-

×

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00 -

×

The Illustrated Guide to Technical Analysis Signals and Phrases with Constance Brown

1 × $6.00

The Illustrated Guide to Technical Analysis Signals and Phrases with Constance Brown

1 × $6.00 -

×

ValueCharts Ultimate Bundle with Base Camp Trading

1 × $54.00

ValueCharts Ultimate Bundle with Base Camp Trading

1 × $54.00 -

×

The Blueprint Course 2.0 with Mike Anderson

1 × $17.00

The Blueprint Course 2.0 with Mike Anderson

1 × $17.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00 -

×

PFA SD Model Trading System (Apr 2013)

1 × $31.00

PFA SD Model Trading System (Apr 2013)

1 × $31.00 -

×

Cryptocurrency Investment Course 2021 Fund your Retirement with Suppoman

1 × $5.00

Cryptocurrency Investment Course 2021 Fund your Retirement with Suppoman

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00 -

×

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00 -

×

Forex Mentor 2007 with Peter Bain

1 × $6.00

Forex Mentor 2007 with Peter Bain

1 × $6.00 -

×

Follow the Leader Trading System with Anthony Gibson

1 × $6.00

Follow the Leader Trading System with Anthony Gibson

1 × $6.00 -

×

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00 -

×

Activedaytrader - Workshop: Practical Money Management

1 × $23.00

Activedaytrader - Workshop: Practical Money Management

1 × $23.00 -

×

My Forex League - The Course

1 × $5.00

My Forex League - The Course

1 × $5.00 -

×

The Complete 32 Plus Hour Video Course Bundle with Rob Hoffman - Become a Better Trader

1 × $6.00

The Complete 32 Plus Hour Video Course Bundle with Rob Hoffman - Become a Better Trader

1 × $6.00 -

×

Complete Day Trading Course with The Trading Floor

1 × $13.00

Complete Day Trading Course with The Trading Floor

1 × $13.00 -

×

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00 -

×

DaVinci FX Course

1 × $6.00

DaVinci FX Course

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Adventures of the Cycle Hunter. The Cyclist with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Cyclist with Craig Bttlc

1 × $6.00 -

×

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00 -

×

Football Hedging System with Tony Langley

1 × $54.00

Football Hedging System with Tony Langley

1 × $54.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

Forex Retracement Theory with CopperChips

1 × $6.00

Forex Retracement Theory with CopperChips

1 × $6.00 -

×

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00 -

×

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00 -

×

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00 -

×

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00 -

×

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00 -

×

Investment Psychology. Explained Classic Strategies to Beat the Markets with Martin Pring

1 × $6.00

Investment Psychology. Explained Classic Strategies to Beat the Markets with Martin Pring

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00 -

×

The Traders Battle Plan

1 × $6.00

The Traders Battle Plan

1 × $6.00 -

×

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00 -

×

ASFX Advanced Divergence Training Course & VIP Chat

1 × $39.00

ASFX Advanced Divergence Training Course & VIP Chat

1 × $39.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

Advanced Swing Trading with John Crane

1 × $6.00

Advanced Swing Trading with John Crane

1 × $6.00 -

×

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Cheatcode Trend System with Dominique Woodson

1 × $15.00

Cheatcode Trend System with Dominique Woodson

1 × $15.00 -

×

Investment Leadership & Portfolio Management with Brian Singer

1 × $6.00

Investment Leadership & Portfolio Management with Brian Singer

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Power Trade System by Arthur Christian & John Prow

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

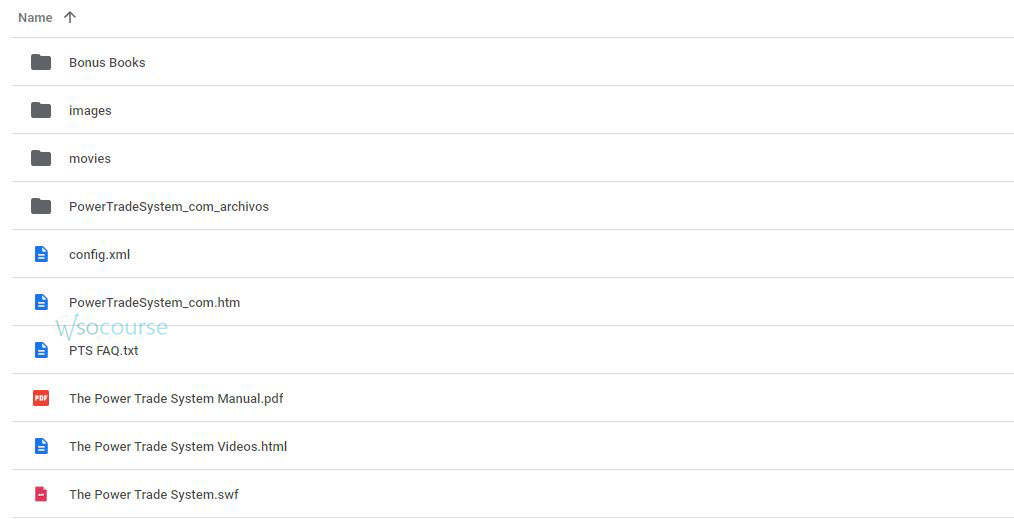

Content Proof: Watch Here!

You may check content proof of “The Power Trade System by Arthur Christian & John Prow” below:

The Power Trade System by Arthur Christian & John Prow

In the dynamic world of trading, having a robust system can make all the difference. “The Power Trade System” by Arthur Christian and John Prow is designed to provide traders with a strategic edge. This system combines technical analysis, market psychology, and risk management to create a comprehensive trading approach. Let’s dive into the details of this powerful system and how it can transform your trading strategy.

