-

×

XLT - Futures Trading Course

1 × $54.00

XLT - Futures Trading Course

1 × $54.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Analysis & Interpretation in Qualitative Market Research with Gill Ereaut

1 × $6.00

Analysis & Interpretation in Qualitative Market Research with Gill Ereaut

1 × $6.00 -

×

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

Basecamptrading - Naked Trading Part 2

1 × $6.00

Basecamptrading - Naked Trading Part 2

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Tradingconceptsinc - Calendar Spreads

1 × $23.00

Tradingconceptsinc - Calendar Spreads

1 × $23.00 -

×

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Trading For a Living By Thomas Carr (Dr. Stoxx)

1 × $34.00

Trading For a Living By Thomas Carr (Dr. Stoxx)

1 × $34.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

Weekly Iron Condors For Income with Bruce Wayne

1 × $6.00

Weekly Iron Condors For Income with Bruce Wayne

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Volcano Trading with Claytrader

1 × $15.00

Volcano Trading with Claytrader

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Yuri Shamenko Videos

1 × $5.00

Yuri Shamenko Videos

1 × $5.00 -

×

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Vol.T Volume-Tick Indicator Package

1 × $23.00

The Vol.T Volume-Tick Indicator Package

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

ApexFX Pro

1 × $5.00

ApexFX Pro

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Top Futures Day Trading Course DVD

1 × $6.00

Top Futures Day Trading Course DVD

1 × $6.00 -

×

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Building a Better Trader with Glenn Ring

1 × $6.00

Building a Better Trader with Glenn Ring

1 × $6.00 -

×

Wyckoff Stock Market Institute

1 × $5.00

Wyckoff Stock Market Institute

1 × $5.00 -

×

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00 -

×

All Time High Trading Course with TRADEVERSITY

1 × $5.00

All Time High Trading Course with TRADEVERSITY

1 × $5.00 -

×

The Trading Room Video Course

1 × $23.00

The Trading Room Video Course

1 × $23.00 -

×

Activedaytrader - Bond Trading Bootcamp

1 × $8.00

Activedaytrader - Bond Trading Bootcamp

1 × $8.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00 -

×

Bond Markets, Analysis and Strategies with Frank Fabozzi

1 × $6.00

Bond Markets, Analysis and Strategies with Frank Fabozzi

1 × $6.00 -

×

A- Z Educational Trading Course with InvestiTrade

1 × $39.00

A- Z Educational Trading Course with InvestiTrade

1 × $39.00 -

×

Back to the Futures

1 × $31.00

Back to the Futures

1 × $31.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

Alfred White’s Rules of Planetary Pictures with Witte, Rudolph, Lefeldt

1 × $6.00

Alfred White’s Rules of Planetary Pictures with Witte, Rudolph, Lefeldt

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

ZipTraderU 2023 with ZipTrader

1 × $5.00

ZipTraderU 2023 with ZipTrader

1 × $5.00 -

×

Wysetrade Forex Masterclass 3.0

1 × $6.00

Wysetrade Forex Masterclass 3.0

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Best & Simple Forex day trading strategy with Forex day trading

1 × $5.00

Best & Simple Forex day trading strategy with Forex day trading

1 × $5.00 -

×

All Access Online Trading Course with Steve Luke

1 × $6.00

All Access Online Trading Course with Steve Luke

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00 -

×

Top Ultimate Breakout with Top Trade Tools

1 × $6.00

Top Ultimate Breakout with Top Trade Tools

1 × $6.00 -

×

Trade on the Fly

1 × $6.00

Trade on the Fly

1 × $6.00 -

×

You AreThe Indicator Online Course

1 × $31.00

You AreThe Indicator Online Course

1 × $31.00 -

×

Advanced Gap Trading Strategies with Master Trader

1 × $31.00

Advanced Gap Trading Strategies with Master Trader

1 × $31.00 -

×

What is Strategy with Michael E.Porter

1 × $6.00

What is Strategy with Michael E.Porter

1 × $6.00 -

×

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00 -

×

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00

Transforms and Applications Handbook (2nd Edition) with Alexander Poularikas

1 × $6.00 -

×

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trade Execution with Yuri Shramenko

