-

×

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00 -

×

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00 -

×

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00 -

×

Financial Astrology Course with Brian James Sklenka

1 × $6.00

Financial Astrology Course with Brian James Sklenka

1 × $6.00 -

×

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00 -

×

The TradingKey - Mastering Elliott Wave by Rob Roy 2010 + Complete Workbooks with HUBB Financial

1 × $6.00

The TradingKey - Mastering Elliott Wave by Rob Roy 2010 + Complete Workbooks with HUBB Financial

1 × $6.00 -

×

The Hindenburg Strategy with Todd Mitchell

1 × $23.00

The Hindenburg Strategy with Todd Mitchell

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00 -

×

The Heretics of Finance with Andrew Lo & Jasmina Hasanhodzic

1 × $4.00

The Heretics of Finance with Andrew Lo & Jasmina Hasanhodzic

1 × $4.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

Essential Skills for Consistency in Trading Class with Don Kaufman

1 × $6.00

Essential Skills for Consistency in Trading Class with Don Kaufman

1 × $6.00 -

×

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00 -

×

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Trading Non-Farm Payroll Report

1 × $6.00

Trading Non-Farm Payroll Report

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Sovereign Man Confidential

1 × $6.00

Sovereign Man Confidential

1 × $6.00

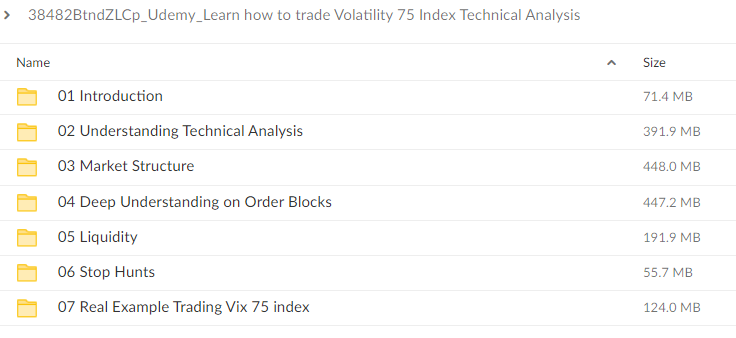

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

$89.00 Original price was: $89.00.$6.00Current price is: $6.00.

File Size: 1.69 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke” below:

Learn How to Trade Volatility 75 Index Technical Analysis with Patrick Muke

Introduction

The Volatility 75 Index, often referred to as VIX 75, is a measure of market volatility and has become a favorite among traders who thrive on rapid market movements. Patrick Muke, a renowned expert in technical analysis, has developed specific strategies that help traders navigate the complexities of this volatile index. This article will guide you through the fundamentals of trading VIX 75 using technical analysis as taught by Patrick Muke.

Understanding the Volatility 75 Index

Before diving into the strategies, it’s crucial to understand what VIX 75 represents and why it is a significant tool for market predictions.

What is the Volatility 75 Index?

- Definition: VIX 75 measures the market’s expectation of volatility over the coming 30 days.

- Importance: It is often called the “fear gauge” because it typically increases when market sentiment is poor.

Characteristics of VIX 75

- High Volatility: This index is particularly volatile, which can lead to significant trading opportunities.

- Non-directional: It measures volatility, not direction, making it unique compared to other financial indices.

Patrick Muke’s Approach to VIX 75

Patrick Muke emphasizes a disciplined approach to trading the VIX 75, using technical analysis to make informed decisions.

Core Principles of Muke’s Strategy

- Technical Indicators: Focuses on indicators that are best suited for volatile markets.

- Risk Management: Prioritizes strategies to minimize losses in a highly unpredictable market.

Technical Analysis Tools for VIX 75

Choosing the Right Indicators

- Relative Strength Index (RSI): Determines overbought or oversold conditions.

- Moving Averages: Helps identify trends.

Chart Patterns

- Breakouts: Indicates significant moves that could suggest entry or exit points.

- Reversals: Helps predict changes in the current trend.

Setting Up Your Trading Platform

To effectively trade VIX 75, you need a trading platform that supports real-time data and advanced charting capabilities.

Features to Look For

- Real-Time Data: Essential for keeping up with rapid changes.

- Customizable Indicators: Allows for personal adjustments based on Muke’s recommendations.

Developing a Trading Plan

Establishing Entry and Exit Points

- Entry Points: Based on specific signals from chosen indicators.

- Exit Points: Determined by predefined profit targets and stop-loss orders.

Risk Management Techniques

- Position Sizing: Determines how much capital to risk on a single trade.

- Stop-Loss Orders: Critical for limiting potential losses.

Common Mistakes to Avoid

Overtrading

- Symptoms: Excessive trading that can lead to quick depletion of capital.

- Prevention: Set strict trading limits and adhere to them.

Ignoring Market News

- Impact: News can drastically affect market volatility.

- Strategy: Stay informed and be ready to adjust your trading plan.

The Psychological Aspect of Trading VIX 75

Stress Management

- Techniques: Regular breaks, meditation, and maintaining a balanced lifestyle.

Maintaining Discipline

- Importance: Consistency in following your trading plan is key to long-term success.

Patrick Muke’s Insights on Market Trends

Understanding Market Sentiment

- Tools: Use of sentiment analysis to gauge market mood.

Adapting to Market Changes

- Flexibility: How to adjust your strategies based on new information.

Real-World Examples of Successful Trades

Illustrating successful trades can provide practical insights and boost confidence in applying these strategies.

Conclusion

Trading the Volatility 75 Index using technical analysis is a challenging yet rewarding endeavor. With the guidance of Patrick Muke, traders can develop the necessary skills to navigate this complex market effectively. By adhering to a disciplined approach and continuously refining your strategies, you can enhance your trading proficiency and potentially increase your profitability.

FAQs

- What is the Volatility 75 Index?

- It is an index measuring the market’s expectation of volatility over the next 30 days.

- Why is VIX 75 known as the ‘fear gauge’?

- Because it tends to rise when market sentiment is negative, indicating increased fear.

- What are key indicators for trading VIX 75?

- Key indicators include the Relative Strength Index (RSI) and Moving Averages.

- How important is risk management in trading VIX 75?

- It is crucial due to the index’s high volatility, making risk management essential to protect against large losses.

- Can beginners trade VIX 75 successfully?

- Yes, but with careful study and adherence to sound trading strategies and risk management principles.

Be the first to review “Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke” Cancel reply

You must be logged in to post a review.

Related products

Others

Others

Others

Reviews

There are no reviews yet.