-

×

Larry Williams Newsletters (1994-1997)

1 × $6.00

Larry Williams Newsletters (1994-1997)

1 × $6.00 -

×

Currency Strategy with Callum Henderson

1 × $6.00

Currency Strategy with Callum Henderson

1 × $6.00 -

×

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00 -

×

Adx Mastery Complete Course

1 × $6.00

Adx Mastery Complete Course

1 × $6.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

A Trader’s Guide To Discipline

1 × $6.00

A Trader’s Guide To Discipline

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Cash In On Chaos with Hans Hannula

1 × $6.00

Cash In On Chaos with Hans Hannula

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00 -

×

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00 -

×

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00 -

×

Professional Chart Reading Bootcamp - 2 CDs

1 × $6.00

Professional Chart Reading Bootcamp - 2 CDs

1 × $6.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00 -

×

The Psychology of Investing with John Nofsinger

1 × $6.00

The Psychology of Investing with John Nofsinger

1 × $6.00 -

×

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Future DayTrading (German)

1 × $6.00

Future DayTrading (German)

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Day Trade Futures Online with Larry Williams

1 × $6.00

Day Trade Futures Online with Larry Williams

1 × $6.00 -

×

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00 -

×

Master Forex Fundamentals

1 × $15.00

Master Forex Fundamentals

1 × $15.00 -

×

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00 -

×

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Best of Livestock with Timothy Sykes

1 × $5.00

Best of Livestock with Timothy Sykes

1 × $5.00 -

×

Advanced Trading Course with Edney Pinheiro

1 × $5.00

Advanced Trading Course with Edney Pinheiro

1 × $5.00 -

×

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Commodities for Dummies with Amine Bouchentouf

1 × $6.00

Commodities for Dummies with Amine Bouchentouf

1 × $6.00 -

×

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00 -

×

The Banks Code with Smart Money Trader

1 × $34.00

The Banks Code with Smart Money Trader

1 × $34.00 -

×

Peter Borish Online Trader Program

1 × $15.00

Peter Borish Online Trader Program

1 × $15.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00 -

×

4D Bootcamp with Black Rabbit

1 × $10.00

4D Bootcamp with Black Rabbit

1 × $10.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00 -

×

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00 -

×

ALGO™ Online Retail - Version 2.9

1 × $155.00

ALGO™ Online Retail - Version 2.9

1 × $155.00 -

×

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00 -

×

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00 -

×

T3 Live - The Simple Art of Trading

1 × $31.00

T3 Live - The Simple Art of Trading

1 × $31.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Candlesticks Explained with Martin Pring

1 × $6.00

Candlesticks Explained with Martin Pring

1 × $6.00 -

×

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Hedge Fund Investment Management with Izze Nelken

1 × $6.00

Hedge Fund Investment Management with Izze Nelken

1 × $6.00 -

×

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00 -

×

How to avoid the GAP

1 × $6.00

How to avoid the GAP

1 × $6.00 -

×

Build Your Own Trading System with John Hill

1 × $6.00

Build Your Own Trading System with John Hill

1 × $6.00 -

×

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00 -

×

RSI Basic with Andrew Cardwell

1 × $54.00

RSI Basic with Andrew Cardwell

1 × $54.00 -

×

A Bull in China with Jim Rogers

1 × $6.00

A Bull in China with Jim Rogers

1 × $6.00 -

×

Beginner's Guide to Trading Intraday Futures Class with Don Kaufman

1 × $6.00

Beginner's Guide to Trading Intraday Futures Class with Don Kaufman

1 × $6.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00 -

×

Selective Forex Trading with Don Snellgrove

1 × $6.00

Selective Forex Trading with Don Snellgrove

1 × $6.00 -

×

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00 -

×

The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies with Guy Cohen

1 × $6.00

The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies with Guy Cohen

1 × $6.00 -

×

FasTrack Premium with Note Conference

1 × $78.00

FasTrack Premium with Note Conference

1 × $78.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

Secret Income with James Altucher

1 × $62.00

Secret Income with James Altucher

1 × $62.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Dynamic Trading Master Course with Robert Miner

1 × $54.00

The Dynamic Trading Master Course with Robert Miner

1 × $54.00 -

×

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00 -

×

3 Day WorkShop with HYDRA

1 × $13.00

3 Day WorkShop with HYDRA

1 × $13.00 -

×

Forex Eye

1 × $5.00

Forex Eye

1 × $5.00 -

×

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00 -

×

CFA Level 2 - Sample Item Sets 2003

1 × $6.00

CFA Level 2 - Sample Item Sets 2003

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00 -

×

Iron Condors in a Volatile Market 2022 with Dan Sheridan - Sheridan Options Mentoring

1 × $46.00

Iron Condors in a Volatile Market 2022 with Dan Sheridan - Sheridan Options Mentoring

1 × $46.00 -

×

Exploring MetaStock Basic with Martin Pring

1 × $6.00

Exploring MetaStock Basic with Martin Pring

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Sell & Sell Short with Alexander Elder

1 × $6.00

Sell & Sell Short with Alexander Elder

1 × $6.00 -

×

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00 -

×

Forex Trading MasterClass with Torero Traders School

1 × $5.00

Forex Trading MasterClass with Torero Traders School

1 × $5.00 -

×

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00 -

×

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00 -

×

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00 -

×

Forex Mentor Seminar with Peter Bain

1 × $6.00

Forex Mentor Seminar with Peter Bain

1 × $6.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Derivates Demystified

