2 Trades A Day with Jason Hale

$495.00 Original price was: $495.00.$15.00Current price is: $15.00.

File Size: 239 MB

Delivery Time: 1–12 hours

Media Type: Online Course

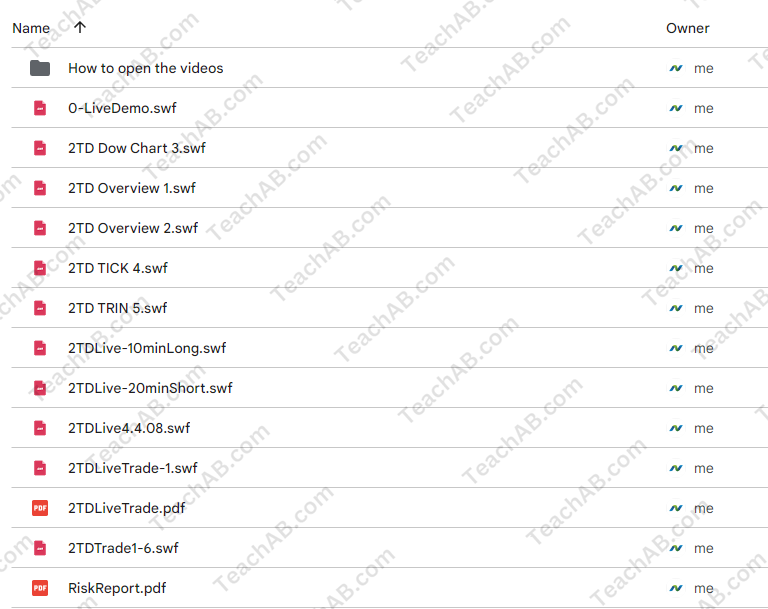

Content Proof: Watch Here!

You may check content proof of “2 Trades A Day with Jason Hale” below:

In the dynamic world of stock trading, having a clear, concise strategy is key to success. Jason Hale’s “2 Trades A Day” method provides just that—a focused, systematic approach to making the most out of your trading day, every day. In this article, we delve into how this strategy works, its benefits, and how you can implement it to potentially increase your trading success.

Introduction to Jason Hale and His Trading Philosophy

Who is Jason Hale?

Jason Hale is a seasoned trader known for his pragmatic approach to the stock market. With years of experience, Jason has refined his strategy to what he believes is an optimal approach for consistent gains.

The Core of His Strategy: Simplicity and Focus

At its heart, the “2 Trades A Day” strategy is about reducing complexity and focusing on two well-planned trades each trading day. This method encourages discipline and helps traders avoid common pitfalls like overtrading.

Understanding the ‘2 Trades A Day’ Strategy

Selection of Trades

The first step in Jason’s strategy is selecting two trades with the highest potential each day. This involves detailed market analysis and identifying signals that suggest a strong move in stock prices.

Criteria for Trade Selection

- Market Trends: Understanding broader market trends is crucial.

- Volume Analysis: High trading volumes can indicate strong interest in a stock.

- Technical Indicators: Tools like moving averages and RSI play a key role.

Timing the Trades

Timing is everything in trading. Jason emphasizes the importance of executing trades at optimal times during the trading day, often around market open or close, to capitalize on market volatility.

Benefits of the ‘2 Trades A Day’ Method

Enhanced Focus

By limiting the number of trades, you can dedicate more time and resources to researching and executing each trade effectively.

Risk Management

This approach inherently limits exposure to market volatility, as it avoids the temptation to make impulsive trades throughout the day.

Consistency and Discipline

Following a strict rule of two trades per day fosters discipline, a crucial trait for successful traders.

How to Implement This Strategy

Pre-Market Preparation

- Review market news and events: Be aware of factors that could impact the markets.

- Prepare your watchlist: Select potential stocks based on your pre-market analysis.

Execution

- Enter trades with precision: Timing your entry is as important as the selection.

- Monitor and adjust: Stay vigilant and be ready to exit if conditions change.

Tools and Resources for Support

Technical Analysis Software

Utilizing robust technical analysis tools can enhance the effectiveness of your trades by providing real-time data and insights.

Continual Education

Engage with resources like webinars, books, and courses to keep your trading skills sharp and up-to-date.

Challenges and How to Overcome Them

Emotional Trading

Sticking strictly to the strategy helps mitigate emotional decisions, which can often lead to losses.

Market Anomalies

Sometimes, the market behaves unpredictably. In such cases, it’s important to stick to your risk management principles and not deviate from your strategy.

Conclusion

Jason Hale’s “2 Trades A Day” approach simplifies trading into manageable, focused actions that, if executed well, can lead to consistent trading success. By adopting this strategy, you embrace a disciplined, informed trading practice that can significantly enhance your ability to make profitable decisions in the stock market.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “2 Trades A Day with Jason Hale” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.