-

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

Secrets to Short Term Trading with Larry Williams

1 × $6.00

Secrets to Short Term Trading with Larry Williams

1 × $6.00 -

×

The Right Stock at the Right Time. Prospering in the Coming Good Years with Larry Williams

1 × $6.00

The Right Stock at the Right Time. Prospering in the Coming Good Years with Larry Williams

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00 -

×

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00 -

×

E-mini Weekly Options Income with Peter Titus

1 × $15.00

E-mini Weekly Options Income with Peter Titus

1 × $15.00 -

×

The Q’s (2nd Ed.) with Darlene Nelson

1 × $6.00

The Q’s (2nd Ed.) with Darlene Nelson

1 × $6.00 -

×

The Connors Research Volatility Trading Strategy Summit

1 × $85.00

The Connors Research Volatility Trading Strategy Summit

1 × $85.00 -

×

Swing Trading College IX 2010 with Larry Connors

1 × $15.00

Swing Trading College IX 2010 with Larry Connors

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00 -

×

How to Profit in Gold with Jonathan Spall

1 × $6.00

How to Profit in Gold with Jonathan Spall

1 × $6.00 -

×

Support and Resistance Trading with Rob Booker

1 × $6.00

Support and Resistance Trading with Rob Booker

1 × $6.00 -

×

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

Starting Out in Futures Trading with Mark Powers

1 × $6.00

Starting Out in Futures Trading with Mark Powers

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

The Any Hour Trading System with Markets Mastered

1 × $6.00

The Any Hour Trading System with Markets Mastered

1 × $6.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

Geometry of Markets I with Bruce Gilmore

1 × $6.00

Geometry of Markets I with Bruce Gilmore

1 × $6.00 -

×

T3 Live - The Simple Art of Trading

1 × $31.00

T3 Live - The Simple Art of Trading

1 × $31.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00 -

×

FTMO Academy Course

1 × $5.00

FTMO Academy Course

1 × $5.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

The EAP Training Program (Apr 2019)

1 × $6.00

The EAP Training Program (Apr 2019)

1 × $6.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

Investment Performance Measurement with Bruce Feibel

1 × $6.00

Investment Performance Measurement with Bruce Feibel

1 × $6.00 -

×

Tornado Trend Trading System with John Bartlett

1 × $6.00

Tornado Trend Trading System with John Bartlett

1 × $6.00 -

×

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00 -

×

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Professional Trader Course

1 × $5.00

Professional Trader Course

1 × $5.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00 -

×

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

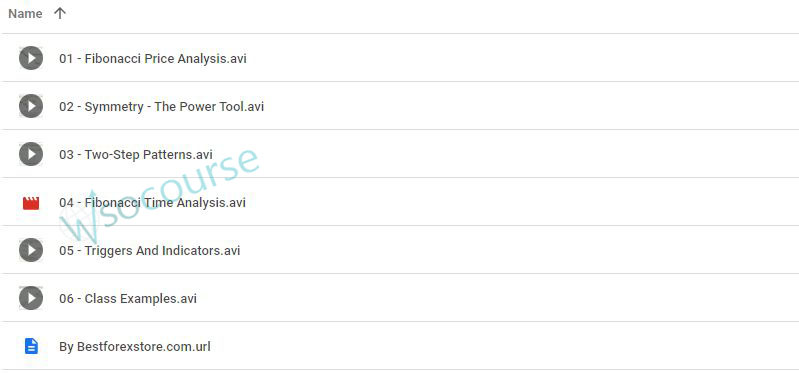

Introduction to Fibonacci Time Analysis with Carolyn Boroden

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Introduction to Fibonacci Time Analysis with Carolyn Boroden” below:

Introduction to Fibonacci Time Analysis with Carolyn Boroden

Fibonacci time analysis is a fascinating field within technical trading that uses historical data and mathematical ratios derived from the Fibonacci sequence to predict changes in market behavior over time. Carolyn Boroden, a renowned expert in Fibonacci market analysis, has developed techniques that can provide traders with insights into timing the markets with greater precision. In this article, we delve into the basics of Fibonacci time analysis, exploring its principles, applications, and tips on how to leverage this technique to enhance trading strategies.

Understanding Fibonacci Time Analysis

Fibonacci time analysis involves identifying potential reversal points in the markets based on distance between dates that are Fibonacci ratios of each other. This method is grounded in the belief that financial markets tend to move in cycles, which are influenced by external and internal factors.

The Fibonacci Sequence and Its Application

The Fibonacci sequence, starting with 0 and 1, each subsequent number is the sum of the two preceding ones. In the context of market analysis, these sequences are not just numbers, but potential indicators of significant market events.

How Carolyn Boroden Applies Fibonacci Techniques

Carolyn Boroden’s approach involves using Fibonacci ratios to determine potential support and resistance levels, thus identifying strategic points for entry or exit.

Key Components of Fibonacci Time Analysis

Understanding the components used in Fibonacci time analysis can significantly enhance your trading decisions.

Fibonacci Ratios

The common ratios used include 23.6%, 38.2%, 61.8%, and 78.6%. These ratios are derived from mathematical relationships within the sequence.

Critical Time Zones

Identifying time zones where market changes are likely can help traders optimize their trading times.

Integration with Other Trading Tools

Carolyn recommends integrating Fibonacci time analysis with other technical tools for a holistic trading strategy.

Implementing Fibonacci Time Analysis in Your Trading

Implementing this analysis requires patience, precision, and practice. Here are some steps to get you started.

Step-by-Step Guide to Fibonacci Time Analysis

- Identify major highs and lows in market charts.

- Apply Fibonacci ratios to these points to determine potential future movements.

- Use these points to refine your trading strategy.

Tools and Software for Fibonacci Analysis

Various trading platforms offer tools specifically for Fibonacci analysis, enhancing the ease and accuracy of implementing these techniques.

Challenges and Considerations

While powerful, Fibonacci time analysis is not foolproof. It requires a combination of analytical skills, intuition, and thorough understanding of market dynamics.

Common Pitfalls in Fibonacci Time Analysis

Avoid common mistakes such as over-reliance on indicators or misinterpreting Fibonacci levels.

Advanced Tips for Using Fibonacci Time Analysis

Experienced traders might explore combining Fibonacci time analysis with wave theories or other advanced strategies for improved accuracy.

Case Studies and Success Stories

Looking at successful applications of these techniques can provide practical insights and inspiration.

Conclusion

Fibonacci time analysis offers valuable tools for those looking to enhance their trading strategies. With practice and proper application, traders can potentially increase their success rate in the market.

Frequently Asked Questions:

- What is Fibonacci time analysis?

Fibonacci time analysis is a technique used in technical trading to predict changes in market behavior based on Fibonacci ratios. - How does Carolyn Boroden use Fibonacci analysis?

Carolyn Boroden uses Fibonacci ratios to identify potential support and resistance levels, aiding in market timing decisions. - What are the common Fibonacci ratios?

Common Fibonacci ratios include 23.6%, 38.2%, 61.8%, and 78.6%. - Can Fibonacci time analysis be used alone?

While it can be used alone, it is more effective when combined with other technical analysis tools. - What are the main challenges of Fibonacci time analysis?

Challenges include the need for precise market timing and the risk of relying too heavily on the analysis.

Be the first to review “Introduction to Fibonacci Time Analysis with Carolyn Boroden” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.