Tail Hedging – Learn to Insure Stocks Against Large Declines with James Marsh

$300.00 Original price was: $300.00.$15.00Current price is: $15.00.

File Size: 891 MB

Delivery Time: 1–12 hours

Media Type: Online Course

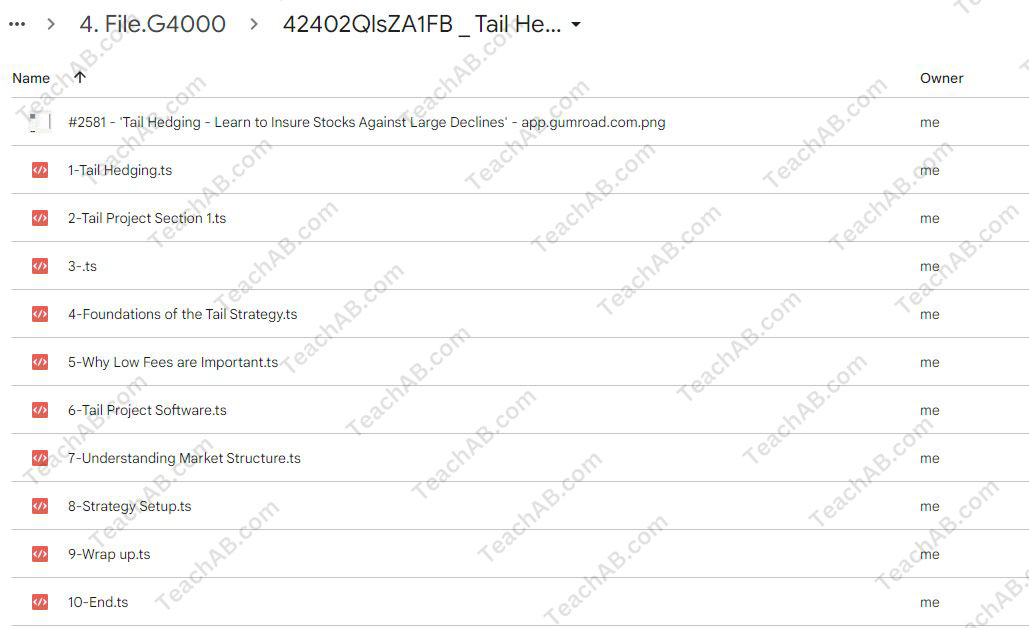

Content Proof: Watch Here!

You may check content proof of “Tail Hedging – Learn to Insure Stocks Against Large Declines with James Marsh” below:

Tail Hedging – Learn to Insure Stocks Against Large Declines with James Marsh

Investing in the stock market can sometimes feel like navigating a ship on stormy seas. What if there was a way to insure your investments against sudden downturns? This is where tail hedging comes in, and expert James Marsh is here to guide us through its complexities. Tail hedging can be a crucial strategy for investors looking to protect their portfolios from extreme market shocks.

Understanding Tail Hedging

What is Tail Hedging?

Tail hedging is essentially an insurance policy for your investment portfolio. It involves using financial instruments to protect against extreme losses that occur from rare and unpredictable events, often referred to as “black swan” events.

Why Consider Tail Hedging?

The main appeal of tail hedging lies in its ability to limit losses during severe market downturns without significantly impacting potential gains during stable times. It’s a balancing act that, when done correctly, offers peace of mind while maintaining growth opportunities.

Implementing Tail Hedging with James Marsh’s Strategies

Identifying Tail Risks

Before you can protect against tail risks, you must first identify them. James Marsh suggests analyzing historical market data and looking for patterns of decline that are severe yet uncommon.

Choosing the Right Instruments

Options and Futures

Options, particularly put options, are commonly used in tail hedging strategies. They allow you to sell a stock at a predetermined price, regardless of how low the market drops.

Inverse ETFs

Inverse ETFs increase in value when a specific index declines. They are simpler than options but can be less precise in their coverage.

Balancing Cost and Protection

Tail hedging is not free, and its costs can erode investment returns. James advises a careful balance, ensuring that the cost of hedging does not outweigh the benefits.

Case Studies and Practical Application

Success Stories

James shares several case studies where tail hedging has significantly mitigated losses during downturns, emphasizing the practical value of this strategy in real-world scenarios.

Common Pitfalls

It’s also important to learn from failures. James discusses common mistakes and how to avoid them, such as over-hedging or choosing the wrong duration for your hedge.

Advanced Tail Hedging Techniques

Dynamic Hedging

This approach adjusts the level of hedging in response to changes in market volatility. James explains how dynamic hedging can be more cost-effective over time.

Using Derivatives Wisely

Derivatives like swaps can be used for tail hedging, but they require a deeper understanding of financial markets. James breaks down these complex instruments in an accessible way.

Tail Hedging in Different Market Conditions

Bull Markets

In a rising market, the cost of hedging can seem unjustifiable. James discusses how to maintain a cost-effective hedge during these times without cutting into profits.

Bear Markets

During market declines, tail hedging can be a portfolio’s best friend. James provides insights into optimizing your hedge when the market is expected to drop.

Integrating Tail Hedging into Your Investment Strategy

Portfolio Considerations

Tail hedging should be part of a broader investment strategy. James emphasizes the importance of aligning your hedging techniques with your overall investment goals.

Risk Management

Effective risk management involves more than just hedging. James covers how to combine different risk management techniques to create a robust defensive investment strategy.

Conclusion

Tail hedging is not just about avoiding losses; it’s about smart investing. By understanding and implementing the strategies shared by James Marsh, investors can protect themselves against large declines while still participating in the market’s upside. Remember, in investing, sometimes the best offense is a good defense.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Tail Hedging – Learn to Insure Stocks Against Large Declines with James Marsh” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.