-

×

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00 -

×

Stock Traders Almanac 2010 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Traders Almanac 2010 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

Learn To Trade Markets with Karl Richards

1 × $6.00

Learn To Trade Markets with Karl Richards

1 × $6.00 -

×

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00 -

×

Evolution Course with Kevin Trades

1 × $15.00

Evolution Course with Kevin Trades

1 × $15.00 -

×

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00 -

×

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00 -

×

Forex Strategies Course For Weekly Charts with Cory Mitchell - Vantage Point Trading

1 × $4.00

Forex Strategies Course For Weekly Charts with Cory Mitchell - Vantage Point Trading

1 × $4.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

LBFX Academy Training Course

1 × $5.00

LBFX Academy Training Course

1 × $5.00 -

×

If You Are So Smart Why Aren’t You Rich with Ben Branch

1 × $6.00

If You Are So Smart Why Aren’t You Rich with Ben Branch

1 × $6.00 -

×

How to Trade Choppy, Sideways Markets with Wayne Gorman - Elliott Wave International

1 × $6.00

How to Trade Choppy, Sideways Markets with Wayne Gorman - Elliott Wave International

1 × $6.00 -

×

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Electronic AGS Trading Workshop with John Carter & Hunert Senters

1 × $6.00

Electronic AGS Trading Workshop with John Carter & Hunert Senters

1 × $6.00 -

×

Price Action Prophet

1 × $54.00

Price Action Prophet

1 × $54.00 -

×

Mastering the Orderbook with Rowan Crawford

1 × $6.00

Mastering the Orderbook with Rowan Crawford

1 × $6.00 -

×

Trading Forex Exchange with Clifford Bennett

1 × $6.00

Trading Forex Exchange with Clifford Bennett

1 × $6.00 -

×

Market Fluidity

1 × $6.00

Market Fluidity

1 × $6.00 -

×

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00 -

×

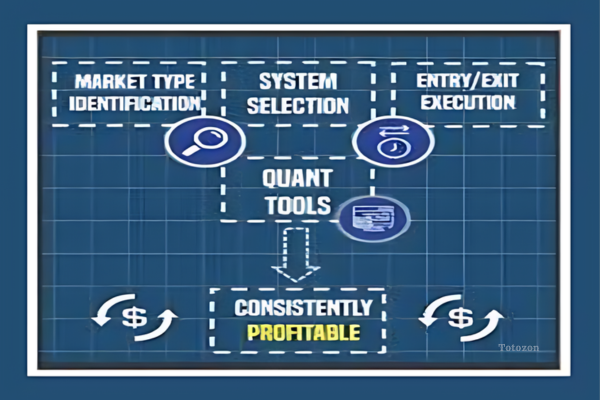

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

Guide To Selling High Probability Spreads Class with Don Kaufman

1 × $6.00

Guide To Selling High Probability Spreads Class with Don Kaufman

1 × $6.00 -

×

Interpreting Balance of Power with Peter Worden

1 × $6.00

Interpreting Balance of Power with Peter Worden

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders - James Bickford

1 × $6.00

Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders - James Bickford

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

May Madness with LIT Trading

1 × $5.00

May Madness with LIT Trading

1 × $5.00 -

×

Master Trader Course

1 × $23.00

Master Trader Course

1 × $23.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

Market Makers Method Forex Trading with Nick Nechanicky

1 × $5.00

Market Makers Method Forex Trading with Nick Nechanicky

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Complete Cryptocurrency Trading 2021

1 × $5.00

Complete Cryptocurrency Trading 2021

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Stock Trading Course Level 2 Market Snapper™ 2019 with Piranha Profits

1 × $6.00

Stock Trading Course Level 2 Market Snapper™ 2019 with Piranha Profits

1 × $6.00 -

×

Oil Trading Academy Code 3 Video Course

1 × $6.00

Oil Trading Academy Code 3 Video Course

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Donald Delves – Stock Options and the New Rules of Corporate Accountability

