-

×

All Time High Trading Course with TRADEVERSITY

1 × $5.00

All Time High Trading Course with TRADEVERSITY

1 × $5.00 -

×

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00 -

×

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00 -

×

Selective Forex Trading with Don Snellgrove

1 × $6.00

Selective Forex Trading with Don Snellgrove

1 × $6.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

Volume Breakout Indicator

1 × $31.00

Volume Breakout Indicator

1 × $31.00 -

×

Trading Course 2024 with ZMC x BMO

1 × $17.00

Trading Course 2024 with ZMC x BMO

1 × $17.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

Forecast, Filings, & News with Jtrader

1 × $6.00

Forecast, Filings, & News with Jtrader

1 × $6.00 -

×

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00 -

×

Candlestick Secrets For Profiting In Options

1 × $23.00

Candlestick Secrets For Profiting In Options

1 × $23.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

Double Top Trader Trading System with Anthony Gibson

1 × $6.00

Double Top Trader Trading System with Anthony Gibson

1 × $6.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00 -

×

Cotton Trading Manual with Terry Townsend

1 × $6.00

Cotton Trading Manual with Terry Townsend

1 × $6.00 -

×

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00 -

×

DaVinci FX Course

1 × $6.00

DaVinci FX Course

1 × $6.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00 -

×

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00 -

×

SPX All Put Flat ButterFly with Mark Fenton - Sheridan Options Mentoring

1 × $39.00

SPX All Put Flat ButterFly with Mark Fenton - Sheridan Options Mentoring

1 × $39.00 -

×

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00 -

×

The Aime Workshop with Clay Marafiote

1 × $6.00

The Aime Workshop with Clay Marafiote

1 × $6.00 -

×

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00 -

×

VIP - One on One Coursework with Talkin Options

1 × $15.00

VIP - One on One Coursework with Talkin Options

1 × $15.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00 -

×

The Practical Fractal with Bill Williams

1 × $6.00

The Practical Fractal with Bill Williams

1 × $6.00 -

×

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00 -

×

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00 -

×

Beat The Market Maker

1 × $62.00

Beat The Market Maker

1 × $62.00 -

×

Traders Edge with Steven Dux

1 × $5.00

Traders Edge with Steven Dux

1 × $5.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00 -

×

Catching the Big Moves with Jack Bernstein

1 × $6.00

Catching the Big Moves with Jack Bernstein

1 × $6.00 -

×

Candlestick Charting Explained with Greg Morris

1 × $8.00

Candlestick Charting Explained with Greg Morris

1 × $8.00 -

×

Trading With an Edge with Bruce Gilmore

1 × $6.00

Trading With an Edge with Bruce Gilmore

1 × $6.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

Exchange-Traded Derivatives with Erik Banks

1 × $6.00

Exchange-Traded Derivatives with Erik Banks

1 × $6.00 -

×

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

Forex Retracement Theory with CopperChips

1 × $6.00

Forex Retracement Theory with CopperChips

1 × $6.00 -

×

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00 -

×

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00 -

×

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00 -

×

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00 -

×

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00 -

×

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00 -

×

Forex Master Method Evolution with Russ Horn

1 × $6.00

Forex Master Method Evolution with Russ Horn

1 × $6.00 -

×

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00 -

×

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00 -

×

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00 -

×

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00 -

×

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00 -

×

SNR Trader Course with Ariff T

1 × $6.00

SNR Trader Course with Ariff T

1 × $6.00 -

×

The TC2000 Masterclass Course with Sasha Evdakov - Rise2learn

1 × $23.00

The TC2000 Masterclass Course with Sasha Evdakov - Rise2learn

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

TradingMind Course with Jack Bernstein

1 × $6.00

TradingMind Course with Jack Bernstein

1 × $6.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Equity Trader 101 Course with KeyStone Trading

1 × $6.00

Equity Trader 101 Course with KeyStone Trading

1 × $6.00 -

×

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Power Trade System by Arthur Christian & John Prow

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

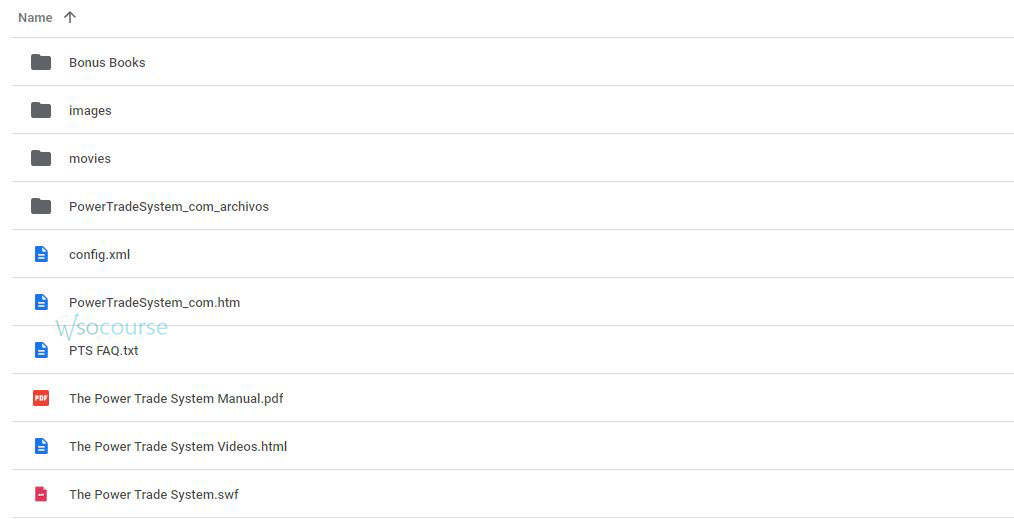

You may check content proof of “The Power Trade System by Arthur Christian & John Prow” below:

The Power Trade System by Arthur Christian & John Prow

In the dynamic world of trading, having a robust system can make all the difference. “The Power Trade System” by Arthur Christian and John Prow is designed to provide traders with a strategic edge. This system combines technical analysis, market psychology, and risk management to create a comprehensive trading approach. Let’s dive into the details of this powerful system and how it can transform your trading strategy.

