-

×

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00 -

×

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

TOP Gamma Bundle with TopTrade Tools

1 × $69.00

TOP Gamma Bundle with TopTrade Tools

1 × $69.00 -

×

Mentfx Paid Mentoship (2021)

1 × $5.00

Mentfx Paid Mentoship (2021)

1 × $5.00 -

×

Expert Forex Systems with Andrew Fields

1 × $6.00

Expert Forex Systems with Andrew Fields

1 × $6.00 -

×

Sequence Trading Course with Kevin Haggerty

1 × $4.00

Sequence Trading Course with Kevin Haggerty

1 × $4.00 -

×

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00 -

×

Market Energy Trader with Top Trade Tools

1 × $5.00

Market Energy Trader with Top Trade Tools

1 × $5.00 -

×

Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt

1 × $6.00

Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt

1 × $6.00 -

×

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00 -

×

Options For Gold, Oil and Other Commodities

1 × $6.00

Options For Gold, Oil and Other Commodities

1 × $6.00 -

×

Advanced Iron Condor Course in 2021

1 × $6.00

Advanced Iron Condor Course in 2021

1 × $6.00 -

×

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00 -

×

Design for Six Sigma with Subir Chowdhury

1 × $6.00

Design for Six Sigma with Subir Chowdhury

1 × $6.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00 -

×

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00 -

×

Full Members Area (Icludes 2006 Seminar & Webinars) with Tom Yeomans

1 × $6.00

Full Members Area (Icludes 2006 Seminar & Webinars) with Tom Yeomans

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Algohub 2023 Full Completed with Algohub

1 × $5.00

Algohub 2023 Full Completed with Algohub

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00 -

×

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00 -

×

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00 -

×

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00 -

×

Advanced Stock Trading Course + Strategies

1 × $15.00

Advanced Stock Trading Course + Strategies

1 × $15.00 -

×

Affinity Foundation Option Course with Affinitytrading

1 × $6.00

Affinity Foundation Option Course with Affinitytrading

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00 -

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00 -

×

The Ultimate Option Guide When & How to Use Which Strategy for The Best Results with Larry Gaines - Power Cycle Trading

1 × $39.00

The Ultimate Option Guide When & How to Use Which Strategy for The Best Results with Larry Gaines - Power Cycle Trading

1 × $39.00 -

×

Dynamite TNT Forex System with Clarence Chee

1 × $6.00

Dynamite TNT Forex System with Clarence Chee

1 × $6.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Forex Trading with Ed Ponsi

1 × $6.00

Forex Trading with Ed Ponsi

1 × $6.00 -

×

Futures Commodity Trading with G. Scott Martin

1 × $6.00

Futures Commodity Trading with G. Scott Martin

1 × $6.00 -

×

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00

Basic Options Course Cash Flow. Diversification. Flexibility with Michael Drew

1 × $6.00 -

×

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00 -

×

Elite Core Advance Course with Urban Forex

1 × $5.00

Elite Core Advance Course with Urban Forex

1 × $5.00 -

×

Harmonic Vibrations with Larry Pesavento

1 × $6.00

Harmonic Vibrations with Larry Pesavento

1 × $6.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

Pristine Seminar - Options Trading the Pristine Way

1 × $6.00

Pristine Seminar - Options Trading the Pristine Way

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

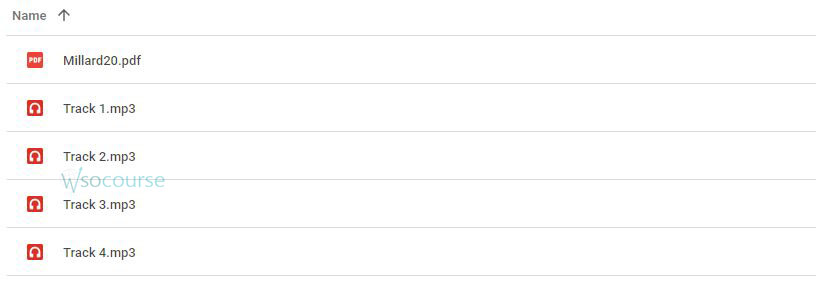

Content Proof: Watch Here!