1 × $6.00

Donald Delves – Stock Options and the New Rules of Corporate Accountability

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Quantifiable Edges Swing Trading Course with Quantifiable Edges

1 × $15.00

Quantifiable Edges Swing Trading Course with Quantifiable Edges

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

Trading the Moves – Consistent Gains in All Markets with Ed Downs

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading the Moves – Consistent Gains in All Markets with Ed Downs” below:

Trading the Moves: Consistent Gains in All Markets with Ed Downs

Introduction

Trading in financial markets can be as unpredictable as the weather. However, with the right strategies, like those pioneered by Ed Downs, achieving consistent gains across various market conditions becomes more attainable. Let’s explore the actionable techniques and insights from Ed Downs on how to trade the moves successfully.

Understanding Market Dynamics

What Influences Market Movements?

Market movements are influenced by a plethora of factors including economic data, geopolitical events, and market sentiment. Recognizing these can provide a significant advantage.

The Importance of Market Timing

Timing is crucial in trading. Ed Downs emphasizes the significance of entering and exiting trades at the most opportune moments to maximize gains and minimize losses.

Ed Downs’ Strategies for Trading the Moves

1. Identifying High Probability Trades

Key Indicators Used

Ed Downs recommends using a combination of technical indicators like moving averages, RSI, and MACD to pinpoint high-probability trading opportunities.

2. The Role of Volume in Confirming Moves

Volume Analysis

Understanding volume patterns can confirm the strength of a move, suggesting whether to enter or exit a trade.

3. Using Sentiment Analysis to Gauge Market Direction

Sentiment Tools

Leverage sentiment analysis tools to understand the overall market mood, aiding in decision-making.

Risk Management Techniques

Setting Realistic Risk Parameters

It’s vital to set risk management parameters that align with your trading style and goals to ensure sustainability in the market.

The Importance of Stop-Loss Orders

Using stop-loss orders protects your capital by limiting potential losses on trades that don’t go as planned.

Adapting to Different Market Conditions

Trading in Bull Markets

Strategies for Bull Markets

Focus on buying strategies that capitalize on rising prices and strong market optimism.

Navigating Bear Markets

Tactics for Bear Markets

Implement short-selling techniques and defensive trading strategies to manage and profit from market downturns.

Leveraging Technology in Trading

Automated Trading Systems

Explore how automated trading systems can execute trades based on predefined criteria, increasing efficiency and reducing emotional trading decisions.

The Power of Backtesting

Backtesting trading strategies using historical data ensures their effectiveness before applying them in real markets.

Ed Downs’ Impact on Modern Trading

Educational Contributions

Ed Downs has contributed significantly to trader education through his books and seminars, equipping traders with the knowledge to succeed.

Innovation in Technical Analysis

His innovative approach to technical analysis has helped many traders improve their ability to identify market trends and make informed decisions.

Conclusion

Trading the moves with strategies developed by Ed Downs offers a pragmatic approach to achieving consistent gains in all markets. By understanding market dynamics, employing robust risk management, and utilizing technology, traders can enhance their trading performance significantly.

FAQs

- What makes Ed Downs’ trading strategies effective in all markets?

- Ed Downs’ strategies are based on a deep understanding of market mechanics and effective risk management, making them adaptable to any market condition.

- How can beginners start applying Ed Downs’ methods?

- Beginners should start by learning the basic concepts of technical analysis and gradually integrate Ed Downs’ strategies through practice and simulation.

- What is the most critical aspect of trading the moves?

- Timing is crucial; knowing when to enter and when to exit a trade can significantly influence the success of trading strategies.

- Can Ed Downs’ strategies be automated?

- Yes, many of Ed Downs’ strategies can be automated, which helps in maintaining discipline and executing strategies efficiently.

- Where can I find more resources on Ed Downs’ trading techniques?

- Ed Downs’ official publications and training programs are great resources. Additionally, various financial education platforms offer courses based on his methodologies.

Be the first to review “Trading the Moves – Consistent Gains in All Markets with Ed Downs” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.