-

×

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00 -

×

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00 -

×

Volume Profile Trading Strategy with Critical Trading

1 × $15.00

Volume Profile Trading Strategy with Critical Trading

1 × $15.00 -

×

Starting Out in Futures Trading with Mark Powers

1 × $6.00

Starting Out in Futures Trading with Mark Powers

1 × $6.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

Wealth Management with Dimitris Chorafas

1 × $6.00

Wealth Management with Dimitris Chorafas

1 × $6.00 -

×

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00 -

×

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00 -

×

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00 -

×

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00 -

×

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00 -

×

FruitFly For Consistent Income with Matt Williamson

1 × $6.00

FruitFly For Consistent Income with Matt Williamson

1 × $6.00 -

×

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00 -

×

Rhythm of the Moon with Jack Gillen

1 × $4.00

Rhythm of the Moon with Jack Gillen

1 × $4.00 -

×

Research And Trade Like The Pros with Lex Van Dam & James Helliwell

1 × $15.00

Research And Trade Like The Pros with Lex Van Dam & James Helliwell

1 × $15.00 -

×

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00 -

×

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00 -

×

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00 -

×

Pattern Trader Pro with ForexStore

1 × $6.00

Pattern Trader Pro with ForexStore

1 × $6.00 -

×

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00 -

×

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00 -

×

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00 -

×

Rocking Wall Street with Gary Marks

1 × $6.00

Rocking Wall Street with Gary Marks

1 × $6.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00 -

×

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00 -

×

The Mathematics of Technical Analysis with Clifford Sherry

1 × $6.00

The Mathematics of Technical Analysis with Clifford Sherry

1 × $6.00 -

×

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

The Michanics of Futures Trading - Roy Habben

1 × $6.00

The Michanics of Futures Trading - Roy Habben

1 × $6.00 -

×

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

IRON CONDORS FOR INCOME 2017 with Sheridan Options Mentoring

1 × $6.00

IRON CONDORS FOR INCOME 2017 with Sheridan Options Mentoring

1 × $6.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

Get More Leads Quickly with Brittany Lynch

1 × $6.00

Get More Leads Quickly with Brittany Lynch

1 × $6.00 -

×

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00 -

×

Short Swing Trading v6.0 with David Smith

1 × $6.00

Short Swing Trading v6.0 with David Smith

1 × $6.00 -

×

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

PennyStocking with Timothy Sykes

1 × $5.00

PennyStocking with Timothy Sykes

1 × $5.00 -

×

Renko Mastery Intensive Program

1 × $85.00

Renko Mastery Intensive Program

1 × $85.00 -

×

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Signals

1 × $6.00

Signals

1 × $6.00 -

×

Foundations of Forex Trading with TradeSmart University

1 × $6.00

Foundations of Forex Trading with TradeSmart University

1 × $6.00 -

×

Century Capital Group Course with Dylan Forexia

1 × $6.00

Century Capital Group Course with Dylan Forexia

1 × $6.00 -

×

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00 -

×

My General Counsel™

1 × $23.00

My General Counsel™

1 × $23.00 -

×

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00 -

×

The Key to Profits in Tough Times

1 × $6.00

The Key to Profits in Tough Times

1 × $6.00 -

×

High Yield Investments I & II with Lance Spicer

1 × $6.00

High Yield Investments I & II with Lance Spicer

1 × $6.00 -

×

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00 -

×

Private Seminars

1 × $23.00

Private Seminars

1 × $23.00 -

×

The Handbook of Risk with Ben Warwick

1 × $6.00

The Handbook of Risk with Ben Warwick

1 × $6.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Targeting Profitable Entry & Exit Points with Alan Farley

1 × $6.00

Targeting Profitable Entry & Exit Points with Alan Farley

1 × $6.00 -

×

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00 -

×

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00 -

×

Technical Timing Patterns

1 × $6.00

Technical Timing Patterns

1 × $6.00 -

×

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Trading Day By Day & Code (chickgoslin.com) with Chick Goslin

