-

×

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00 -

×

The 5 Day Momentum Method

1 × $6.00

The 5 Day Momentum Method

1 × $6.00 -

×

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00 -

×

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00 -

×

Random Walk Trading - J.L.Lord - One Strategy for All Markets

1 × $6.00

Random Walk Trading - J.L.Lord - One Strategy for All Markets

1 × $6.00 -

×

Original Charting 1936 with W.D.Gann

1 × $6.00

Original Charting 1936 with W.D.Gann

1 × $6.00 -

×

The Stock Rocket Trading System with Dave Wooding

1 × $6.00

The Stock Rocket Trading System with Dave Wooding

1 × $6.00 -

×

Speculating with Futures and Traditional Commodities with Liverpool Group

1 × $6.00

Speculating with Futures and Traditional Commodities with Liverpool Group

1 × $6.00 -

×

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00 -

×

TOP Gamma Bundle with TopTrade Tools

1 × $69.00

TOP Gamma Bundle with TopTrade Tools

1 × $69.00 -

×

Price Analysis Webinar with Carolyn Boroden

1 × $6.00

Price Analysis Webinar with Carolyn Boroden

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

Cryptocurrency Investment Course 2021 Fund your Retirement with Suppoman

1 × $5.00

Cryptocurrency Investment Course 2021 Fund your Retirement with Suppoman

1 × $5.00 -

×

Build a Professional Trading System using Amibroker with Trading Tuitions - Marwood Research

1 × $23.00

Build a Professional Trading System using Amibroker with Trading Tuitions - Marwood Research

1 × $23.00 -

×

NXT Level FX with Investors Domain

1 × $5.00

NXT Level FX with Investors Domain

1 × $5.00 -

×

Advanced Calculus with Applications in Statistics

1 × $6.00

Advanced Calculus with Applications in Statistics

1 × $6.00 -

×

Krautgap By John Piper

1 × $6.00

Krautgap By John Piper

1 × $6.00 -

×

CFA Level 2 - Sample Item Sets 2003

1 × $6.00

CFA Level 2 - Sample Item Sets 2003

1 × $6.00 -

×

Open Trader Pro Training

1 × $23.00

Open Trader Pro Training

1 × $23.00 -

×

Market Structure Masterclass with Braveheart Trading

1 × $5.00

Market Structure Masterclass with Braveheart Trading

1 × $5.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Next Great Bull Market with Matthew McCall

1 × $6.00

The Next Great Bull Market with Matthew McCall

1 × $6.00 -

×

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00 -

×

Pairs Trading The Final Frontier with Don Kaufman

1 × $6.00

Pairs Trading The Final Frontier with Don Kaufman

1 × $6.00 -

×

Complete Price Action, Volume Profile and Orderflow Trading Bundle with Price Action Volume Trader

1 × $78.00

Complete Price Action, Volume Profile and Orderflow Trading Bundle with Price Action Volume Trader

1 × $78.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00 -

×

War Room Technicals Vol. 4 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Vol. 4 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Portfolio Investing with Ron Bertino

1 × $54.00

Portfolio Investing with Ron Bertino

1 × $54.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

Adz Trading Academy

1 × $5.00

Adz Trading Academy

1 × $5.00 -

×

What Works in Online Trading with Mark Etzkorn

1 × $6.00

What Works in Online Trading with Mark Etzkorn

1 × $6.00 -

×

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00 -

×

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

Fierce 10 with Mandi Rafsendjani

1 × $5.00

Fierce 10 with Mandi Rafsendjani

1 × $5.00 -

×

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00 -

×

ICT Mastery with Casper SMC

1 × $14.00

ICT Mastery with Casper SMC

1 × $14.00 -

×

Using Fundamental Analysis with Andrew Baxter

1 × $6.00

Using Fundamental Analysis with Andrew Baxter

1 × $6.00 -

×

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00 -

×

Secrets to Short Term Trading with Larry Williams

1 × $6.00

Secrets to Short Term Trading with Larry Williams

1 × $6.00 -

×

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Metals Webinar

1 × $6.00

Metals Webinar

1 × $6.00 -

×

Leading Indicators

1 × $23.00

Leading Indicators

1 × $23.00 -

×

Pristine - Cardinal Rules of Trading

1 × $6.00

Pristine - Cardinal Rules of Trading

1 × $6.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Scientific Trading Machine with Nicola Delic

1 × $54.00

Scientific Trading Machine with Nicola Delic

1 × $54.00 -

×

Prometheus Course with QuantProgram

1 × $13.00

Prometheus Course with QuantProgram

1 × $13.00 -

×

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00 -

×

Show Tax Losses On Your 1040, Yet Show Lenders You Are Making Money! with Information Services Unlimited

1 × $6.00

Show Tax Losses On Your 1040, Yet Show Lenders You Are Making Money! with Information Services Unlimited