1 × $6.00

Trade Execution with Yuri Shramenko

1 × $6.00 -

×

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00 -

×

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

VectorVest - Options Course - 4 CD Course + PDF Workbook

1 × $6.00

VectorVest - Options Course - 4 CD Course + PDF Workbook

1 × $6.00 -

×

4 Class Bundle

1 × $31.00

4 Class Bundle

1 × $31.00 -

×

What Every Investor Shoud Know About Accounting Fraud with Jeff Madura

1 × $6.00

What Every Investor Shoud Know About Accounting Fraud with Jeff Madura

1 × $6.00 -

×

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00 -

×

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00 -

×

Volume Analysis – Smart Money

1 × $6.00

Volume Analysis – Smart Money

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00 -

×

Video On Demand Pathway with Trade With Profile

1 × $5.00

Video On Demand Pathway with Trade With Profile

1 × $5.00 -

×

Volume Profile Formula with Aaron Korbs

1 × $5.00

Volume Profile Formula with Aaron Korbs

1 × $5.00 -

×

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00 -

×

Advance Gap Trading with Master Trader

1 × $39.00

Advance Gap Trading with Master Trader

1 × $39.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00 -

×

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00 -

×

AdjustMax

1 × $31.00

AdjustMax

1 × $31.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Ichimoku Traders Academy with Tyler Espitia

1 × $31.00

Ichimoku Traders Academy with Tyler Espitia

1 × $31.00 -

×

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00 -

×

Ron Ianieri – Advanced Options Strategies

1 × $6.00

Ron Ianieri – Advanced Options Strategies

1 × $6.00 -

×

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00 -

×

Value, Price & Profit with Karl Marx

1 × $6.00

Value, Price & Profit with Karl Marx

1 × $6.00 -

×

Real Options in Practice with Marion A.Brach

1 × $6.00

Real Options in Practice with Marion A.Brach

1 × $6.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

Master Class: Income Trading with Option Pit

1 × $101.00

Master Class: Income Trading with Option Pit

1 × $101.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

MATS Market Auction Trading System with Ryan Watts

1 × $6.00

MATS Market Auction Trading System with Ryan Watts

1 × $6.00 -

×

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00 -

×

Futures Foundation Program with SMS Capital

1 × $101.00

Futures Foundation Program with SMS Capital

1 × $101.00 -

×

Momentum Explained

1 × $6.00

Momentum Explained

1 × $6.00 -

×

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00 -

×

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00 -

×

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00 -

×

HYDRA 3 Day Bootcamp

1 × $5.00

HYDRA 3 Day Bootcamp

1 × $5.00 -

×

Managing Investment Portfolios (3rd Ed.) with John Maginn

1 × $6.00

Managing Investment Portfolios (3rd Ed.) with John Maginn

1 × $6.00 -

×

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00 -

×

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00 -

×

Mastering Candlestick Charts I with Greg Capra

1 × $6.00

Mastering Candlestick Charts I with Greg Capra

1 × $6.00 -

×

Market Internals & Intraday Timing Webinar

1 × $6.00

Market Internals & Intraday Timing Webinar

1 × $6.00 -

×

LT Pulse and LT Trend/Ultra

1 × $23.00

LT Pulse and LT Trend/Ultra

1 × $23.00 -

×

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00 -

×

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

Instant Profits System with Bill Poulos

1 × $6.00

Instant Profits System with Bill Poulos

1 × $6.00 -

×

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00 -

×

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

War Room Technicals Vol. 4 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Vol. 4 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

GTA Professional Course with Gova Trading Academy

1 × $5.00

GTA Professional Course with Gova Trading Academy

1 × $5.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00 -

×

MambaFX - Bundle - Trading/Scalping

1 × $23.00

MambaFX - Bundle - Trading/Scalping

1 × $23.00 -

×

KASH-FX JOURNAL

1 × $10.00

KASH-FX JOURNAL

1 × $10.00 -

×

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00 -

×

Documenting and Review Process With Live Trades by Philakone Crypto

1 × $6.00

Documenting and Review Process With Live Trades by Philakone Crypto

1 × $6.00 -

×

MarketSharks Forex Training

1 × $31.00

MarketSharks Forex Training

1 × $31.00 -

×

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00 -

×

Forex Trading for Newbies Complete Course with Chuck Low

1 × $6.00

Forex Trading for Newbies Complete Course with Chuck Low

1 × $6.00 -

×

Linear Regression 3030 with David Elliott

1 × $6.00

Linear Regression 3030 with David Elliott

1 × $6.00 -

×

Lazy Emini Trader Master Class

1 × $15.00

Lazy Emini Trader Master Class

1 × $15.00 -

×

FX GOAT NASDAQ COURSE 2.0

1 × $13.00

FX GOAT NASDAQ COURSE 2.0

1 × $13.00 -

×

Random Walk Trading Options Professional

1 × $31.00

Random Walk Trading Options Professional

1 × $31.00 -

×

Fish Forex Robot 4G

1 × $6.00

Fish Forex Robot 4G

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Trading Options for Dummies with George Fontanills

