-

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

501 Stock Market Tips & Guidelines with Arshad Khan

1 × $6.00

501 Stock Market Tips & Guidelines with Arshad Khan

1 × $6.00 -

×

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Trading From Your Gut with Curtis Faith

1 × $6.00

Trading From Your Gut with Curtis Faith

1 × $6.00 -

×

Supply And Demand Zone Trading Course with Trading180

1 × $5.00

Supply And Demand Zone Trading Course with Trading180

1 × $5.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00 -

×

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00 -

×

The Complete Turtle Trader with Michael Covel

1 × $6.00

The Complete Turtle Trader with Michael Covel

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The 4 Horsemen CD with David Elliott

1 × $6.00

The 4 Horsemen CD with David Elliott

1 × $6.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00 -

×

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

3 Volatility Strategies with Quantified Strategies

$349.00 Original price was: $349.00.$23.00Current price is: $23.00.

File Size: 5.01 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

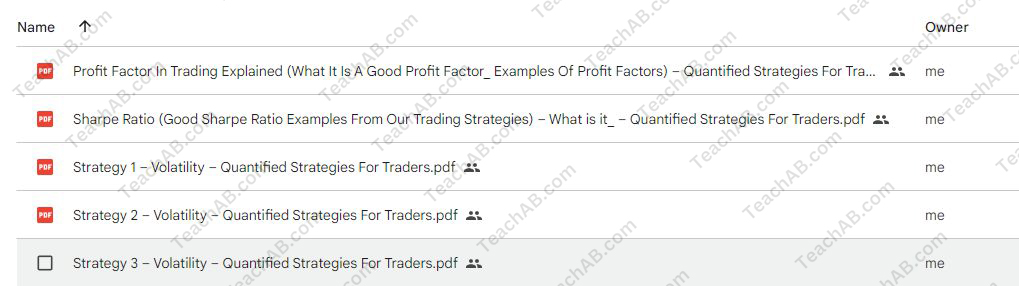

You may check content proof of “3 Volatility Strategies with Quantified Strategies” below:

3 Volatility Strategies with Quantified Strategies

Introduction

In the dynamic world of trading, understanding and leveraging volatility can lead to significant gains. We explore three quantified strategies designed to help traders not just survive but thrive in volatile markets. Each strategy is backed by data-driven insights, providing a robust foundation for making informed trading decisions.

Understanding Market Volatility

Before diving into the strategies, it’s crucial to grasp what market volatility is and why it matters. Volatility refers to the rate at which the price of a security increases or decreases for a given set of returns. High volatility means that a security’s price can change dramatically over a short period in either direction, which can be both an opportunity and a risk.

Why Trade Volatility?

Trading volatility offers the potential for high returns, especially when markets are unpredictable. By mastering volatility trading strategies, we can capitalize on market inefficiencies.

Strategy 1: The Mean Reversion Setup

The mean reversion theory is based on the premise that prices and returns eventually move back towards the mean or average. This strategy is particularly effective in volatile markets.

How to Implement the Mean Reversion Strategy

- Identify Overextended Prices: Look for prices that have moved significantly away from their historical averages.

- Setup Entry and Exit Points: Use technical indicators to determine when to enter and exit trades.

- Risk Management: Set stop-loss orders to manage potential losses effectively.

Tools and Indicators

- Bollinger Bands

- Moving Average Convergence Divergence (MACD)

- Relative Strength Index (RSI)

Strategy 2: The Breakout Strategy

This strategy capitalizes on moments when the price breaks out from its existing range or pattern, often due to increased volatility.

Implementing the Breakout Strategy

- Identify Key Levels: Focus on levels of support and resistance.

- Wait for the Breakout: Enter the trade when the price moves beyond these levels.

- Follow Through: Ensure the breakout is supported by high volume, indicating strength.

Key Considerations

- False breakouts can occur, so it’s important to confirm breakouts with additional signals.

Strategy 3: The Momentum Ignition Strategy

Momentum ignition strategies aim to capitalize on the acceleration of an asset’s price movement in a particular direction.

Steps to Execute the Momentum Ignition Strategy

- Identify Momentum Build-Up: Look for signs that the price is about to make a big move.

- Entry Strategy: Enter the trade after confirming the momentum direction.

- Monitoring and Exit: Monitor the trade closely and exit at pre-defined profit targets.

Effective Tools for Momentum Trading

- Stochastic Oscillator

- Average Directional Index (ADI)

Integrating Advanced Technology

Leveraging advanced technology such as algorithmic trading can enhance the effectiveness of these strategies by increasing execution speed and minimizing errors.

Algorithmic Trading and Its Benefits

- Speed: Faster order execution.

- Precision: Accurate entry and exit points.

- Consistency: Reduces human emotional involvement.

Conclusion

Understanding and implementing these three volatility trading strategies can significantly enhance your trading performance. Whether it’s the mean reversion, the breakout strategy, or momentum ignition, each has its unique approach to capitalizing on market movements. With the right tools and a disciplined approach, these strategies offer a pathway to potential profitability in volatile markets.

FAQs

- What is market volatility? Market volatility refers to the fluctuation in the price of securities within a short period.

- Which volatility strategy is best for beginners? The mean reversion strategy is often recommended for beginners due to its straightforward approach.

- How important is risk management in volatility trading? Extremely important; it helps mitigate potential losses during unexpected market movements.

- Can these strategies be automated? Yes, all three strategies can be automated using algorithmic trading systems.

- How do I test these strategies without risking capital? Simulated trading or paper trading platforms allow for risk-free strategy testing.

Be the first to review “3 Volatility Strategies with Quantified Strategies” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.