-

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Global Product with John Stark

1 × $6.00

Global Product with John Stark

1 × $6.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Sector Rotation & Market Timing with Frank Barbera

1 × $6.00

Sector Rotation & Market Timing with Frank Barbera

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The TFDW Bundle – Tradingfanatic

1 × $15.00

The TFDW Bundle – Tradingfanatic

1 × $15.00 -

×

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00 -

×

Advanced Course with Jtrader

1 × $6.00

Advanced Course with Jtrader

1 × $6.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

Advanced Pattern Trader Course with Trade Empowered

1 × $23.00

Advanced Pattern Trader Course with Trade Empowered

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00 -

×

3 Day WorkShop with HYDRA

1 × $13.00

3 Day WorkShop with HYDRA

1 × $13.00 -

×

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00 -

×

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00 -

×

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00 -

×

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

Kicker Signals with Stephen W.Bigalow

1 × $6.00

Kicker Signals with Stephen W.Bigalow

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00 -

×

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00 -

×

Investment Fables with Aswath Damodaran

1 × $6.00

Investment Fables with Aswath Damodaran

1 × $6.00 -

×

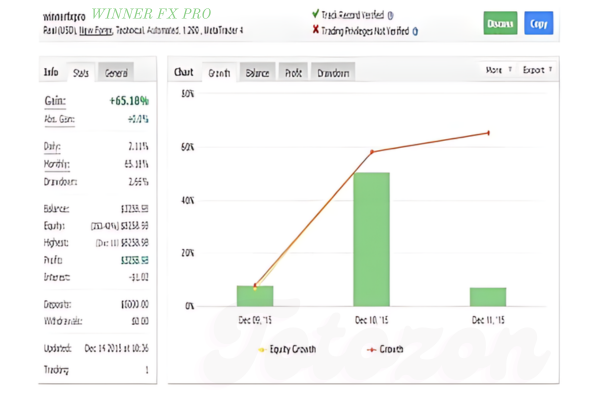

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

Advanced Swing Trading with John Crane

1 × $6.00

Advanced Swing Trading with John Crane

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00 -

×

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00 -

×

Selling Options For A Living Class with Don Kaufman

1 × $6.00

Selling Options For A Living Class with Don Kaufman

1 × $6.00 -

×

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

Best of Livestock with Timothy Sykes

1 × $5.00

Best of Livestock with Timothy Sykes

1 × $5.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00 -

×

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00 -

×

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

Pattern Recognition & Trading Decisions with Chris Satchwell

1 × $6.00

Pattern Recognition & Trading Decisions with Chris Satchwell

1 × $6.00 -

×

Sniper Trading System for Forex with Chris Capre

1 × $4.00

Sniper Trading System for Forex with Chris Capre

1 × $4.00 -

×

Fundamentals Trading

1 × $6.00

Fundamentals Trading

1 × $6.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Adventures of the Cycle Hunter. The Cyclist with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Cyclist with Craig Bttlc

1 × $6.00

The Dick Davis Dividend: Straight Talk on Making Money from 40 Years on Wall Street with Dick Davis

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The Dick Davis Dividend: Straight Talk on Making Money from 40 Years on Wall Street with Dick Davis” below:

The Dick Davis Dividend: Straight Talk on Making Money from 40 Years on Wall Street

Introduction: Decades of Wall Street Wisdom

When it comes to investing, experience counts for a lot, and few have as much as Dick Davis. In “The Dick Davis Dividend,” Davis distills 40 years of stock market insights into practical advice for both new and seasoned investors.

Who is Dick Davis?

1. A Storied Career: A brief biography of Dick Davis, highlighting his extensive experience on Wall Street.

2. Contributions to Financial Journalism: Davis’s role as a columnist and editor, influencing generations of investors.

Core Investment Philosophies

1. The Value of Dividends: Why Davis emphasizes dividend-paying stocks in building wealth.

2. Long-Term Investment Strategies: The benefits of viewing investments with a long horizon.

Understanding Market Cycles

1. Recognizing Patterns: How Davis’s experiences have taught him to recognize and react to market cycles.

2. Adapting to Market Changes: Strategies to stay resilient during market fluctuations.

Risk Management Techniques

1. Mitigating Losses: Practical advice from Davis on how to protect your portfolio from significant losses.

2. The Role of Diversification: Why spreading your investments is crucial in risk management.

Decoding Wall Street Jargon

1. Simplifying Complex Terms: Davis’s ability to break down complex financial terminologies into understandable language.

2. Empowering the Average Investor: How this knowledge can make you a more confident investor.

The Psychological Aspects of Investing

1. Emotional Investing: Davis discusses how emotions can lead to poor investment decisions.

2. Developing a Disciplined Approach: Techniques to maintain objectivity in investment choices.

Leveraging Economic Indicators

1. Key Indicators to Watch: What economic signals Davis follows closely and why.

2. The Impact on Stocks: How these indicators can influence stock prices and investment decisions.

Technology and Investing

1. Embracing Technological Tools: How technology has changed investing and how Davis suggests we adapt.

2. Staying Informed: Tools and resources that keep you ahead in the digital age.

Building and Managing an Investment Portfolio

1. Starting Your Investment Journey: Tips from Davis on how to begin building your portfolio.

2. Portfolio Maintenance: How to manage and adjust your portfolio over time to maximize returns.

The Importance of Being Informed

1. Continuous Learning: Davis’s advice on the necessity of ongoing education in finance.

2. Staying Current with Market Trends: How to keep up-to-date with financial news that impacts your investments.

Conclusion

In “The Dick Davis Dividend,” readers gain access to the wealth of knowledge that comes from four decades on Wall Street. Davis’s straightforward advice provides a roadmap for anyone looking to navigate the complexities of investing and build a successful financial future.

FAQs

- What is the key focus of ‘The Dick Davis Dividend’?

- The book emphasizes the importance of dividend-paying stocks and long-term investment strategies.

- How does Dick Davis suggest investors manage risk?

- Through diversification and understanding market cycles to make informed decisions.

- Can beginners in investing understand this book?

- Yes, Davis has a knack for simplifying complex concepts, making it accessible for beginners.

- What does Dick Davis say about technological advancements in investing?

- He encourages embracing technology to enhance investment strategies and stay informed.

- Why is continuous learning important according to Davis?

- The financial world is constantly evolving, and staying educated helps investors adapt and succeed.

Be the first to review “The Dick Davis Dividend: Straight Talk on Making Money from 40 Years on Wall Street with Dick Davis” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.