-

×

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Krautgap By John Piper

1 × $6.00

Krautgap By John Piper

1 × $6.00 -

×

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00 -

×

Advent Forex Course with Cecil Robles

1 × $6.00

Advent Forex Course with Cecil Robles

1 × $6.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

Learn Plan Profit – How To Trade Stocks

1 × $15.00

Learn Plan Profit – How To Trade Stocks

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00 -

×

Guide to Getting Short and Collecting Income with Don Kaufman

1 × $6.00

Guide to Getting Short and Collecting Income with Don Kaufman

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Fixed-Income Securities: Valuation, Risk Management and Portfolio Strategies - Lionel Martellini, Philippe Priaulet & Stéphane Priaulet

1 × $6.00

Fixed-Income Securities: Valuation, Risk Management and Portfolio Strategies - Lionel Martellini, Philippe Priaulet & Stéphane Priaulet

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Level II Trading Warfare - The Undergroundtrader's Powerful Weapons for Winning - Jea Yu

1 × $6.00

Level II Trading Warfare - The Undergroundtrader's Powerful Weapons for Winning - Jea Yu

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

Best of Livestock with Timothy Sykes

1 × $5.00

Best of Livestock with Timothy Sykes

1 × $5.00 -

×

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00 -

×

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00 -

×

Trading From Your Gut with Curtis Faith

1 × $6.00

Trading From Your Gut with Curtis Faith

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Original Curriculum with Home Options Trading Course

1 × $6.00

Original Curriculum with Home Options Trading Course

1 × $6.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

Nora Bystra Legacy International Complete Course

1 × $6.00

Nora Bystra Legacy International Complete Course

1 × $6.00 -

×

Cotton Trading Manual with Terry Townsend

1 × $6.00

Cotton Trading Manual with Terry Townsend

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00 -

×

RSI Basic with Andrew Cardwell

1 × $54.00

RSI Basic with Andrew Cardwell

1 × $54.00 -

×

The Any Hour Trading System with Markets Mastered

1 × $6.00

The Any Hour Trading System with Markets Mastered

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00 -

×

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00 -

×

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00 -

×

Global Product with John Stark

1 × $6.00

Global Product with John Stark

1 × $6.00 -

×

Better Trading with the Guppy Multiple Moving Average WorkBook with Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average WorkBook with Daryl Guppy

1 × $6.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00 -

×

The New Reality Of Wall Street with Donald Coxe

1 × $6.00

The New Reality Of Wall Street with Donald Coxe

1 × $6.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

Foundations of Forex Trading with TradeSmart University

1 × $6.00

Foundations of Forex Trading with TradeSmart University

1 × $6.00 -

×

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00 -

×

Consistently Profitable Trader with Pollinate Trading

1 × $13.00

Consistently Profitable Trader with Pollinate Trading

1 × $13.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Judgemental Trend Following (Audio) with Russell Sands

1 × $6.00

Judgemental Trend Following (Audio) with Russell Sands

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Professional Training Program with OpenTrader

1 × $6.00

Professional Training Program with OpenTrader

1 × $6.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

Examination Book Morning Section (1999)

1 × $6.00

Examination Book Morning Section (1999)

1 × $6.00 -

×

Pristine Seminar - Options Trading the Pristine Way

1 × $6.00

Pristine Seminar - Options Trading the Pristine Way

1 × $6.00

How I Trade the QQQs with Don Miller

$6.00

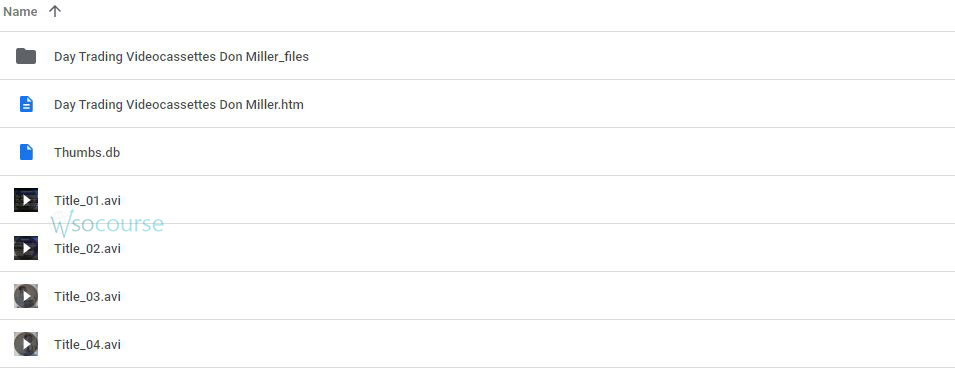

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.