-

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00 -

×

EURUSD Trading System with CopperChips

1 × $6.00

EURUSD Trading System with CopperChips

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

ENG Renko Mastery with International Scalpers

1 × $10.00

ENG Renko Mastery with International Scalpers

1 × $10.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Secrets of a Winning Trader with Gareth Soloway

1 × $871.00

Secrets of a Winning Trader with Gareth Soloway

1 × $871.00 -

×

FasTrack Premium with Note Conference

1 × $78.00

FasTrack Premium with Note Conference

1 × $78.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

Project Gorilla

1 × $5.00

Project Gorilla

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

Best of Livestock with Timothy Sykes

1 × $5.00

Best of Livestock with Timothy Sykes

1 × $5.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00 -

×

Cash In On Chaos with Hans Hannula

1 × $6.00

Cash In On Chaos with Hans Hannula

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Measuring Risk in Complex Stochastic Systems with J.Franke, W. Hardle, G. Stahl

1 × $6.00

Measuring Risk in Complex Stochastic Systems with J.Franke, W. Hardle, G. Stahl

1 × $6.00 -

×

Equity Trader 101 Course with KeyStone Trading

1 × $6.00

Equity Trader 101 Course with KeyStone Trading

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00 -

×

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00 -

×

Starter Guide to Investing Stocks, Crypto & Precious Metals with Ryan Hogue

1 × $5.00

Starter Guide to Investing Stocks, Crypto & Precious Metals with Ryan Hogue

1 × $5.00 -

×

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00 -

×

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

FXJake Webinars with Walter Peters

1 × $6.00

FXJake Webinars with Walter Peters

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Trading Pivot Points with Andrew Peters

1 × $6.00

Trading Pivot Points with Andrew Peters

1 × $6.00 -

×

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00 -

×

KASH-FX JOURNAL

1 × $10.00

KASH-FX JOURNAL

1 × $10.00 -

×

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

Path to Profits By Scott Redler - T3 Live

1 × $6.00

Path to Profits By Scott Redler - T3 Live

1 × $6.00 -

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00 -

×

Technical Analysis for Short-Term Traders

1 × $6.00

Technical Analysis for Short-Term Traders

1 × $6.00 -

×

Best of AM Review (Volume 1-3) with Peter Bain

1 × $6.00

Best of AM Review (Volume 1-3) with Peter Bain

1 × $6.00 -

×

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

LBFX Academy Training Course

1 × $5.00

LBFX Academy Training Course

1 × $5.00 -

×

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00 -

×

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00 -

×

Five Trading Trends of 2005 with Dan Denning

1 × $6.00

Five Trading Trends of 2005 with Dan Denning

1 × $6.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00 -

×

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

Traders Secret Code Complete Course with Mark McRae

1 × $6.00

Traders Secret Code Complete Course with Mark McRae

1 × $6.00 -

×

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00 -

×

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00 -

×

Global Product with John Stark

1 × $6.00

Global Product with John Stark

1 × $6.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00 -

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Design for Six Sigma with Subir Chowdhury

1 × $6.00

Design for Six Sigma with Subir Chowdhury

1 × $6.00 -

×

Investment Illusions with Martin S.Fridson

1 × $6.00

Investment Illusions with Martin S.Fridson

1 × $6.00 -

×

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00 -

×

Forex Project Advanced Course with Tyler Crowell

1 × $5.00

Forex Project Advanced Course with Tyler Crowell

1 × $5.00 -

×

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

Option Hydra - Mar 2020 Edition - Basics with Rajandran R

1 × $23.00

Option Hydra - Mar 2020 Edition - Basics with Rajandran R

1 × $23.00 -

×

Evolutionary Decision Trees for Stock Index Options and Futures Arbitrage by S.Markose, E.Tsang,H.Er

1 × $6.00

Evolutionary Decision Trees for Stock Index Options and Futures Arbitrage by S.Markose, E.Tsang,H.Er

