Stop Being the Stock Market Plankton with Idan Gabrieli

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

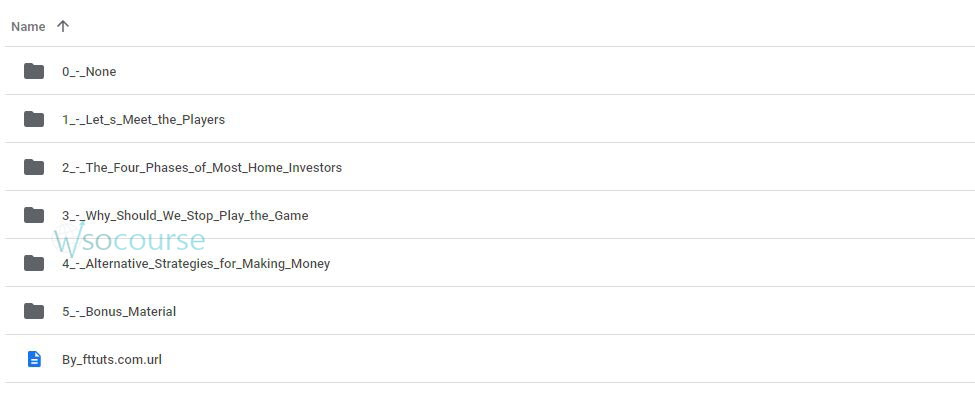

Content Proof: Watch Here!

You may check content proof of “Stop Being the Stock Market Plankton with Idan Gabrieli” below:

Stop Being the Stock Market Plankton with Idan Gabrieli

Introduction

In the vast ocean of the stock market, many individual investors often find themselves playing the role of plankton, floating along and being swept up by the currents of larger market forces. However, Idan Gabrieli, an expert in investment strategies, teaches us how we can evolve from being mere market fodder to becoming savvy investors. This article explores Gabrieli’s insights and strategies, empowering you to take control of your financial destiny.

Understanding Your Position in the Market

The Plankton Analogy

Why compare small investors to plankton? Just as plankton are small organisms that larger sea creatures consume, small investors often feel at the mercy of larger financial institutions. Recognizing this position is the first step toward change.

Assessing the Impact of Market Whales

The actions of major players like banks and hedge funds can significantly influence market trends and stock prices. Understanding these influences can help you anticipate market movements more effectively.

Strategies to Elevate Your Market Status

Education: Your First Weapon

Knowledge is power in the stock market. Idan Gabrieli emphasizes the importance of financial literacy. Understanding fundamental and technical analysis, market indicators, and economic factors can drastically improve your investing skills.

Diversification: Not Just a Buzzword

Diversification isn’t about having different stocks but having investments that react differently to the same economic events. This strategy reduces risk and prevents your portfolio from becoming fodder.

Psychological Resilience

The stock market is not just numbers; it’s also about psychology. Developing resilience against fear and greed, the two emotions that frequently drive market decisions, is crucial.

Tools and Techniques for Smarter Investing

Leveraging Technology

Utilize financial tools and platforms that provide real-time data and analytics to make informed decisions quickly.

The Power of Community

Engage with other investors. Platforms like social media groups, forums, and investment clubs can provide insights and support.

Continuous Learning

The market evolves, and so should you. Stay updated with the latest trends, news, and strategies.

Idan Gabrieli’s Investment Philosophy

Long-Term Over Short-Term

Gabrieli advocates for long-term investing as a strategy to reduce risks and increase potential returns.

Ethical Investing

Investing in companies that adhere to ethical practices and contribute positively to society can be rewarding both financially and morally.

Implementing Gabrieli’s Advice

Setting Realistic Goals

Start with clear, achievable goals. Whether it’s saving for retirement, buying a home, or funding education, your goals should dictate your investment strategy.

Risk Management

Understand your risk tolerance and manage it through appropriate asset allocation and position sizing.

Regular Portfolio Review

Regularly reviewing your portfolio to ensure it aligns with your goals and risk tolerance is essential.

Conclusion

Transitioning from being the stock market plankton to a more formidable market player is about mindset, strategy, and continuous learning. With the insights and techniques shared by Idan Gabrieli, you’re better equipped to navigate the complexities of the stock market and work towards achieving your financial goals.

FAQs

- What is the first step to stop being market plankton?

- Recognize your current position and educate yourself about the market.

- How does diversification help in the stock market?

- It spreads risk across different investment types that react differently under the same conditions.

- Can technology really improve my investing skills?

- Yes, using advanced tools and platforms can provide better data analysis and real-time market insights.

- What should I consider when setting investment goals?

- Consider what you’re investing for, the time you have, and your risk tolerance.

- How often should I review my investment portfolio?

- It’s advisable to review your portfolio at least annually or after significant market changes.

Be the first to review “Stop Being the Stock Market Plankton with Idan Gabrieli” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.