-

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

2014 Advanced Swing Trading Summit

1 × $31.00

2014 Advanced Swing Trading Summit

1 × $31.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

2010 The Market Mastery Protégé Program

1 × $31.00

2010 The Market Mastery Protégé Program

1 × $31.00 -

×

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

ICT Mastery with Casper SMC

1 × $14.00

ICT Mastery with Casper SMC

1 × $14.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

'Smart Money' Institutional Forex Trading with Jeffrey Edahs

1 × $6.00

'Smart Money' Institutional Forex Trading with Jeffrey Edahs

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Investing Under Fire with Alan R.Ackerman

1 × $6.00

Investing Under Fire with Alan R.Ackerman

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

Managing Debt for Dummies with John Ventura

1 × $6.00

Managing Debt for Dummies with John Ventura

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Secrets to Picking Small Cap Winners with Gareth Soloway - InTheMoneyStocks

1 × $116.00

Secrets to Picking Small Cap Winners with Gareth Soloway - InTheMoneyStocks

1 × $116.00 -

×

2-Phase A.I. Trade Spy Total Immersion Experience with Jeff Bierman - The Quant Guy

1 × $209.00

2-Phase A.I. Trade Spy Total Immersion Experience with Jeff Bierman - The Quant Guy

1 × $209.00 -

×

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00 -

×

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00 -

×

2 Trades A Day with Jason Hale

1 × $15.00

2 Trades A Day with Jason Hale

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00 -

×

2-Phase Inducement Theorem with Vector Trading FX

1 × $6.00

2-Phase Inducement Theorem with Vector Trading FX

1 × $6.00 -

×

Pivotboss Masters - Become Elite

1 × $5.00

Pivotboss Masters - Become Elite

1 × $5.00 -

×

21 Candlesticks Every Trader Should Know with Melvin Pasternak

1 × $5.00

21 Candlesticks Every Trader Should Know with Melvin Pasternak

1 × $5.00 -

×

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00 -

×

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00 -

×

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00 -

×

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00 -

×

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00

Earnings Boot Camp with Big Trends

$295.00 Original price was: $295.00.$6.00Current price is: $6.00.

File Size: 2.99 GB

Delivery Time: 1–12 hours

Media Type: Online Course

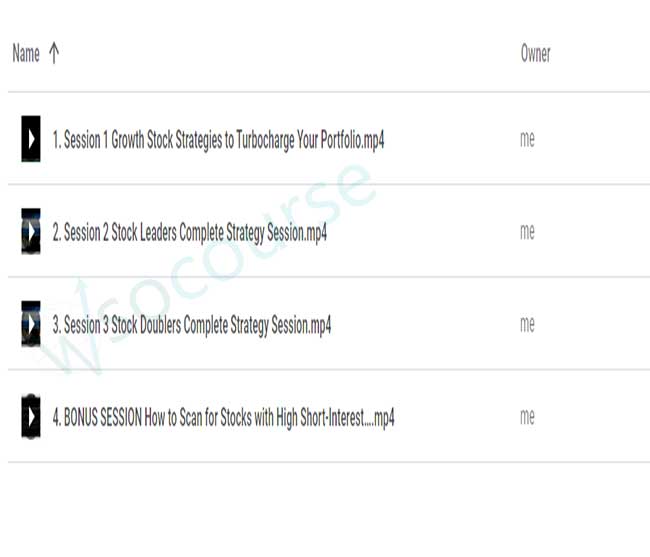

Content Proof: Watch Here!

You may check content proof of “Earnings Boot Camp with Big Trend” below:

Earnings Boot Camp with Big Trends

Introduction to Earnings Boot Camp

In the fast-paced world of trading, understanding how to capitalize on earnings reports is crucial. The “Earnings Boot Camp with Big Trends” is a comprehensive program designed to equip traders with the knowledge and skills to navigate earnings season effectively.

What is Earnings Boot Camp?

The Earnings Boot Camp is an intensive training program that focuses on strategies for trading around earnings reports. It’s led by experts at Big Trends, who provide in-depth analysis and practical techniques for maximizing profits during earnings season.

Why Participate in Earnings Boot Camp?

