-

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

Secrets to Short Term Trading with Larry Williams

1 × $6.00

Secrets to Short Term Trading with Larry Williams

1 × $6.00 -

×

The Right Stock at the Right Time. Prospering in the Coming Good Years with Larry Williams

1 × $6.00

The Right Stock at the Right Time. Prospering in the Coming Good Years with Larry Williams

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00 -

×

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00 -

×

E-mini Weekly Options Income with Peter Titus

1 × $15.00

E-mini Weekly Options Income with Peter Titus

1 × $15.00 -

×

The Q’s (2nd Ed.) with Darlene Nelson

1 × $6.00

The Q’s (2nd Ed.) with Darlene Nelson

1 × $6.00 -

×

The Connors Research Volatility Trading Strategy Summit

1 × $85.00

The Connors Research Volatility Trading Strategy Summit

1 × $85.00 -

×

Swing Trading College IX 2010 with Larry Connors

1 × $15.00

Swing Trading College IX 2010 with Larry Connors

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00 -

×

How to Profit in Gold with Jonathan Spall

1 × $6.00

How to Profit in Gold with Jonathan Spall

1 × $6.00 -

×

Support and Resistance Trading with Rob Booker

1 × $6.00

Support and Resistance Trading with Rob Booker

1 × $6.00 -

×

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

Starting Out in Futures Trading with Mark Powers

1 × $6.00

Starting Out in Futures Trading with Mark Powers

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

The Any Hour Trading System with Markets Mastered

1 × $6.00

The Any Hour Trading System with Markets Mastered

1 × $6.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

Geometry of Markets I with Bruce Gilmore

1 × $6.00

Geometry of Markets I with Bruce Gilmore

1 × $6.00 -

×

T3 Live - The Simple Art of Trading

1 × $31.00

T3 Live - The Simple Art of Trading

1 × $31.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00 -

×

FTMO Academy Course

1 × $5.00

FTMO Academy Course

1 × $5.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

The EAP Training Program (Apr 2019)

1 × $6.00

The EAP Training Program (Apr 2019)

1 × $6.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

Investment Performance Measurement with Bruce Feibel

1 × $6.00

Investment Performance Measurement with Bruce Feibel

1 × $6.00 -

×

Tornado Trend Trading System with John Bartlett

1 × $6.00

Tornado Trend Trading System with John Bartlett

1 × $6.00 -

×

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00 -

×

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Professional Trader Course

1 × $5.00

Professional Trader Course

1 × $5.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00 -

×

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Earnings Engine Class with Sami Abusaad – T3 Live

$297.00 Original price was: $297.00.$23.00Current price is: $23.00.

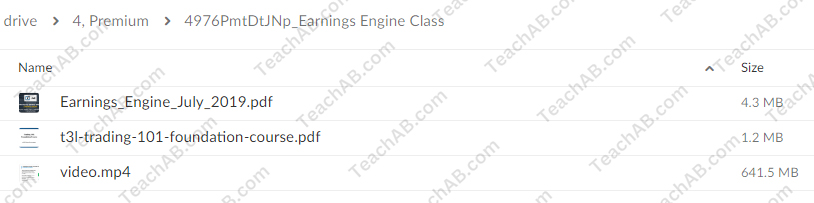

File Size: 647.1 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here

You may check content proof of “Earnings Engine Class with Sami Abusaad – T3 Live” below:

Trading earnings reports can be a highly profitable endeavor if done correctly. The Earnings Engine Class with Sami Abusaad at T3 Live is designed to equip traders with the skills and strategies needed to capitalize on earnings announcements. This article provides a detailed overview of what this class offers and how it can benefit traders.

Introduction

Sami Abusaad is a seasoned trader and educator with a wealth of experience in the financial markets. His expertise in trading earnings reports makes him an ideal mentor for this specialized class.

Who is Sami Abusaad?

- Professional Trader: Sami has a proven track record of successful trading.

- Educator: He is passionate about sharing his knowledge and helping others succeed.

