Theoptionschool – The 6 Secrets of Options Trading

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

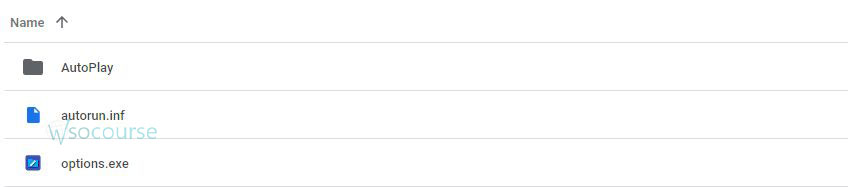

Content Proof: Watch Here!

You may check content proof of “ Theoptionschool – The 6 Secrets of Options Trading” below:

Theoptionschool – The 6 Secrets of Options Trading

Introduction Welcome to our in-depth exploration of options trading, guided by the expert insights from Theoptionschool. Options trading can be complex, but armed with the right knowledge and strategies, it becomes an exciting avenue for traders. Today, we uncover “The 6 Secrets of Options Trading” that could dramatically enhance your trading effectiveness.

What is Options Trading?

Before diving into the secrets, let’s clarify what options trading involves. Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time frame. It’s a strategic form of trading that requires precision and understanding.

The First Secret: Understanding Leverage

- Leverage Explained

- Options allow significant leverage, meaning you control larger amounts of stock for a fraction of the price.

The Second Secret: Risk Management

- Setting Limits

- Effective options traders always set risk limits to protect their capital.

- Hedging Strategies

- Options can hedge against potential losses in other investments.

The Third Secret: The Importance of Timing

- Market Trends

- Successful options trading often depends on timing market entries and exits with precision.

- Expiration Times

- Understanding when options expire is crucial to not being caught off-guard.

The Fourth Secret: Diversification

- Spread Your Risks

- Diversifying your options portfolio can reduce risk and increase potential returns.

The Fifth Secret: Utilizing Technology

- Trading Platforms

- Utilize advanced trading platforms that offer analytical tools to enhance decision-making.

The Sixth Secret: Continuous Education

- Stay Updated

- The most successful traders never stop learning about new strategies and market changes.

How to Implement These Secrets in Your Trading Strategy Integrating these secrets requires practice and dedication:

- Start Small: Begin with small trades to understand the practical aspects of these secrets.

- Use Simulators: Many platforms offer simulators to practice without financial risk.

- Keep Learning: Join webinars, courses, and read up-to-date materials from trusted sources like Theoptionschool.

Conclusion The six secrets of options trading from Theoptionschool offer a foundation for anyone looking to enhance their trading skills. By embracing these strategies, you can navigate the complexities of the options market with greater confidence and success.

FAQs

What is the best way to start with options trading?

Begin with educational resources and small, low-risk trades to build your knowledge and experience.

How important is risk management in options trading?

It’s crucial; proper risk management can be the difference between success and significant losses.

Can options trading be a full-time career?

Yes, with the right expertise and commitment, options trading can be pursued as a full-time career.

What are the common mistakes in options trading?

Over-leveraging and insufficient market research are among the common pitfalls.

How often should I review my trading strategy?

Regularly reviewing and adjusting your strategy is vital, especially in response to market changes or new learning.

Be the first to review “Theoptionschool – The 6 Secrets of Options Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.