-

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Iron Condors in a Volatile Market 2022 with Dan Sheridan – Sheridan Options Mentoring

$297.00 Original price was: $297.00.$46.00Current price is: $46.00.

File Size: 4.12 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

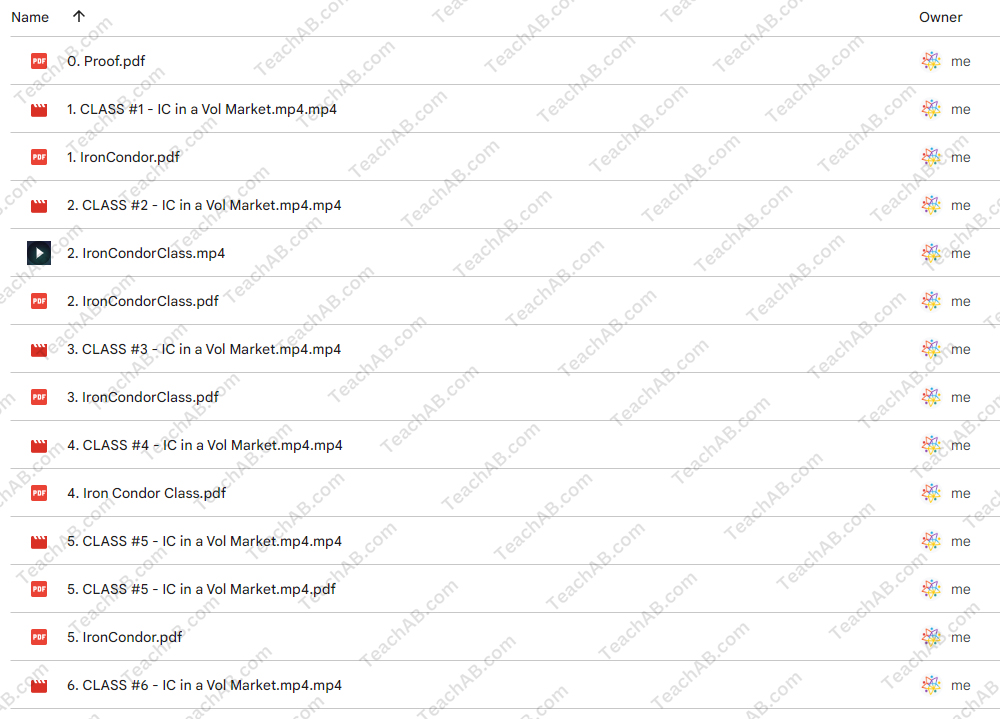

You may check content proof of “Iron Condors in a Volatile Market 2022 with Dan Sheridan – Sheridan Options Mentoring” below:

Navigating the tumultuous waves of the stock market in 2022 requires not just courage but a robust strategy. The Iron Condor, a popular options trading strategy, has shown considerable promise in such volatile environments. This article explores the intricacies of executing Iron Condors effectively under the guidance of Dan Sheridan of Sheridan Options Mentoring.

Introduction to Iron Condors

What is an Iron Condor?

An Iron Condor is a non-directional options strategy that involves selling and buying of calls and puts to generate profit from a stock that remains within a specific price range. It is best utilized in markets where significant price swings are not expected.

Understanding Market Volatility

The Impact of Volatility on Options

2022 has been a year marked by significant volatility, influenced by economic uncertainties and geopolitical tensions. This environment impacts options trading, particularly strategies like the Iron Condor, which thrive in stable conditions.

Mastering Iron Condors with Dan Sheridan

Dan Sheridan’s Expertise

Dan Sheridan is a veteran options trader and respected mentor in the trading community. His approach to Iron Condors in volatile markets is both strategic and informed, aimed at minimizing risk while maximizing profitability.

Sheridan’s Strategy for 2022

- Adjusting Strike Prices: Slightly wider spreads to accommodate unexpected movements.

- Risk Management: Tighter stop-loss levels to protect gains.

- Profit Targets: Realistic profit targets to ensure timely exit.

Course Structure and Content

What the Course Offers

Sheridan Options Mentoring offers a comprehensive course that covers:

- Theory of Iron Condors

- Application in Current Markets

- Hands-on Trading Simulations

Key Learning Modules

- Basics of Options Trading

- Introduction to Iron Condors

- Adapting to Market Volatility

- Risk and Money Management

Who Should Attend?

Target Audience

- Novice Traders: Those new to options trading.

- Experienced Traders: Seasoned traders looking to refine their strategies.

- Investment Professionals: Analysts and portfolio managers.

Benefits of Learning from Dan Sheridan

Why Choose This Mentor?

- Expert Guidance: Direct insights from a seasoned trader.

- Proven Strategies: Tested methods in real-world scenarios.

- Community and Support: Access to a like-minded community of traders.

Preparing for the Course

What You Need to Know Beforehand

- Basic Understanding of Options

- Familiarity with Trading Platforms

- Willingness to Learn and Adapt

Course Highlights and Features

Unique Aspects of the Course

- Live Trading Sessions: Real-time application of strategies.

- Interactive Q&A: Direct interaction with Dan Sheridan.

- Post-Course Support: Continued learning and mentorship.

Success Stories

Testimonials from Past Participants

Many participants have successfully applied the strategies learned, noting improved confidence and profitability in their trading endeavors.

Conclusion

The Iron Condors strategy, especially in a volatile market like that of 2022, offers a sophisticated means of risk-controlled trading. Under the expert tutelage of Dan Sheridan and Sheridan Options Mentoring, traders can learn to navigate these waters with greater assurance and achieve consistent returns.

Frequently Asked Questions

- What is an Iron Condor? An Iron Condor is an options strategy involving four different contracts to profit from stocks trading within a specific price range.

- Why is the Iron Condor suitable for volatile markets? With proper adjustments, it can capitalize on market stability and mitigate risk during fluctuations.

- How experienced should I be to enroll in the course? While beginners are welcome, some basic knowledge of options trading is beneficial.

- What can I realistically expect to gain from this course? Expect to learn effective risk management and strategic planning for trading Iron Condors.

- Is there any follow-up support after the course? Yes, participants gain access to an exclusive community for ongoing support and learning.

Be the first to review “Iron Condors in a Volatile Market 2022 with Dan Sheridan – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.