1 × $6.00 -

×

Sure Fire Forex Trading with Mark McRae

1 × $6.00

Sure Fire Forex Trading with Mark McRae

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00 -

×

Fractal Energy Trading with Doc Severson

1 × $6.00

Fractal Energy Trading with Doc Severson

1 × $6.00 -

×

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00 -

×

Getting New Insights from Old Indicators with Martin Pring

1 × $6.00

Getting New Insights from Old Indicators with Martin Pring

1 × $6.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

FX Pips Predator

1 × $54.00

FX Pips Predator

1 × $54.00 -

×

The Blueprint to Success with Humair FX

1 × $5.00

The Blueprint to Success with Humair FX

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00 -

×

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00 -

×

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00 -

×

Geometry of Markets I with Bruce Gilmore

1 × $6.00

Geometry of Markets I with Bruce Gilmore

1 × $6.00 -

×

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Trading Full Circle with Jea Yu

1 × $6.00

Trading Full Circle with Jea Yu

1 × $6.00 -

×

Complete Day Trading Course with The Trading Floor

1 × $13.00

Complete Day Trading Course with The Trading Floor

1 × $13.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

Trading Options Effectively with Paul Forchione

1 × $4.00

Trading Options Effectively with Paul Forchione

1 × $4.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

Live in London (5 DVD) with Martin Pring

1 × $6.00

Live in London (5 DVD) with Martin Pring

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

Simple Sector Trading Strategies with John Murphy

1 × $6.00

Simple Sector Trading Strategies with John Murphy

1 × $6.00 -

×

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00 -

×

Kicker Signals with Stephen W.Bigalow

1 × $6.00

Kicker Signals with Stephen W.Bigalow

1 × $6.00 -

×

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00 -

×

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00 -

×

News Profiteer System Manual & Members Area Videos with Henry Liu

1 × $6.00

News Profiteer System Manual & Members Area Videos with Henry Liu

1 × $6.00 -

×

Sovereign Man Confidential

1 × $6.00

Sovereign Man Confidential

1 × $6.00 -

×

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00 -

×

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00 -

×

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00 -

×

Floor Traders Edge Mentorship Program with Market Geeks

1 × $6.00

Floor Traders Edge Mentorship Program with Market Geeks

1 × $6.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00 -

×

Profiletraders - MARKET PROFILE TACTICAL STRATEGIES FOR DAY TRADING

1 × $23.00

Profiletraders - MARKET PROFILE TACTICAL STRATEGIES FOR DAY TRADING

1 × $23.00 -

×

Exploring MetaStock Basic with Martin Pring

1 × $6.00

Exploring MetaStock Basic with Martin Pring

1 × $6.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00 -

×

Smart Money Course with Forex XL

1 × $6.00

Smart Money Course with Forex XL

1 × $6.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00 -

×

Fast Track Course with Tradelikerocket

1 × $233.00

Fast Track Course with Tradelikerocket

1 × $233.00 -

×

Master Bundle with Gemify Academy

1 × $5.00

Master Bundle with Gemify Academy

1 × $5.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00

How I Trade the QQQs with Don Miller

$6.00

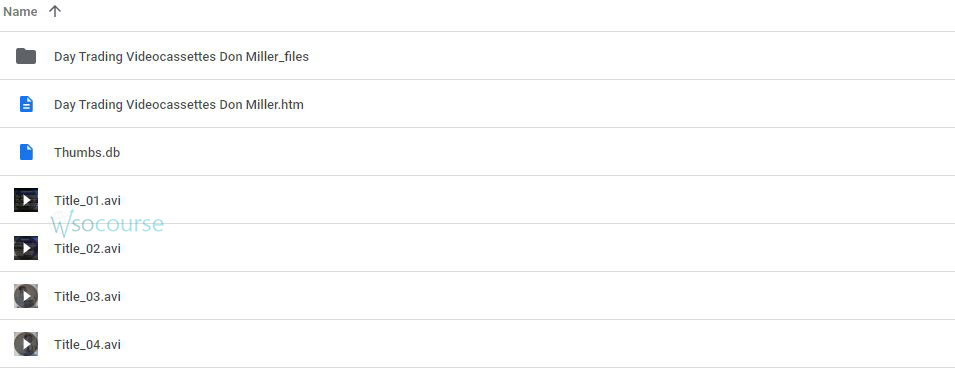

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.