-

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Simple Setups For Consistent Profits with Base Camp Trading

1 × $6.00

Simple Setups For Consistent Profits with Base Camp Trading

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00 -

×

Systems Mastery Course with Chris Dover - Pollinate Trading

1 × $5.00

Systems Mastery Course with Chris Dover - Pollinate Trading

1 × $5.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Boomer Quick Profits Day Trading Course

1 × $23.00

Boomer Quick Profits Day Trading Course

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Stock Option Trading 3 – Easy Advanced Profits and Success with Scott Paton

1 × $6.00

Stock Option Trading 3 – Easy Advanced Profits and Success with Scott Paton

1 × $6.00 -

×

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00 -

×

M3-4u Trading System with John Locke

1 × $5.00

M3-4u Trading System with John Locke

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Bear Trading For Profit Profit From Stock Market Crashes

1 × $6.00

Bear Trading For Profit Profit From Stock Market Crashes

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

TradeWithChris - TWC Forex Trading Course

1 × $6.00

TradeWithChris - TWC Forex Trading Course

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00 -

×

How Stocks Work with David L.Scott

1 × $6.00

How Stocks Work with David L.Scott

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

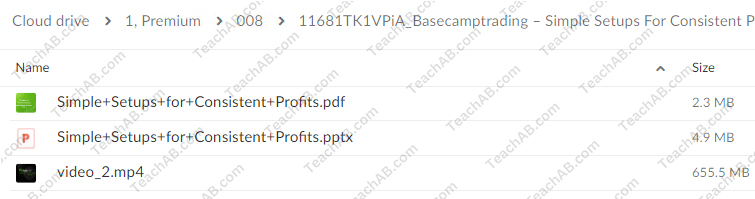

Simple Setups For Consistent Profits with Base Camp Trading

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 662.7 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Simple Setups For Consistent Profits with Base Camp Trading” below:

Simple Setups For Consistent Profits with Base Camp Trading

Introduction

Achieving consistent profits in trading is the ultimate goal for any trader. Base Camp Trading, a renowned trading education provider, offers a variety of simple yet effective setups designed to help traders achieve this goal. In this article, we will explore the key setups and strategies taught by Base Camp Trading, providing a comprehensive guide to help traders enhance their performance and profitability.

Who is Base Camp Trading?

Background and Expertise

Base Camp Trading is a leading provider of trading education and resources. Their team of experienced traders and educators offers practical insights and strategies to help traders succeed in various market conditions.

Key Offerings

- Educational Courses: Comprehensive courses covering different aspects of trading.

- Trading Setups: Simple and effective setups designed for consistent profits.

- Community Support: Access to a community of traders and ongoing support.

Understanding Trading Setups

What is a Trading Setup?

A trading setup is a specific condition or combination of conditions that indicate a potential trading opportunity. Setups help traders identify when to enter or exit trades based on technical and fundamental analysis.

Importance of Simple Setups

Simple setups are crucial because they are easy to understand and implement, reducing the chances of errors and increasing the likelihood of consistent profits.

Key Setups by Base Camp Trading

Trend Following Setups

Identifying Trends

Base Camp Trading teaches traders to identify and follow trends, capitalizing on the market’s momentum. Trends are identified using tools like moving averages and trendlines.

Entry and Exit Points

Traders are guided on the best points to enter and exit trades within a trend to maximize profits and minimize losses.

Breakout Setups

Recognizing Breakouts

Breakout setups involve entering a trade when the price breaks through a significant support or resistance level. This strategy aims to capture significant price movements.

Setting Targets

Setting profit targets and stop-loss orders is essential to manage risk and ensure consistent profits from breakout trades.

Reversal Setups

Identifying Reversals

Reversal setups are used to identify points where the market is likely to change direction. Indicators such as RSI and MACD are commonly used to spot potential reversals.

Timing the Entry

Accurate timing is crucial for reversal setups. Base Camp Trading provides strategies to enter trades at the right moment to capture the reversal effectively.

Scalping Setups

Quick Trades

Scalping involves making quick trades to capture small price movements. This setup requires a keen eye for detail and quick execution.

Risk Management

Effective risk management is critical in scalping to ensure that small gains are not offset by larger losses.

Implementing Base Camp Trading Setups

Developing a Trading Plan

- Define Objectives: Set clear trading goals and objectives.

- Select Setups: Choose the setups that align with your trading style and goals.

- Risk Management: Incorporate risk management techniques, such as stop-loss orders and position sizing.

Backtesting Strategies

Before applying setups in live trading, backtest them using historical data to assess their effectiveness and refine your approach.

Live Trading

Start with small positions when transitioning to live trading. Gradually increase your position size as you gain confidence and experience.

Tools and Resources for Trading

Recommended Trading Platforms

Base Camp Trading recommends using reliable trading platforms that offer advanced charting tools, real-time data, and robust security features.

Educational Materials

Leverage the educational resources provided by Base Camp Trading, including tutorials, webinars, and community support.

Common Mistakes to Avoid

Overtrading

Avoid making too many trades, which can lead to increased costs and emotional exhaustion.

Ignoring Risk Management

Never neglect risk management practices, such as setting stop-loss orders and proper position sizing.

Chasing the Market

Stick to your trading plan and avoid chasing the market based on emotions or hunches.

Advanced Techniques in Trading

Multiple Time Frame Analysis

Analyzing multiple time frames provides a broader perspective on market trends and potential trade setups.

Algorithmic Trading

For advanced traders, algorithmic trading can automate strategies and ensure consistent execution.

Case Studies

Successful Trend Following

A trader uses Base Camp Trading’s trend-following setup, identifying a strong upward trend in the S&P 500. By following the strategy, the trader achieves consistent profits over several months.

Profitable Breakout Trade

Another trader applies the breakout setup from Base Camp Trading, entering a position as the EUR/USD breaks through key resistance levels. This approach leads to significant gains.

Conclusion

Base Camp Trading’s simple setups provide a robust framework for achieving consistent profits in trading. By understanding and implementing these setups, traders can enhance their performance, manage risks effectively, and achieve their trading goals. Embrace the strategies and principles taught by Base Camp Trading to navigate the complexities of the market and build a successful trading career.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Simple Setups For Consistent Profits with Base Camp Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.