1 × $6.00 -

×

The 1st Leveraged ETF Trading Strategies Workshop

1 × $54.00

The 1st Leveraged ETF Trading Strategies Workshop

1 × $54.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

JokerSZN Course with David

1 × $20.00

JokerSZN Course with David

1 × $20.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

Inefficient Markets with Andrei Shleifer

1 × $6.00

Inefficient Markets with Andrei Shleifer

1 × $6.00 -

×

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00 -

×

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00 -

×

Yin Yang Forex Training Program

1 × $85.00

Yin Yang Forex Training Program

1 × $85.00 -

×

Mastering Amibroker Formula Language

1 × $15.00

Mastering Amibroker Formula Language

1 × $15.00 -

×

The Litle Book of Bulletproof Investing

1 × $6.00

The Litle Book of Bulletproof Investing

1 × $6.00 -

×

Volatility Master Class

1 × $62.00

Volatility Master Class

1 × $62.00 -

×

Advanced Trading System 2020

1 × $179.00

Advanced Trading System 2020

1 × $179.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Market Analysis Companion for Metastock with Martin Pring

1 × $6.00

Market Analysis Companion for Metastock with Martin Pring

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00 -

×

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00 -

×

NFTMastermind with Charting Wizards

1 × $5.00

NFTMastermind with Charting Wizards

1 × $5.00 -

×

Trading Decoded with Axia Futures

1 × $31.00

Trading Decoded with Axia Futures

1 × $31.00 -

×

Correct Stage for Average with Stan Weinstein

1 × $6.00

Correct Stage for Average with Stan Weinstein

1 × $6.00 -

×

Elliott Wave Forex Course

1 × $6.00

Elliott Wave Forex Course

1 × $6.00 -

×

Onyx Platinum Trading Accelerator 2.0 with Nick Deflorio

1 × $6.00

Onyx Platinum Trading Accelerator 2.0 with Nick Deflorio

1 × $6.00 -

×

Trading Systems Explained with Martin Pring

1 × $6.00

Trading Systems Explained with Martin Pring

1 × $6.00 -

×

The Trading Avantage with Joseph Duffy

1 × $6.00

The Trading Avantage with Joseph Duffy

1 × $6.00 -

×

Stock Trading Success - You Make The Call - How To Set Entries And Exits with Steve Nison and K.Cal

1 × $6.00

Stock Trading Success - You Make The Call - How To Set Entries And Exits with Steve Nison and K.Cal

1 × $6.00 -

×

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00 -

×

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00 -

×

Advanced Technical Analysis PART2 with Corey Halliday

1 × $6.00

Advanced Technical Analysis PART2 with Corey Halliday

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Confessions of a Street Addict with James Cramer

1 × $6.00

Confessions of a Street Addict with James Cramer

1 × $6.00 -

×

Dan Sheridan Volatility Class

1 × $6.00

Dan Sheridan Volatility Class

1 × $6.00 -

×

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00 -

×

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00 -

×

Quick Scalp Trader (Unlocked)

1 × $31.00

Quick Scalp Trader (Unlocked)

1 × $31.00 -

×

Paradox Forex Course

1 × $5.00

Paradox Forex Course

1 × $5.00 -

×

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00 -

×

The 10%ers with Trader Mike

1 × $5.00

The 10%ers with Trader Mike

1 × $5.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00 -

×

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00 -

×

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

Shorting for Profit

1 × $31.00

Shorting for Profit

1 × $31.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00 -

×

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00 -

×

FOREX UNLIMITED WEALTH EA

1 × $6.00

FOREX UNLIMITED WEALTH EA

1 × $6.00 -

×

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00 -

×

Order Flow Trading Advanced Masterclass with The Forex Scalpers

1 × $24.00

Order Flow Trading Advanced Masterclass with The Forex Scalpers

1 × $24.00 -

×

Trading Earnings Formula Class with Don Kaufman

1 × $6.00

Trading Earnings Formula Class with Don Kaufman

1 × $6.00 -

×

LBFX Academy Training Course

1 × $5.00

LBFX Academy Training Course

1 × $5.00 -

×

Master Trader Technical Strategies with Greg Capra - Master Trader

1 × $5.00

Master Trader Technical Strategies with Greg Capra - Master Trader

1 × $5.00 -

×

Earnings Power Play with Dave Aquino

1 × $15.00

Earnings Power Play with Dave Aquino

1 × $15.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00 -

×

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00 -

×

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00 -

×

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00 -

×

The Telecoms Trade War with Mark Naftel

1 × $6.00

The Telecoms Trade War with Mark Naftel

1 × $6.00 -

×

Trading Indicators for the 21st Century

1 × $6.00

Trading Indicators for the 21st Century

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00

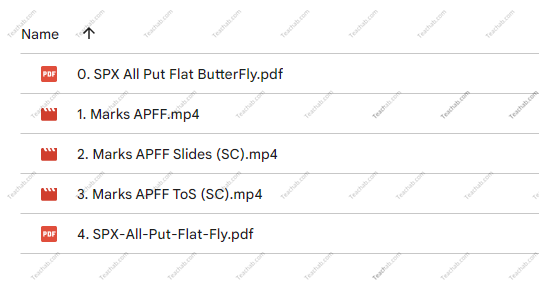

SPX All Put Flat ButterFly with Mark Fenton – Sheridan Options Mentoring

$247.00 Original price was: $247.00.$39.00Current price is: $39.00.