What is The Power Trade System?

The Power Trade System is a structured trading methodology developed by Arthur Christian and John Prow. It integrates various trading techniques and principles to help traders maximize their returns while minimizing risks.

Key Components of The Power Trade System

- Technical Analysis: Utilizing charts and indicators to predict market movements.

- Market Psychology: Understanding trader behavior and market sentiment.

- Risk Management: Implementing strategies to protect trading capital.

Technical Analysis in The Power Trade System

Technical analysis is the backbone of The Power Trade System. It involves analyzing price charts and using various indicators to identify trading opportunities.

Essential Technical Indicators

- Moving Averages: Helps in identifying the direction of the trend.

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- Bollinger Bands: Indicates market volatility and potential price breakouts.

Moving Averages

Moving averages smooth out price data to create a single flowing line, making it easier to identify trends and potential reversal points.

Relative Strength Index (RSI)

RSI is a momentum oscillator that measures the speed and change of price movements. It is used to identify overbought or oversold conditions in a market.

Market Psychology in The Power Trade System

Understanding market psychology is crucial for successful trading. The Power Trade System emphasizes the importance of trader behavior and sentiment.

Key Psychological Concepts

- Fear and Greed: Recognizing the impact of emotions on trading decisions.

- Herd Mentality: Understanding how group behavior influences market trends.

- Market Sentiment: Gauging overall market mood to anticipate movements.

Fear and Greed

Fear and greed are powerful emotions that can drive market movements. Recognizing these emotions in oneself and others can help traders make more rational decisions.

Herd Mentality

Herd mentality occurs when traders follow the majority without independent analysis, often leading to market bubbles and crashes. Being aware of this behavior can help traders avoid costly mistakes.

Risk Management in The Power Trade System

Risk management is a critical component of The Power Trade System. It involves implementing strategies to protect trading capital and ensure long-term success.

Effective Risk Management Strategies

- Stop-Loss Orders: Predefined exit points to limit losses.

- Position Sizing: Allocating appropriate amounts of capital to each trade.

- Diversification: Spreading investments across different assets to reduce risk.

Stop-Loss Orders

Stop-loss orders are designed to limit an investor’s loss on a position in a security. Setting a stop-loss order at a predetermined price allows traders to minimize their losses on any given trade.

Position Sizing

Position sizing refers to determining the amount of capital to allocate to each trade. Proper position sizing helps manage risk and maximize returns.

Implementing The Power Trade System

To successfully implement The Power Trade System, traders need to follow a structured approach.

Step-by-Step Implementation Guide

- Set Clear Goals: Define your trading objectives and risk tolerance.

- Analyze the Market: Use technical analysis to identify potential trades.

- Monitor Market Sentiment: Keep an eye on market psychology and sentiment indicators.

- Execute Trades: Enter and exit trades based on the system’s signals.

- Review and Adjust: Regularly review your trades and adjust your strategy as needed.

Set Clear Goals

Having clear and achievable goals is the first step in any successful trading strategy. Define what you want to achieve and the level of risk you are willing to accept.

Analyze the Market

Use the technical analysis tools outlined in The Power Trade System to identify trading opportunities. Look for signals from moving averages, RSI, and Bollinger Bands.

Benefits of The Power Trade System

The Power Trade System offers numerous benefits to traders at all levels.

Key Benefits

- Consistency: Provides a structured approach to trading, reducing emotional decision-making.

- Flexibility: Can be adapted to different markets and trading styles.

- Risk Control: Emphasizes risk management, helping traders protect their capital.

Consistency

By following a structured system, traders can reduce emotional decision-making and achieve more consistent results.

Flexibility

The Power Trade System can be adapted to various markets, including stocks, forex, and commodities, making it versatile for different trading environments.

Common Challenges and Solutions

While The Power Trade System is robust, traders may still face challenges. Here are some common issues and their solutions.

Challenges

- Market Volatility: Rapid price movements can lead to unexpected losses.

- Emotional Trading: Letting emotions drive trading decisions.

- Overtrading: Taking too many trades without proper analysis.

Solutions

- Market Volatility: Use stop-loss orders and proper position sizing to manage volatility.

- Emotional Trading: Stick to the system and avoid making decisions based on emotions.

- Overtrading: Focus on quality trades rather than quantity.

Conclusion

The Power Trade System by Arthur Christian and John Prow offers a comprehensive and structured approach to trading. By integrating technical analysis, market psychology, and risk management, traders can enhance their decision-making process and improve their trading outcomes. Whether you are a novice or an experienced trader, adopting The Power Trade System can provide you with the tools and strategies needed for long-term success.

Frequently Asked Questions:

- What is The Power Trade System?

The Power Trade System is a trading methodology developed by Arthur Christian and John Prow, combining technical analysis, market psychology, and risk management. - How does technical analysis work in The Power Trade System?

It involves using charts and indicators like moving averages, RSI, and Bollinger Bands to identify trading opportunities. - Why is market psychology important in trading?

Understanding trader behavior and market sentiment helps anticipate market movements and make informed decisions. - What are the key risk management strategies in The Power Trade System?

Key strategies include using stop-loss orders, proper position sizing, and diversification. - Can The Power Trade System be used in different markets?

Yes, it is versatile and can be adapted to various markets, including stocks, forex, and commodities.

Be the first to review “The Power Trade System by Arthur Christian & John Prow” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.