-

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

2-Phase A.I. Trade Spy Total Immersion Experience with Jeff Bierman - The Quant Guy

1 × $209.00

2-Phase A.I. Trade Spy Total Immersion Experience with Jeff Bierman - The Quant Guy

1 × $209.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

2-Phase Inducement Theorem with Vector Trading FX

1 × $6.00

2-Phase Inducement Theorem with Vector Trading FX

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

Pristine – Oliver Velez – Swing Trading Tactics 2001

$6.00

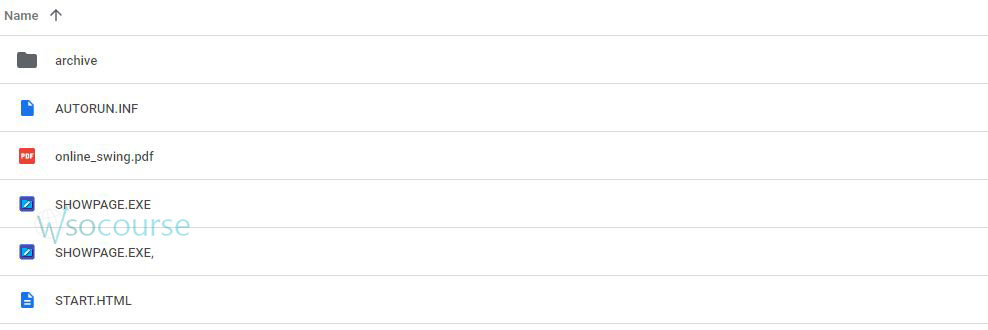

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-31224RjpybtNy

Category: Forex Trading

You may check content proof of “Pristine – Oliver Velez – Swing Trading Tactics 2001” below:

Pristine – Oliver Velez: Swing Trading Tactics 2001

In 2001, Oliver Velez, a pioneering figure in the trading world, introduced a series of swing trading tactics that revolutionized how traders approach the market. These tactics, known for their simplicity and effectiveness, continue to influence traders worldwide. Let’s explore these fundamental tactics and understand how they can be applied in today’s trading environment.

Introduction: The Evolution of Swing Trading

Swing trading has long been a preferred strategy among traders who look for medium-term opportunities. Oliver Velez, with his 2001 swing trading tactics, brought a new dimension to this style, focusing on maximizing gains from short-term market movements.

Tactic 1: Mastering the Pullback Trade

Identifying Pullbacks

A pullback in a market offers a strategic buying opportunity within an existing trend. Recognizing these moments is key to implementing Velez’s tactics.

Executing the Trade

- Wait for confirmation of the trend resumption.

- Set buy orders at strategic points.

- Use stop-loss orders to minimize risks.

Tactic 2: The Power of Bull and Bear Flags

Understanding Flags

Flags indicate a consolidation following a significant price movement, which typically results in a continuation of the prior trend.

Trading Flags Effectively

- Identify flag patterns early.

- Determine entry points based on breakout directions.

- Implement risk management strategies.

Tactic 3: Using Relative Strength

The Role of Relative Strength

Relative strength helps identify stocks that perform better or worse than the market, providing a competitive edge in decision making.

Applying Relative Strength

- Compare stock performance to market indices.

- Select stocks showing strong upward momentum.

- Diversify across sectors showing relative strength.

Tactic 4: Capitalizing on Market Cycles

Market Cycle Dynamics

Understanding the phases of market cycles (expansion, peak, contraction, trough) is crucial for timing trades accurately.

Strategies for Each Phase

- Expansion: Increase exposure to high-momentum stocks.

- Peak: Start to realize profits and reduce positions.

- Contraction: Look for short-selling opportunities.

- Trough: Prepare for the next wave of buying.

Tactic 5: Effective Use of Volume Analysis

Volume as an Indicator

Volume analysis can confirm or refute the strength behind price movements, providing insights into the potential longevity of a trend.

Integrating Volume into Trading

- Monitor volume spikes for potential entry or exit points.

- Use volume trends to assess the strength of a trend.

Conclusion: The Lasting Impact of Velez’s Tactics

Oliver Velez’s 2001 swing trading tactics have stood the test of time, offering valuable lessons that are still relevant in today’s trading world. By understanding and applying these principles, traders can enhance their ability to make informed decisions and maximize their potential in the markets.

FAQs

- What makes swing trading a preferred strategy?

- Swing trading is favored for its balance between short-term gain potential and reduced exposure to overnight market volatility.

- How important is volume analysis in swing trading?

- Volume analysis is crucial as it confirms the strength of market movements and helps traders make more confident decisions.

- Can these tactics be applied in any market condition?

- Yes, while some adjustments may be necessary, the core principles of these tactics are versatile and can be adapted to various market conditions.

- What is the most challenging aspect of implementing these tactics?

- The most challenging aspect is accurately identifying the right timing and conditions for entry and exit points.

- How has swing trading evolved since 2001?

- Swing trading has incorporated more advanced technology and analysis tools, making it more precise and accessible to a broader range of traders.

Be the first to review “Pristine – Oliver Velez – Swing Trading Tactics 2001” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.