1 × $6.00

Derivates Demystified

1 × $6.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00 -

×

Evolved Trader with Mark Croock

1 × $69.00

Evolved Trader with Mark Croock

1 × $69.00 -

×

Acclimation Course with Base Camp Trading

1 × $10.00

Acclimation Course with Base Camp Trading

1 × $10.00 -

×

Advanced Trading System 2020

1 × $179.00

Advanced Trading System 2020

1 × $179.00 -

×

Private Seminar with Alan Andrew

1 × $6.00

Private Seminar with Alan Andrew

1 × $6.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

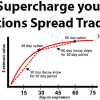

Supercharge your Options Spread Trading with John Summa

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Supercharge your Options Spread Trading with John Summa” below:

Supercharge Your Options Spread Trading with John Summa

Introduction

Options spread trading offers a sophisticated way to manage risk and enhance returns. John Summa, a seasoned expert in options trading, provides invaluable insights into maximizing the potential of options spreads. This guide delves into the strategies and techniques that can help you supercharge your options spread trading.

Understanding Options Spread Trading

What is Options Spread Trading?

Options spread trading involves buying and selling multiple options simultaneously to create a spread. This approach can limit risk and leverage potential gains.

Types of Options Spreads

There are various types of options spreads, including vertical spreads, horizontal spreads, diagonal spreads, and more. Each type has its unique characteristics and applications.

Benefits of Options Spread Trading

Risk Management

Options spreads can help manage risk by limiting potential losses. By using spreads, traders can set maximum loss limits.

Enhanced Profit Potential

Spreads can enhance profit potential by taking advantage of specific market conditions. They allow traders to profit from volatility, time decay, and price movements.

Flexibility

Options spreads offer flexibility, allowing traders to create strategies tailored to their market outlook and risk tolerance.

Key Strategies for Options Spread Trading

Bull Call Spread

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price. This strategy profits from upward price movements.

Bear Put Spread

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price. This strategy profits from downward price movements.

Iron Condor

An iron condor involves selling a lower strike put, buying a higher strike put, selling a higher strike call, and buying a lower strike call. This strategy profits from low volatility.

Calendar Spread

A calendar spread involves buying a longer-term option and selling a shorter-term option with the same strike price. This strategy profits from time decay.

Tools for Successful Spread Trading

Trading Platforms

Utilize advanced trading platforms that offer comprehensive options analytics, real-time data, and strategy builders.

Technical Analysis Tools

Technical analysis tools, such as moving averages, Bollinger Bands, and RSI, can help identify entry and exit points for options spreads.

Option Greeks

Understanding option Greeks (Delta, Gamma, Theta, Vega, Rho) is crucial for managing the sensitivity of options spreads to various factors.

Building a Robust Trading Plan

Define Your Goals

Set clear, realistic goals for your options spread trading. Determine your risk tolerance and desired returns.

Develop a Strategy

Based on your goals and market analysis, develop a detailed trading strategy. Include specific entry and exit criteria and risk management rules.

Backtest Your Strategy

Before implementing your strategy in live markets, backtest it using historical data to assess its performance and make necessary adjustments.

Risk Management Techniques

Position Sizing

Proper position sizing ensures that you do not risk too much on a single trade. This technique helps protect your capital and manage overall risk.

Stop-Loss Orders

Use stop-loss orders to limit potential losses. Set these orders based on your risk tolerance and market conditions.

Diversification

Diversify your options spreads across different underlying assets and strategies to spread risk.

Advanced Techniques for Supercharging Your Trading

Leveraging Volatility

Take advantage of market volatility by using strategies like straddles and strangles. These strategies can profit from significant price movements in either direction.

Adjusting Positions

Be prepared to adjust your positions as market conditions change. This might involve rolling options or adding additional spreads to manage risk and enhance returns.

Using Synthetic Positions

Create synthetic positions to mimic the payoff of traditional options strategies with potentially lower costs or different risk profiles.

Common Mistakes to Avoid

Overleveraging

Avoid overleveraging your trades. Use margin wisely and ensure that your trades are sized appropriately for your account.

Ignoring Time Decay

Be aware of time decay, especially when trading short-term options. Time decay can erode the value of your options positions.

Lack of Discipline

Maintain discipline in your trading. Stick to your trading plan and avoid making impulsive decisions based on market fluctuations.

Practical Tips for Consistent Success

Continuous Learning

The options market is constantly evolving. Stay updated with the latest strategies, tools, and market developments.

Stay Informed

Keep abreast of economic news, earnings reports, and other factors that can impact the markets. Informed trading decisions are more likely to succeed.

Review and Adjust

Regularly review your trading performance and adjust your strategies as needed. Continuous improvement is key to long-term success.

Conclusion

John Summa‘s insights into options spread trading provide a powerful framework for traders looking to maximize their potential. By understanding the various strategies, tools, and techniques, you can supercharge your options trading and achieve consistent success. Remember, the key to successful options trading lies in disciplined execution, continuous learning, and effective risk management.

FAQs

1. What is a bull call spread?

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price to profit from upward price movements.

2. How can I manage risk in options spread trading?

Manage risk by using stop-loss orders, proper position sizing, and diversifying your trades across different assets and strategies.

3. What are option Greeks?

Option Greeks (Delta, Gamma, Theta, Vega, Rho) measure the sensitivity of options prices to various factors, helping traders manage their positions.

4. Why is backtesting important?

Backtesting allows traders to assess the performance of their strategies using historical data, helping them make necessary adjustments before live trading.

5. How can I profit from market volatility?

Strategies like straddles and strangles can profit from significant price movements in either direction, making them effective in volatile markets.

Be the first to review “Supercharge your Options Spread Trading with John Summa” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.