-

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Geometry of Markets II with Bruce Gilmore

1 × $6.00

Geometry of Markets II with Bruce Gilmore

1 × $6.00 -

×

Evolution Course with Kevin Trades

1 × $15.00

Evolution Course with Kevin Trades

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00

Fractal Markets FX (SMC)

$5.00

File Size: 4.34 GB

Delivery Time: 1–12 hours

Media Type: Online Course

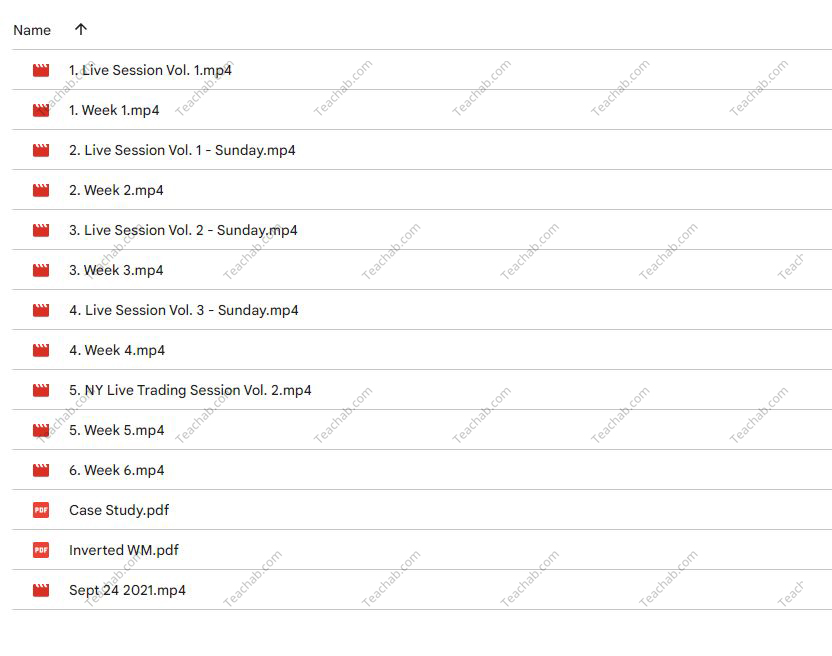

Content Proof: Watch Here!

You may check content proof of “Fractal Markets FX (SMC)” below:

Understanding Fractal Markets FX (SMC): A Comprehensive Guide

Introduction to Fractal Markets FX (SMC)

Welcome to our deep dive into Fractal Markets FX, also known as SMC. If you’re intrigued by the complexities of financial markets and how patterns emerge, you’ve come to the right place. In this article, we will explore the intriguing world of fractal markets, particularly focusing on the Fractal Markets FX (SMC) strategy.

What Are Fractal Markets?

Defining Fractals in Financial Terms

Fractals are patterns that repeat at various scales, creating self-similar and infinitely complex patterns. In finance, these are used to understand and predict market movements more accurately.

The Significance of Fractal Analysis in Forex

Fractal analysis in Forex involves looking for repeating patterns that can offer predictions about future market movements. This method is rooted in the idea that markets are chaotic systems with underlying patterns.

The SMC Approach to Fractal Markets

What Does SMC Stand For?

SMC stands for Signal, Momentum, and Condition, the three pillars of this trading strategy. Each component plays a vital role in making informed trading decisions.

Integrating SMC into Forex Trading

By integrating these components, traders can better interpret fractal signals, enhancing their strategic approach to the forex market.

Benefits of Using Fractal Markets FX (SMC)

Improved Prediction Accuracy

One of the most significant advantages of using Fractal Markets FX is the improvement in prediction accuracy. The SMC model helps in identifying reliable signals that can lead to successful trades.

Risk Management

Effective risk management is crucial in trading. The SMC strategy aids traders in identifying safer entry and exit points, reducing potential losses.

How to Implement Fractal Markets FX (SMC) in Your Trading

Step-by-Step Guide

- Identify the Signal: Look for patterns that have historically led to predictable outcomes.

- Assess the Momentum: Determine if the current market momentum supports the signal.

- Check Market Conditions: Ensure that external market conditions are favorable before executing a trade.

Tools and Resources

Several tools and resources can help in implementing the Fractal Markets FX strategy. Software that identifies fractal patterns can be particularly useful.

Case Studies and Success Stories

Real-Life Applications

We will explore a few case studies where traders have successfully applied the Fractal Markets FX (SMC) methodology to secure profitable returns.

Testimonials from Traders

Hear directly from traders who have benefited from incorporating the SMC strategy into their trading routines.

Challenges and Considerations

Learning Curve

While the benefits are significant, there is a learning curve involved in mastering fractal market strategies.

Market Volatility

Market volatility can affect the reliability of fractal patterns, making it crucial to stay informed and adaptable.

Conclusion

Fractal Markets FX (SMC) offers a fascinating and potentially lucrative approach to forex trading. By understanding and applying the principles of fractals and the SMC strategy, traders can enhance their market predictions and manage risks more effectively. Remember, while no strategy is foolproof, Fractal Markets FX provides a robust framework for navigating the complexities of forex trading.

FAQs About Fractal Markets FX (SMC)

- What is the basic concept of fractal markets?

- Fractal markets theory posits that financial markets exhibit self-similar patterns and scaling properties that can be modeled and predicted.

- How does the SMC strategy enhance forex trading?

- It integrates signal detection, momentum analysis, and condition checks to improve decision-making and risk management.

- What tools are recommended for fractal trading?

- Traders should use software that can identify and analyze fractal patterns effectively.

- Can fractal analysis predict all market movements?

- While fractal analysis provides valuable insights, it cannot predict all market movements due to inherent market unpredictability.

- Is the SMC strategy suitable for beginners?

- While beneficial, it requires a fundamental understanding of forex trading and fractal analysis, which may be challenging for beginners.

Be the first to review “Fractal Markets FX (SMC)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.