Uncover Resilient Stocks in Today’s Market with Peter Worden

$249.00 Original price was: $249.00.$6.00Current price is: $6.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

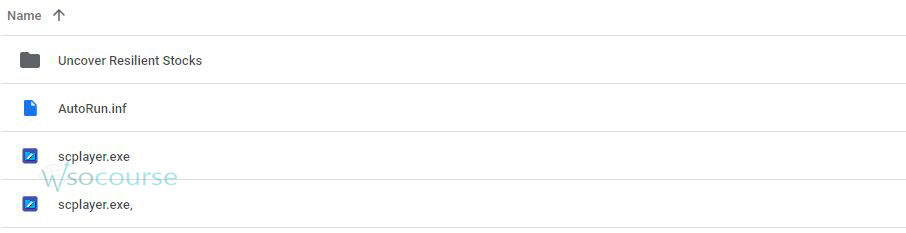

Content Proof: Watch Here!

You may check content proof of “Uncover Resilient Stocks in Today’s Market with Peter Worden” below:

Uncover Resilient Stocks in Today’s Market with Peter Worden

In the unpredictable landscape of today’s stock market, finding resilient stocks can be akin to searching for a needle in a haystack. However, with the right guidance and expertise, investors can navigate this terrain with confidence. Enter Peter Worden, a seasoned investor with a knack for uncovering hidden gems amidst market turbulence.

Meet Peter Worden: The Resilience Guru

Who is Peter Worden?

Peter Worden is a veteran investor with over two decades of experience in the financial markets. Known for his keen insights and unwavering discipline, Peter has earned a reputation as a trusted advisor among investors seeking to weather market storms and emerge stronger on the other side.

The Resilience Approach

Peter Worden’s approach to investing revolves around the concept of resilience. Instead of chasing fleeting trends or succumbing to market hysteria, Peter focuses on identifying fundamentally strong companies with the ability to withstand adversity and thrive over the long term.

Uncovering Resilient Stocks

Identifying Resilience Indicators

- Stable Financials: Companies with consistent revenue growth, healthy profit margins, and manageable debt levels are often more resilient in turbulent times.

- Strong Leadership: A competent management team with a clear vision and proven track record is crucial for navigating challenges and seizing opportunities.

- Diversified Portfolio: Companies with diverse revenue streams and exposure to multiple markets are better equipped to weather sector-specific downturns.

Case Studies: Resilient Stocks in Action

- Tech Titans: Despite market volatility, tech giants like Apple and Microsoft have demonstrated resilience thanks to their robust business models and innovative products.

- Consumer Staples: Companies in the consumer staples sector, such as Procter & Gamble and Coca-Cola, have historically shown resilience due to the steady demand for everyday essentials.

Peter Worden’s Insights

Navigating Market Volatility

Peter Worden emphasizes the importance of staying calm and focused during periods of market volatility. By maintaining a long-term perspective and adhering to a disciplined investment strategy, investors can capitalize on opportunities amidst the chaos.

Embracing Contrarianism

Contrary to popular belief, Peter believes that market downturns present unique buying opportunities for savvy investors. By adopting a contrarian mindset and investing in undervalued stocks with strong fundamentals, investors can position themselves for significant gains when the market rebounds.

Conclusion

In today’s ever-changing market landscape, resilience is the key to success. With Peter Worden as your guide, you can uncover resilient stocks that have the potential to withstand market turbulence and deliver long-term growth. By focusing on fundamental strength and maintaining a disciplined approach, you can navigate the ups and downs of the market with confidence.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable.Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Uncover Resilient Stocks in Today’s Market with Peter Worden” Cancel reply

You must be logged in to post a review.

Related products

Others

Others

Others

Others

Reviews

There are no reviews yet.