-

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Developing the Psychological Trader’s Edge with Robin Dayne

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

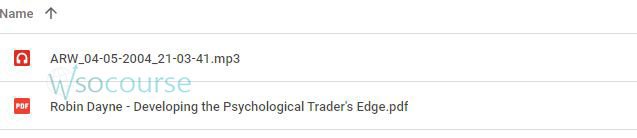

You may check content proof of “Developing the Psychological Trader’s Edge with Robin Dayne” below:

Developing the Psychological Trader’s Edge with Robin Dayne

Navigating the stock market requires more than just financial acumen and a good strategy; it demands a strong psychological foundation. Robin Dayne, often dubbed ‘The Trader’s Coach,’ has revolutionized the way we think about trading with her approach to developing a trader’s psychological edge. This article explores key insights from her methodology, providing practical advice to enhance your trading mindset.

Introduction to Trading Psychology

Trading is not just a battle of wits against the market but also an internal struggle against one’s own emotions. Robin Dayne teaches traders how to harness and control these emotions to make calculated decisions without the interference of fear, greed, or undue excitement.

The Importance of Emotional Discipline

Mastering Self-Control

- Scenario: Overcoming the urge to ‘revenge trade’ after a loss.

- Outcome: Developing strategies that focus on long-term gains over immediate recovery.

Staying Calm Under Pressure

- Scenario: Managing stress during high volatility.

- Outcome: Techniques that help maintain clarity and objectivity.

Building Confidence in Trading

Confidence is crucial, but overconfidence is dangerous. Robin Dayne emphasizes the balance between the two, teaching traders how to trust their strategies through:

- Testing and Refinement: Continuously testing trading strategies to ensure their effectiveness.

- Feedback Loops: Learning from past trades to build a more robust trading plan.

The Role of Routine in Trading Success

Routine and structure are pivotal in trading. Robin advocates for:

- Pre-Market Preparation: Analyzing market conditions and readying oneself for different scenarios.

- Post-Market Review: Reflecting on trading decisions to identify areas for improvement.

Cognitive Biases and How to Avoid Them

Traders often fall victim to psychological traps. Recognizing these can significantly enhance decision-making:

- Confirmation Bias: Seeking information that only supports your beliefs.

- Loss Aversion: The fear of losing money impacting trading choices.

The Power of a Positive Trading Community

Being part of a trading community can provide support and valuable insights, helping traders to:

- Share Experiences: Learning from the successes and mistakes of others.

- Emotional Support: Having a support system during tough trading periods.

Advanced Psychological Strategies Used by Top Traders

Robin Dayne delves into complex psychological strategies that top traders use, such as:

- Mental Rehearsal: Visualizing successful trades to prepare psychologically.

- Emotional Detachment: Keeping emotions separate from trading decisions.

Practical Tips for Everyday Trading

Applying Robin Dayne’s principles, traders should:

- Keep a Trading Journal: Documenting all trades to observe emotional triggers and outcomes.

- Set Realistic Goals: Defining what success looks like on a personal level.

- Practice Mindfulness: Staying present and focused to make better trading decisions.

Conclusion

Developing a psychological edge in trading is not achieved overnight. It requires dedication, a willingness to learn from mistakes, and the ability to maintain emotional equilibrium under pressure. Robin Dayne’s insights offer a foundation upon which traders can build a resilient and psychologically sound trading practice.

FAQs

What is the first step to developing a trader’s psychological edge?

Begin by understanding your emotional responses and how they affect your trading decisions.

Can psychological training improve trading outcomes?

Yes, by reducing emotional biases and improving decision-making, psychological training can lead to better trading results.

How important is routine in trading?

Extremely important; it helps in maintaining discipline and consistency in your trading approach.

What is one common psychological trap for traders?

Confirmation bias is common, where traders look for information that supports their preconceived notions.

How can a trading community help in developing psychological strength?

A community offers diverse perspectives and emotional support, which can mitigate the psychological stress of trading.

Be the first to review “Developing the Psychological Trader’s Edge with Robin Dayne” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.