1 × $6.00

Trading Options for Dummies with George Fontanills

1 × $6.00 -

×

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

W.D. Gann’s Secret Divergence Method with Hexatrade350

1 × $5.00

W.D. Gann’s Secret Divergence Method with Hexatrade350

1 × $5.00 -

×

Yarimi University Course

1 × $56.00

Yarimi University Course

1 × $56.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

Best of Livestock with Timothy Sykes

1 × $5.00

Best of Livestock with Timothy Sykes

1 × $5.00 -

×

Activedaytrader - Workshop: Practical Money Management

1 × $23.00

Activedaytrader - Workshop: Practical Money Management

1 × $23.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

Trade Like Warren Buffett with James Altucher

1 × $6.00

Trade Like Warren Buffett with James Altucher

1 × $6.00 -

×

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00 -

×

X-Factor Day-Trading

1 × $5.00

X-Factor Day-Trading

1 × $5.00 -

×

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00 -

×

Trading for a Bright Future with Martin Cole

1 × $6.00

Trading for a Bright Future with Martin Cole

1 × $6.00 -

×

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00 -

×

WD Gann’s Master Time Factor DVD With Miles Wilson Walker

1 × $6.00

WD Gann’s Master Time Factor DVD With Miles Wilson Walker

1 × $6.00 -

×

Wealth Management with Dimitris Chorafas

1 × $6.00

Wealth Management with Dimitris Chorafas

1 × $6.00 -

×

Trading Academy 2024 with Tradeciety

1 × $5.00

Trading Academy 2024 with Tradeciety

1 × $5.00 -

×

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00 -

×

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00 -

×

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00 -

×

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00 -

×

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00

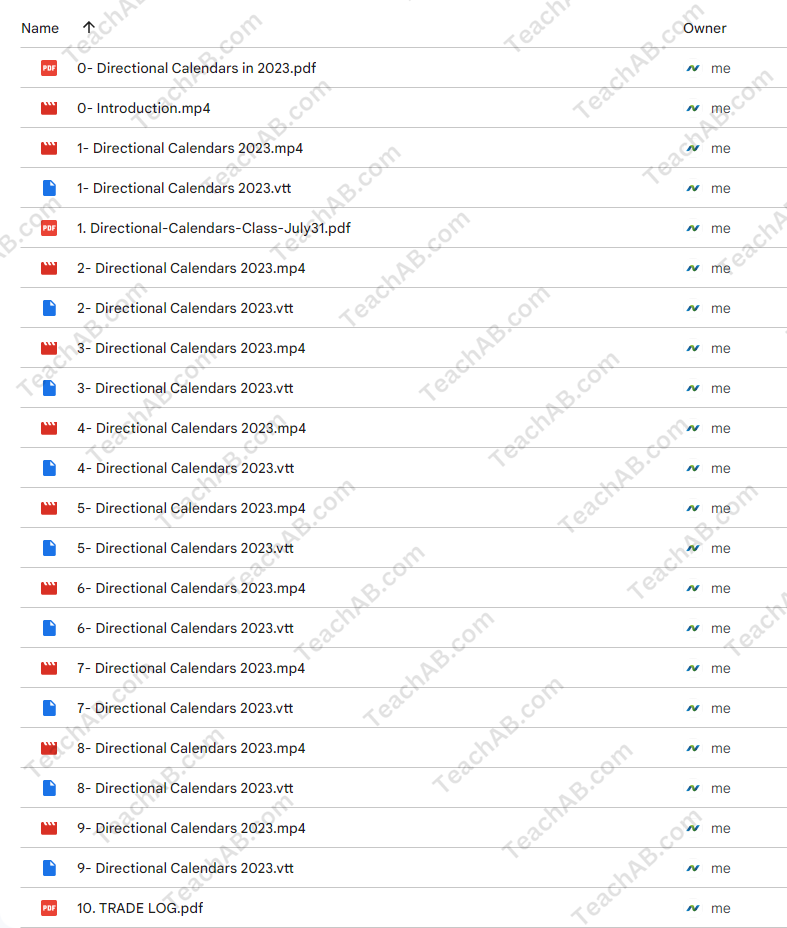

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring

$397.00 Original price was: $397.00.$85.00Current price is: $85.00.