Earnings reports can create significant volatility in the stock market. By participating in the Earnings Boot Camp, traders can learn how to leverage this volatility to their advantage, making informed decisions and reducing risks.

Understanding Earnings Reports

What are Earnings Reports?

Earnings reports are quarterly financial statements released by publicly traded companies. These reports include key financial metrics such as revenue, net income, and earnings per share (EPS).

Importance of Earnings Reports

Earnings reports provide insights into a company’s financial health and future prospects. They influence investor sentiment and can lead to significant price movements in the stock market.

Key Components of an Earnings Report

Revenue

Revenue, also known as sales, is the total amount of money generated by a company’s operations. It is a crucial indicator of business growth.

Net Income

Net income, or profit, is the amount of money a company has left after all expenses have been deducted from revenue. It indicates a company’s profitability.

Earnings Per Share (EPS)

EPS is calculated by dividing net income by the number of outstanding shares. It provides a measure of a company’s profitability on a per-share basis.

Guidance

Guidance refers to a company’s forecast for future performance. Positive or negative guidance can significantly impact a stock’s price.

Trading Strategies for Earnings Season

Pre-Earnings Strategies

Buying Options

One strategy is to buy call or put options before an earnings report. This allows traders to profit from anticipated volatility without committing to a large position.

Straddles and Strangles

Straddles and strangles involve buying both call and put options. These strategies profit from significant price movements in either direction.

Post-Earnings Strategies

Trading the Reaction

After an earnings report, traders can take advantage of the initial market reaction. This involves buying or selling based on whether the report met, exceeded, or fell short of expectations.

Gap Trading

Gap trading involves taking positions based on the gap created by the price movement after an earnings report. Traders can profit from the continuation or reversal of the gap.

Risk Management During Earnings Season

Setting Stop-Loss Orders

Stop-loss orders are essential to limit potential losses. They automatically sell a position if the price moves against the trader by a predetermined amount.

Position Sizing

Proper position sizing ensures that no single trade can significantly impact the trader’s overall portfolio. This is especially important during volatile earnings season.

Diversification

Diversifying trades across different sectors and companies can reduce risk. It prevents the impact of poor earnings results from a single company on the entire portfolio.

Advanced Techniques in Earnings Trading

Volatility Trading

Volatility trading involves taking advantage of the increase in implied volatility around earnings reports. This can be done through options strategies like buying straddles.

Event-Driven Strategies

Event-driven strategies focus on trading based on the specific outcomes of earnings reports and other corporate events. This requires quick decision-making and execution.

Algorithmic Trading

Algorithmic trading uses automated systems to execute trades based on predefined criteria. These systems can quickly respond to earnings announcements and market reactions.

Benefits of Earnings Boot Camp

Expert Guidance

The boot camp is led by experienced traders from Big Trends, offering valuable insights and practical advice.

Hands-On Learning

Participants engage in hands-on learning through interactive sessions and live trading examples, enhancing their understanding and skills.

Community Support

Joining the boot camp provides access to a community of like-minded traders, fostering an environment of shared learning and support.

Conclusion

The “Earnings Boot Camp with Big Trends” is an invaluable resource for traders looking to capitalize on earnings season. By mastering the strategies and techniques taught in the boot camp, traders can navigate the volatility of earnings reports with confidence and precision.

FAQs

1. What is the focus of the Earnings Boot Camp?

The Earnings Boot Camp focuses on strategies for trading around earnings reports, including pre- and post-earnings techniques.

2. How can earnings reports affect stock prices?

Earnings reports can lead to significant price movements based on whether the reported results meet, exceed, or fall short of market expectations.

3. What are some pre-earnings trading strategies?

Pre-earnings strategies include buying options and using straddles or strangles to profit from anticipated volatility.

4. Why is risk management important during earnings season?

Risk management is crucial due to the high volatility during earnings season. It helps protect the trader’s capital and reduce potential losses.

5. What advanced techniques are covered in the boot camp?

Advanced techniques include volatility trading, event-driven strategies, and algorithmic trading, all designed to enhance trading performance during earnings season.

Be the first to review “Earnings Boot Camp with Big Trends” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.