1 × $6.00

Trading Day By Day & Code (chickgoslin.com) with Chick Goslin

1 × $6.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00 -

×

A Trader’s Guide To Discipline

1 × $6.00

A Trader’s Guide To Discipline

1 × $6.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Reading & Understanding Charts with Andrew Baxter

1 × $6.00

Reading & Understanding Charts with Andrew Baxter

1 × $6.00 -

×

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00 -

×

Advanced Breakthroughs in Day Trading DVD course with George Angell

1 × $6.00

Advanced Breakthroughs in Day Trading DVD course with George Angell

1 × $6.00 -

×

The Great Reflation with Anthony Boeckh

1 × $6.00

The Great Reflation with Anthony Boeckh

1 × $6.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00 -

×

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00 -

×

Collection of Articles and Webinars with Sunil Mangwani [9 Videos (FLVs) + 14 eBooks

1 × $6.00

Collection of Articles and Webinars with Sunil Mangwani [9 Videos (FLVs) + 14 eBooks

1 × $6.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

Gap Trading for Stock and Options Traders with Damon Verial

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

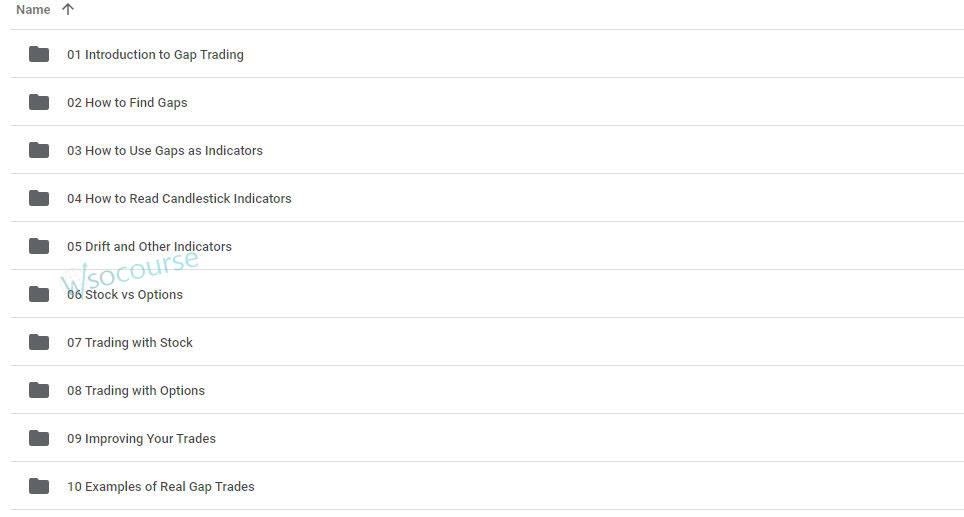

You may check content proof of “Gap Trading for Stock and Options Traders with Damon Verial” below:

Gap Trading for Stock and Options Traders with Damon Verial

Gap trading is a strategy that takes advantage of price gaps in the stock market. These gaps can present lucrative opportunities for traders who know how to navigate them effectively. Damon Verial, a seasoned market analyst, provides insightful strategies for gap trading. In this article, we explore how stock and options traders can benefit from gap trading techniques taught by Damon Verial.

Introduction

Who is Damon Verial?

Damon Verial is a respected market analyst and financial educator known for his expertise in stock and options trading. His strategies focus on data-driven analysis and practical trading techniques.

What is Gap Trading?

Gap trading involves taking advantage of the price gaps that occur when a stock opens at a significantly different price than its previous closing price. These gaps can result from after-hours news, earnings reports, or other market-moving events.

Understanding Price Gaps

Types of Gaps

Common Gaps

Common gaps occur in the middle of a trading range and are usually insignificant in terms of price movement.

Breakaway Gaps

Breakaway gaps happen at the beginning of a trend and indicate a strong movement in the direction of the gap.

Runaway Gaps

Runaway gaps, also known as continuation gaps, occur in the middle of a trend and indicate strong ongoing momentum.