File Size: 4.70 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-54971buZsf4

Category: Forex Trading

Tags: Dan Sheridan, Mark Fenton, Sheridan Options Mentoring

You may check content proof of “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” below:

Mastering Directional Calendars in 2023 with Dan Sheridan & Mark Fenton at Sheridan Options Mentoring

Welcome to the innovative world of options trading where directional calendars stand out as a pivotal strategy for 2023. Under the expert guidance of Dan Sheridan and Mark Fenton from Sheridan Options Mentoring, traders of all levels can learn to navigate and exploit market trends effectively. This comprehensive guide offers insight into utilizing directional calendar strategies to enhance trading outcomes.

1. Introduction to Directional Calendars

What Are Directional Calendars?

Directional calendars are an options strategy that involves the simultaneous buying and selling of options with different expiration dates but the same strike prices, aiming to profit from directional moves in the underlying asset.

2. The Expertise of Dan Sheridan

A Legacy of Options Education

Dan Sheridan brings decades of options trading experience to the table, offering deep insights into sophisticated trading strategies like directional calendars.

3. Mark Fenton’s Analytical Approach

Strategic Market Analysis

Alongside Dan, Mark Fenton provides a critical analytical approach to identifying market trends that are perfect for applying directional calendars.

4. Why Use Directional Calendars?

Advantages in Volatile Markets

Explore how directional calendars can be particularly powerful in volatile markets, offering the ability to leverage slight directional moves for significant profit.

5. Setting Up a Directional Calendar

Step-by-Step Setup

A detailed guide on how to set up a directional calendar, including selecting the right strikes and expirations based on current market conditions.

6. Choosing the Right Markets

Market Selection Criteria

Understand which market conditions and underlying assets are most suitable for directional calendars to maximize your success rate.

7. Risk Management Strategies

Protecting Your Positions

Learn effective risk management techniques specifically tailored for directional calendar trades to safeguard your investments.

8. Tools and Resources

Utilizing the Best Tools

Discover the essential tools and software that can aid in implementing and monitoring directional calendar strategies.

9. Case Studies

Real-World Examples

Analyze several case studies that demonstrate the successful application of directional calendars in various market scenarios.

10. Integration with Other Strategies

Combining Trading Approaches

Learn how to effectively combine directional calendars with other trading strategies to diversify risk and increase potential returns.

11. Adjusting and Exiting Trades

Optimal Trade Management

Guidance on how to make adjustments to your directional calendar positions and the best practices for exiting trades profitably.

12. Learning from the Experts

Sheridan Mentoring Sessions

Opportunities for live mentoring sessions where Dan Sheridan and Mark Fenton personally guide you through the nuances of directional calendars.

13. Continuous Education

Ongoing Learning Opportunities

Explore additional educational resources offered by Sheridan Options Mentoring to keep your trading skills sharp and up-to-date.

14. Joining the Community

Becoming Part of a Trading Family

Benefits of joining the Sheridan Options Mentoring community, including forums, webinars, and member-exclusive events.

15. Conclusion

Adopting directional calendars as part of your trading arsenal in 2023 can significantly enhance your trading strategy. With expert insights from Dan Sheridan and Mark Fenton, embark on a journey to mastering this sophisticated options strategy and watch as your trading proficiency reaches new heights.

FAQs

- What level of trading experience is required for using directional calendars? While beneficial for traders with some options experience, newcomers can also learn this strategy effectively with the right educational resources and mentoring.

- How do directional calendars differ from other calendar strategies? Unlike standard calendars that typically aim for non-directional market conditions, directional calendars are designed to capitalize on forecasted directional moves in the underlying asset.

- What is the typical duration for holding a directional calendar trade? The holding period can vary, but most trades span from a few days to several weeks, depending on the market movement and strategy setup.

- Can directional calendars be used in all market conditions? While particularly effective in volatile or moderately trending markets, the success of directional calendars can depend on proper market analysis and execution.

- How can I start learning with Sheridan Options Mentoring? Visit the Sheridan Options Mentoring website to sign up for courses, workshops, or one-on-one mentoring sessions focused on directional calendars and other advanced options strategies.

Be the first to review “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.