevent significant losses.

Market Volatility

- Adaptability: Trust in the VSTOP’s ability to adjust according to market volatility.

Real-World Applications

Case Study: Successful Implementation

- Background: Trader A used the VSTOPS ProTrader Strategy over six months.

- Outcome: Achieved consistent profits by following the strategy’s signals and managing risk effectively.

Case Study: Risk Management Focus

- Background: Trader B implemented the strategy with a strong emphasis on risk management.

- Outcome: Minimized losses and protected capital during volatile market conditions.

Conclusion

The VSTOPS ProTrader Strategy (Nov 2013) is a comprehensive and adaptable trading method that enhances market precision and risk management. By integrating VSTOP with other technical indicators and adhering to robust risk management principles, traders can achieve consistent and reliable trading performance. Embrace the VSTOPS ProTrader Strategy to elevate your trading approach and navigate the markets with confidence.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns.

2. The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access.

3. Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “VSTOPS ProTrader Strategy (Nov 2013)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.