File Size: 336 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “SPX All Put Flat ButterFly with Mark Fenton – Sheridan Options Mentoring” below:

In the ever-evolving landscape of options trading, strategies like the SPX All Put Flat Butterfly not only demonstrate innovative financial acumen but also highlight the importance of precision and adaptability. Led by Mark Fenton at Sheridan Options Mentoring, this specific strategy offers a unique approach to managing risk while seeking profit in the S&P 500 index options. This article will delve into the nuances of this strategy, exploring how it can be a game-changer in your trading portfolio.

Introduction to SPX All Put Flat Butterfly

What is an All Put Flat Butterfly?

The All Put Flat Butterfly is an advanced options strategy involving multiple puts to create positions that profit from minimal movement in the underlying asset, in this case, the S&P 500 index. This strategy is especially appealing during periods of low volatility or when little movement is expected in the market.

Understanding the Strategy

Components of the Flat Butterfly

- Sell At-The-Money Puts: The core of the butterfly, where you sell puts at the market’s current level.

- Buy Out-of-The-Money Puts: These are typically set at a lower strike price, bracketing the position.

- Buy In-The-Money Puts: Positioned at a higher strike, completing the ‘wings’ of the butterfly.

Why Use All Puts?

Using puts exclusively allows for a more predictable risk profile and potentially higher returns in a flat or bearish market scenario.

Mark Fenton’s Expertise

Who is Mark Fenton?

A seasoned trader and mentor, Mark Fenton’s expertise in options is well-regarded within the Sheridan community. His approach to options trading is both educational and practical, making complex strategies accessible to traders at all levels.

Advantages of Learning from Mark

- Detailed Strategy Breakdowns

- Real-World Application

- Ongoing Mentorship and Support

Navigating Market Conditions with the Flat Butterfly

Ideal Market Conditions for This Strategy

- Low Volatility: The strategy thrives in a stable market where drastic price swings are unlikely.

- Predictable Market Phases: When market trends are clear and steady, regardless of the direction.

Risk Management

- Defined Risk: All potential losses are known in advance, a key feature of the flat butterfly.

- Adjustments: Mark teaches how to adjust the strikes to respond to market changes effectively.

Course Outline: SPX All Put Flat Butterfly

Key Modules of the Course

- Introduction to Options Basics

- Deep Dive into Butterfly Strategies

- Specifics of the All Put Flat Butterfly

- Risk Management Techniques

- Live Trade Execution

Learning Outcomes

- Strategic Depth: Gain a thorough understanding of one of the most nuanced trading strategies.

- Hands-On Experience: Apply concepts through simulated trading scenarios under Mark’s guidance.

Who Should Enroll?

Target Audience

- Intermediate Traders: Those with some options trading experience.

- Advanced Traders: Seasoned traders looking to diversify their strategies.

- Financial Educators: Professionals seeking to broaden their teaching portfolio.

Benefits of the Strategy

Why Choose the SPX All Put Flat Butterfly?

- Capital Efficiency: Requires less capital compared to more straightforward put or call buys.

- Profit Potential in Stable Markets: Maximizes the chance of profit when little movement is expected in the SPX.

Preparing for the Course

What You Need to Prepare

- Basic Options Knowledge

- Access to Trading Software

- Commitment to Learning

Success Stories and Testimonials

Feedback from Previous Participants

Many participants have praised the course for its clarity, depth, and practical applicability, noting significant improvements in their trading tactics.

Conclusion

The SPX All Put Flat Butterfly strategy, as taught by Mark Fenton through Sheridan Options Mentoring, offers a sophisticated toolset for traders aiming to capitalize on specific market conditions. This strategy’s focus on risk management and capital efficiency makes it a valuable addition to any trader’s arsenal.

Frequently Asked Questions

- What is the SPX All Put Flat Butterfly? It’s a refined options strategy focusing on put options to profit from minimal market movement.

- Why is this strategy effective in low volatility? It capitalizes on market stability, which enhances the predictability of outcomes.

- Who can benefit from learning this strategy? Intermediate to advanced traders looking for risk-managed trading setups.

- What are the key risks involved? While losses are limited, improper execution or misunderstanding of market conditions can lead to suboptimal outcomes.

- How can I enroll in the course? Visit Sheridan Options Mentoring’s website and navigate to the courses section for enrollment details.

Be the first to review “SPX All Put Flat ButterFly with Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.