Exhaustion Gaps

Exhaustion gaps appear near the end of a trend and suggest a possible reversal or slowdown in the price movement.

Identifying Gaps

Chart Patterns

Using chart patterns and technical analysis tools helps identify potential gaps. Verial emphasizes the importance of understanding these patterns for successful gap trading.

Volume Analysis

Volume analysis can confirm the significance of a gap. High trading volume typically accompanies more meaningful gaps.

Strategies for Gap Trading

Pre-Market Preparation

Monitoring Pre-Market Activity

Check pre-market trading activity to identify potential gaps. News, earnings reports, and economic data released before the market opens can create significant gaps.

Setting Up Alerts

Set up alerts for stocks you are monitoring to get notified of significant pre-market price changes.

Trading Breakaway Gaps

Entry Points

For breakaway gaps, enter trades in the direction of the gap. If a stock gaps up, consider buying; if it gaps down, consider shorting.

Stop-Loss Orders

Set stop-loss orders to manage risk. Place them just below the gap for long positions and just above the gap for short positions.

Trading Runaway Gaps

Following the Trend

Trade in the direction of the existing trend. Runaway gaps indicate strong momentum, so align your trades with this movement.

Adjusting Positions

As the trend continues, adjust your positions to lock in profits and manage risk.

Trading Exhaustion Gaps

Recognizing Reversals

Exhaustion gaps often signal reversals. Look for confirmation through volume analysis and other technical indicators before entering a trade.

Short-Term Opportunities

Exhaustion gaps can provide short-term trading opportunities. Be prepared to enter and exit trades quickly to capitalize on these movements.

Gap Trading with Options

Advantages of Options in Gap Trading

Leverage

Options provide leverage, allowing you to control a larger position with a smaller investment.

Defined Risk

Options have predefined risk, making them suitable for volatile gap trading scenarios.

Options Strategies for Gaps

Buying Calls and Puts

Buy calls if you expect the stock to gap up and puts if you expect it to gap down. This strategy allows you to capitalize on significant price movements.

Straddles and Strangles

Use straddles and strangles to profit from significant price movements in either direction. These strategies involve buying both call and put options.

Risk Management

Setting Stop-Loss Orders

Importance of Stop-Losses

Stop-loss orders protect your capital by limiting potential losses. Always use them when trading gaps.

Adjusting Stop-Losses

Adjust stop-loss levels as the trade progresses to lock in profits and minimize risk.

Position Sizing

Calculating Position Size

Determine the appropriate position size based on your risk tolerance and the potential size of the gap.

Diversifying Trades

Avoid putting all your capital into a single gap trade. Diversify your trades to spread risk.

Tools and Resources for Gap Trading

Trading Platforms

Choose a trading platform that offers real-time data, advanced charting tools, and customizable alerts.

Educational Resources

Leverage books, articles, and online courses to deepen your understanding of gap trading strategies.

Market Analysis Tools

Use market analysis tools to monitor news, earnings reports, and other events that can create gaps.

Conclusion

Why Practice Gap Trading?

Gap trading offers unique opportunities for significant profits by capitalizing on price movements caused by market events. With Damon Verial’s strategies, traders can effectively navigate these gaps and enhance their trading performance.

FAQs

1. What is gap trading?

Gap trading involves taking advantage of price gaps that occur when a stock opens at a different price than its previous close, usually due to market-moving events.

2. What are the different types of gaps?

The different types of gaps include common gaps, breakaway gaps, runaway gaps, and exhaustion gaps, each indicating different market conditions.

3. How can options be used in gap trading?

Options can be used in gap trading to provide leverage and defined risk. Strategies like buying calls and puts, and using straddles and strangles, can be effective.

4. Why is risk management important in gap trading?

Risk management is crucial in gap trading to protect your capital and minimize potential losses. This includes setting stop-loss orders and diversifying trades.

5. What tools are helpful for gap trading?

Helpful tools for gap trading include advanced trading platforms, market analysis tools, and educational resources to stay informed about potential gaps and trading strategies.

Be the first to review “Gap Trading for Stock and Options Traders with Damon Verial” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.