What is The Power Trade System?

The Power Trade System is a structured trading methodology developed by Arthur Christian and John Prow. It integrates various trading techniques and principles to help traders maximize their returns while minimizing risks.

Key Components of The Power Trade System

- Technical Analysis: Utilizing charts and indicators to predict market movements.

- Market Psychology: Understanding trader behavior and market sentiment.

- Risk Management: Implementing strategies to protect trading capital.

Technical Analysis in The Power Trade System

Technical analysis is the backbone of The Power Trade System. It involves analyzing price charts and using various indicators to identify trading opportunities.

Essential Technical Indicators

- Moving Averages: Helps in identifying the direction of the trend.

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- Bollinger Bands: Indicates market volatility and potential price breakouts.

Moving Averages

Moving averages smooth out price data to create a single flowing line, making it easier to identify trends and potential reversal points.

Relative Strength Index (RSI)

RSI is a momentum oscillator that measures the speed and change of price movements. It is used to identify overbought or oversold conditions in a market.

Market Psychology in The Power Trade System

Understanding market psychology is crucial for successful trading. The Power Trade System emphasizes the importance of trader behavior and sentiment.

Key Psychological Concepts

- Fear and Greed: Recognizing the impact of emotions on trading decisions.

- Herd Mentality: Understanding how group behavior influences market trends.

- Market Sentiment: Gauging overall market mood to anticipate movements.

Fear and Greed

Fear and greed are powerful emotions that can drive market movements. Recognizing these emotions in oneself and others can help traders make more rational decisions.

Herd Mentality

Herd mentality occurs when traders follow the majority without independent analysis, often leading to market bubbles and crashes. Being aware of this behavior can help traders avoid costly mistakes.

Risk Management in The Power Trade System

Risk management is a critical component of The Power Trade System. It involves implementing strategies to protect trading capital and ensure long-term success.

Effective Risk Management Strategies

- Stop-Loss Orders: Predefined exit points to limit losses.

- Position Sizing: Allocating appropriate amounts of capital to each trade.

- Diversification: Spreading investments across different assets to reduce risk.

Stop-Loss Orders

Stop-loss orders are designed to limit an investor’s loss on a position in a security. Setting a stop-loss order at a predetermined price allows traders to minimize their losses on any given trade.

Position Sizing

Position sizing refers to determining the amount of capital to allocate to each trade. Proper position sizing helps manage risk and maximize returns.

Implementing The Power Trade System

To successfully implement The Power Trade System, traders need to follow a structured approach.

Step-by-Step Implementation Guide

- Set Clear Goals: Define your trading objectives and risk tolerance.

- Analyze the Market: Use technical analysis to identify potential trades.

- Monitor Market Sentiment: Keep an eye on market psychology and sentiment indicators.

- Execute Trades: Enter and exit trades based on the system’s signals.

- Review and Adjust: Regularly review your trades and adjust your strategy as needed.

Set Clear Goals

Having clear and achievable goals is the first step in any successful trading strategy. Define what you want to achieve and the level of risk you are willing to accept.

Analyze the Market

Use the technical analysis tools outlined in The Power Trade System to identify trading opportunities. Look for signals from moving averages, RSI, and Bollinger Bands.

Benefits of The Power Trade System

The Power Trade System offers numerous benefits to traders at all levels.

Key Benefits

- Consistency: Provides a structured approach to trading, reducing emotional decision-making.

- Flexibility: Can be adapted to different markets and trading styles.

- Risk Control: Emphasizes risk management, helping traders protect their capital.

Consistency

By following a structured system, traders can reduce emotional decision-making and achieve more consistent results.

Flexibility

The Power Trade System can be adapted to various markets, including stocks, forex, and commodities, making it versatile for different trading environments.

Common Challenges and Solutions

While The Power Trade System is robust, traders may still face challenges. Here are some common issues and their solutions.

Challenges

- Market Volatility: Rapid price movements can lead to unexpected losses.

- Emotional Trading: Letting emotions drive trading decisions.

- Overtrading: Taking too many trades without proper analysis.

Solutions

- Market Volatility: Use stop-loss orders and proper position sizing to manage volatility.

- Emotional Trading: Stick to the system and avoid making decisions based on emotions.

- Overtrading: Focus on quality trades rather than quantity.

Conclusion

The Power Trade System by Arthur Christian and John Prow offers a comprehensive and structured approach to trading. By integrating technical analysis, market psychology, and risk management, traders can enhance their decision-making process and improve their trading outcomes. Whether you are a novice or an experienced trader, adopting The Power Trade System can provide you with the tools and strategies needed for long-term success.

Frequently Asked Questions:

- What is The Power Trade System?

The Power Trade System is a trading methodology developed by Arthur Christian and John Prow, combining technical analysis, market psychology, and risk management. - How does technical analysis work in The Power Trade System?

It involves using charts and indicators like moving averages, RSI, and Bollinger Bands to identify trading opportunities. - Why is market psychology important in trading?

Understanding trader behavior and market sentiment helps anticipate market movements and make informed decisions. - What are the key risk management strategies in The Power Trade System?

Key strategies include using stop-loss orders, proper position sizing, and diversification. - Can The Power Trade System be used in different markets?

Yes, it is versatile and can be adapted to various markets, including stocks, forex, and commodities.

Be the first to review “The Power Trade System by Arthur Christian & John Prow” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.