-

×

Supply And Demand Zone Trading Course with Trading180

1 × $5.00

Supply And Demand Zone Trading Course with Trading180

1 × $5.00 -

×

Live in London (5 DVD) with Martin Pring

1 × $6.00

Live in London (5 DVD) with Martin Pring

1 × $6.00 -

×

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00 -

×

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00 -

×

14-Day Options Trading Bootcamp (Jule 2014)

1 × $15.00

14-Day Options Trading Bootcamp (Jule 2014)

1 × $15.00 -

×

Pivotboss Masters - Become Elite

1 × $5.00

Pivotboss Masters - Become Elite

1 × $5.00 -

×

“The Beast” Automated Trading System V2 (Feb 2015)

1 × $15.00

“The Beast” Automated Trading System V2 (Feb 2015)

1 × $15.00 -

×

The Art and Application of Technical Analysis with Cynthia Kase

1 × $6.00

The Art and Application of Technical Analysis with Cynthia Kase

1 × $6.00 -

×

24-Hour Un-Education Trading Course

1 × $54.00

24-Hour Un-Education Trading Course

1 × $54.00 -

×

Finserv Corp Complete Course

1 × $4.00

Finserv Corp Complete Course

1 × $4.00 -

×

Secrets to Picking Small Cap Winners with Gareth Soloway - InTheMoneyStocks

1 × $116.00

Secrets to Picking Small Cap Winners with Gareth Soloway - InTheMoneyStocks

1 × $116.00 -

×

Letal Forex System with Alex Seeni

1 × $6.00

Letal Forex System with Alex Seeni

1 × $6.00 -

×

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00 -

×

10x Trade Formula Master Collection

1 × $54.00

10x Trade Formula Master Collection

1 × $54.00 -

×

2010 The Market Mastery Protégé Program

1 × $31.00

2010 The Market Mastery Protégé Program

1 × $31.00 -

×

2016 Chicago Annual Options Seminar with Dan Sheridan

1 × $23.00

2016 Chicago Annual Options Seminar with Dan Sheridan

1 × $23.00 -

×

$1,500 to $1 Million In 3 Years

1 × $39.00

$1,500 to $1 Million In 3 Years

1 × $39.00 -

×

FX Pips Predator

1 × $54.00

FX Pips Predator

1 × $54.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00

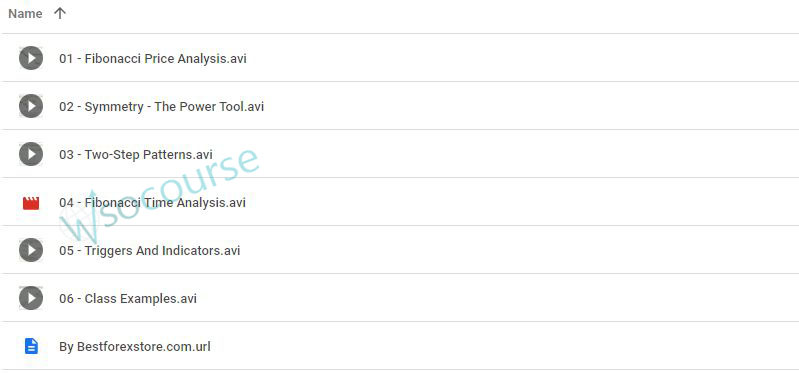

Introduction to Fibonacci Time Analysis with Carolyn Boroden

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Introduction to Fibonacci Time Analysis with Carolyn Boroden” below:

Introduction to Fibonacci Time Analysis with Carolyn Boroden

Fibonacci time analysis is a fascinating field within technical trading that uses historical data and mathematical ratios derived from the Fibonacci sequence to predict changes in market behavior over time. Carolyn Boroden, a renowned expert in Fibonacci market analysis, has developed techniques that can provide traders with insights into timing the markets with greater precision. In this article, we delve into the basics of Fibonacci time analysis, exploring its principles, applications, and tips on how to leverage this technique to enhance trading strategies.

Understanding Fibonacci Time Analysis

Fibonacci time analysis involves identifying potential reversal points in the markets based on distance between dates that are Fibonacci ratios of each other. This method is grounded in the belief that financial markets tend to move in cycles, which are influenced by external and internal factors.

The Fibonacci Sequence and Its Application

The Fibonacci sequence, starting with 0 and 1, each subsequent number is the sum of the two preceding ones. In the context of market analysis, these sequences are not just numbers, but potential indicators of significant market events.

How Carolyn Boroden Applies Fibonacci Techniques

Carolyn Boroden’s approach involves using Fibonacci ratios to determine potential support and resistance levels, thus identifying strategic points for entry or exit.

Key Components of Fibonacci Time Analysis

Understanding the components used in Fibonacci time analysis can significantly enhance your trading decisions.

Fibonacci Ratios

The common ratios used include 23.6%, 38.2%, 61.8%, and 78.6%. These ratios are derived from mathematical relationships within the sequence.

Critical Time Zones

Identifying time zones where market changes are likely can help traders optimize their trading times.

Integration with Other Trading Tools

Carolyn recommends integrating Fibonacci time analysis with other technical tools for a holistic trading strategy.

Implementing Fibonacci Time Analysis in Your Trading

Implementing this analysis requires patience, precision, and practice. Here are some steps to get you started.

Step-by-Step Guide to Fibonacci Time Analysis

- Identify major highs and lows in market charts.

- Apply Fibonacci ratios to these points to determine potential future movements.

- Use these points to refine your trading strategy.

Tools and Software for Fibonacci Analysis

Various trading platforms offer tools specifically for Fibonacci analysis, enhancing the ease and accuracy of implementing these techniques.

Challenges and Considerations

While powerful, Fibonacci time analysis is not foolproof. It requires a combination of analytical skills, intuition, and thorough understanding of market dynamics.

Common Pitfalls in Fibonacci Time Analysis

Avoid common mistakes such as over-reliance on indicators or misinterpreting Fibonacci levels.

Advanced Tips for Using Fibonacci Time Analysis

Experienced traders might explore combining Fibonacci time analysis with wave theories or other advanced strategies for improved accuracy.

Case Studies and Success Stories

Looking at successful applications of these techniques can provide practical insights and inspiration.

Conclusion

Fibonacci time analysis offers valuable tools for those looking to enhance their trading strategies. With practice and proper application, traders can potentially increase their success rate in the market.

Frequently Asked Questions:

- What is Fibonacci time analysis?

Fibonacci time analysis is a technique used in technical trading to predict changes in market behavior based on Fibonacci ratios. - How does Carolyn Boroden use Fibonacci analysis?

Carolyn Boroden uses Fibonacci ratios to identify potential support and resistance levels, aiding in market timing decisions. - What are the common Fibonacci ratios?

Common Fibonacci ratios include 23.6%, 38.2%, 61.8%, and 78.6%. - Can Fibonacci time analysis be used alone?

While it can be used alone, it is more effective when combined with other technical analysis tools. - What are the main challenges of Fibonacci time analysis?

Challenges include the need for precise market timing and the risk of relying too heavily on the analysis.

Be the first to review “Introduction to Fibonacci Time Analysis with Carolyn Boroden” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.