- Mentor: Known for his hands-on approach to teaching and mentoring traders.

Overview of the Earnings Engine Class

The Earnings Engine Class is a comprehensive program designed to teach traders how to navigate and profit from earnings season. It covers everything from the basics to advanced strategies.

What the Class Covers

- Fundamental Analysis: Understanding company earnings and financial health.

- Technical Analysis: Using charts and indicators to predict market reactions.

- Trading Strategies: Specific strategies for trading earnings announcements.

Key Components of the Earnings Engine Class

1. Understanding Earnings Reports

Learn the essentials of reading and interpreting earnings reports, including key metrics like EPS (Earnings Per Share) and revenue.

2. Fundamental Analysis

Gain insights into how fundamental analysis can help predict market reactions to earnings reports.

3. Technical Analysis

Explore various technical analysis tools and how they can be applied to trading earnings.

4. Earnings Trading Strategies

Discover proven strategies for trading earnings reports, including pre-earnings, post-earnings, and volatility strategies.

5. Risk Management

Learn how to manage risk effectively when trading earnings to protect your capital and maximize profits.

6. Live Trading Sessions

Participate in live trading sessions with Sami Abusaad to see these strategies in action.

Benefits of the Earnings Engine Class

Enhanced Trading Skills

The class provides a thorough understanding of earnings trading, helping traders refine their skills and improve their trading performance.

Proven Strategies

Learn from Sami Abusaad’s proven strategies that have been tested and refined over years of trading.

Interactive Learning

The class offers interactive learning experiences, including live trading sessions and Q&A opportunities.

Community Support

Join a community of like-minded traders who share insights and support each other.

Who Should Take the Earnings Engine Class?

New Traders

If you’re new to trading, this class will provide a solid foundation and essential strategies for trading earnings.

Experienced Traders

For seasoned traders, the class offers advanced strategies and techniques to enhance your existing skills.

Investors

Even if you primarily invest rather than trade, understanding earnings reports and market reactions can improve your investment decisions.

How to Make the Most of the Class

Active Participation

Engage actively in all sessions, ask questions, and participate in discussions to maximize your learning experience.

Practice Regularly

Apply the strategies and techniques learned in the class through regular practice and real trading.

Stay Disciplined

Maintain discipline in following the strategies and risk management practices taught in the class.

Trading Tools and Resources

Earnings Calendar

Use an earnings calendar to keep track of upcoming earnings reports and plan your trades accordingly.

Technical Indicators

Familiarize yourself with technical indicators such as moving averages, RSI, and MACD, which are often used in earnings trading.

Risk Management Tools

Utilize stop-loss orders and position sizing techniques to manage risk effectively.

Step-by-Step Guide to Trading Earnings

1. Research Companies

Start by researching companies with upcoming earnings reports. Focus on those with a history of significant post-earnings moves.

2. Analyze Earnings Reports

Examine the earnings reports of these companies, paying attention to key metrics and guidance.

3. Apply Technical Analysis

Use technical analysis to identify potential entry and exit points based on historical price movements.

4. Develop a Trading Plan

Create a detailed trading plan that outlines your strategy, including entry and exit points, stop-loss levels, and position size.

5. Execute the Trade

Place your trade according to the plan and monitor it closely as the earnings report is released.

6. Manage Your Trade

Adjust your trade as needed based on market reactions and follow your risk management rules.

Common Mistakes to Avoid

Overtrading

Avoid the temptation to trade too many earnings reports. Focus on quality over quantity.

Ignoring Risk Management

Never ignore risk management. Always use stop-loss orders and manage your position size carefully.

Emotional Trading

Keep emotions in check. Stick to your trading plan and avoid making impulsive decisions based on market reactions.

Conclusion

The Earnings Engine Class with Sami Abusaad at T3 Live is an invaluable resource for traders looking to profit from earnings reports. By providing a comprehensive education in both fundamental and technical analysis, along with proven trading strategies, this class can help traders at all levels achieve greater success in the markets.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Earnings Engine Class with Sami Abusaad – T3 Live” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.