You may check content proof of “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard ” below:

Channel Analysis: The Key to Improved Timing of Trades with Brian J. Millard

Introduction

In the complex world of trading, timing is everything. Brian J. Millard, renowned for his expertise in technical analysis, emphasizes the critical role of channel analysis in enhancing the timing of trades. This guide explores how traders can utilize channel analysis to refine their trading strategies and maximize profitability.

What is Channel Analysis?

Defining Channel Analysis

- Overview: Channel analysis is a technique used to identify the potential price movement paths of securities based on previous trends.

Importance in Trading

- Strategic Advantage: Understanding how channels work provides traders with insights into market trends and price boundaries.

The Fundamentals of Channel Analysis

Types of Channels

- Ascending, Descending, and Horizontal: Each type provides different insights and trading signals.

Constructing Channels

- Drawing Channels: Guidelines for identifying and drawing accurate channels on price charts.

Brian J. Millard’s Approach to Channel Analysis

Theoretical Background

- Millard’s Philosophy: How Millard integrates channel analysis with other technical indicators to improve trade accuracy.

Practical Applications

- Real-World Examples: Illustrations of how channel analysis has been successfully applied in various market conditions.

Enhancing Trade Timing with Channels

Entry and Exit Points

- Optimal Timing: Using the upper and lower bounds of channels to determine the best times to enter and exit trades.

Risk Management

- Minimizing Losses: How channel analysis can be used to set tighter stop-loss orders.

Tools and Techniques for Effective Channel Analysis

Software Recommendations

- Technical Analysis Tools: Overview of software that can help traders effectively implement channel analysis.

Indicator Integration

- Complementary Indicators: How to combine channel analysis with other indicators like moving averages and RSI.

Channel Analysis in Different Markets

Stocks and Bonds

- Market Specifics: Application of channel analysis across various asset classes.

Forex and Commodities

- Volatility and Liquidity: Special considerations for using channel analysis in highly volatile markets.

Advanced Channel Analysis Strategies

Breakout Patterns

- Identifying Breakouts: Strategies for recognizing and trading breakouts from established channels.

Reversal Signals

- Predicting Reversals: Using channel endpoints to anticipate potential market reversals.

The Psychology of Trading with Channels

Behavioral Insights

- Market Psychology: Understanding the psychological aspects that affect channel formation and sustainability.

Trader Confidence

- Building Trust: How proficiency in channel analysis can increase a trader’s confidence in their decision-making.

Challenges and Solutions in Channel Analysis

Common Pitfalls

- Avoidable Mistakes: Typical errors traders make when using channel analysis and how to avoid them.

Continuous Improvement

- Adapting Strategies: How to continuously refine channel analysis techniques to keep up with market changes.

Success Stories

Testimonials from Traders

- Case Studies: Examples of traders who have successfully implemented Millard’s channel analysis techniques.

Conclusion

Channel analysis, as advocated by Brian J. Millard, is an essential tool for traders seeking to improve the timing of their trades. By understanding and applying the principles of channel analysis, traders can enhance their market predictions, manage risks more effectively, and increase their overall trading performance.

Frequently Asked Questions:

- What is the primary benefit of using channel analysis in trading?

- Channel analysis helps traders identify potential price movement paths, improving the timing for entering and exiting trades.

- Can channel analysis be used for all types of trading instruments?

- Yes, channel analysis is versatile and can be applied across different trading instruments, including stocks, forex, and commodities.

- How does channel analysis aid in risk management?

- It allows traders to set more precise stop-loss orders by providing clear indications of support and resistance levels.

- What should traders combine with channel analysis to enhance its effectiveness?

- Traders should integrate channel analysis with other technical indicators like volume, RSI, and moving averages for better results.

- How can traders overcome common pitfalls in channel analysis?

- By continuously learning and practicing, using quality trading software, and staying updated with market changes and techniques.

Be the first to review “Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.