-

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Learn To Trade with Tori Trades

1 × $8.00

Learn To Trade with Tori Trades

1 × $8.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

Covered Calls Income Generation for Your Stocks With Don Kaufman

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 1.16 GB

Delivery Time: 1–12 hours

Media Type: Online Course

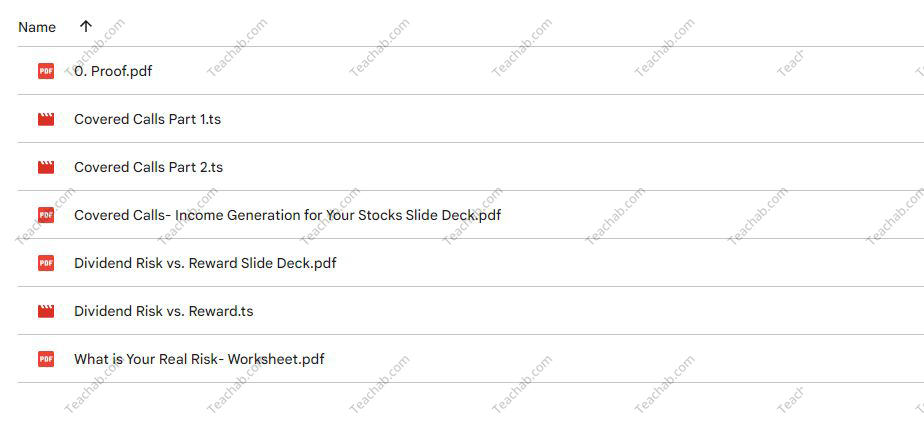

Content Proof: Watch Here!

You may check content proof of “Covered Calls Income Generation for Your Stocks With Don Kaufman” below:

Covered Calls: Income Generation for Your Stocks with Don Kaufman

Introduction: Enhancing Portfolio Yield

In the realm of stock market investing, generating consistent income can be challenging. Don Kaufman, a renowned trading strategist, offers a robust strategy to boost your portfolio’s performance through covered calls.

Who is Don Kaufman?

Expertise and Background

Don Kaufman is a seasoned financial educator known for his deep understanding of options trading. His strategies have empowered countless investors to enhance their trading skills and achieve greater financial security.

Philosophy on Options Trading

Kaufman emphasizes that options, when used wisely, can provide not just leverage but also risk management and income generation.

Understanding Covered Calls

Basics of the Strategy

A covered call involves holding a long position in a stock and selling call options on the same stock to generate income through premiums.

Why Use Covered Calls?

Income Generation

Portfolio Protection

Setting Up a Covered Call

Choosing the Right Stocks

Look for Stable Stocks

Consider Dividend Payers

Selecting the Appropriate Call Options

Strike Price Considerations

Expiration Date Strategy

Benefits of Covered Calls

Additional Income Stream

Covered calls provide a regular income in the form of option premiums, which can be especially appealing in flat market conditions.

Downside Protection

The premium received can offset stock price declines to some extent, offering a cushion against market volatility.

Risks Involved

Limited Upside Potential

Selling a call option caps the maximum profit you can earn on the stock to the strike price of the call.

Potential Stock Assignment

There’s a risk that the stock could be called away if it exceeds the strike price of the call option.

Advanced Techniques with Don Kaufman

Rolling Out Covered Calls

Extending the Expiration Date

Adjusting Strike Prices for More Income or Protection

Managing Early Assignment Risk

Understanding Assignment Triggers

Strategies to Avoid Unwanted Assignments

Kaufman’s Tips for Successful Covered Calls

Consistent Income Focus

Kaufman advises focusing on the consistency of income rather than the magnitude of potential gains.

Regular Monitoring and Adjustments

He emphasizes the importance of regular portfolio reviews to adjust strategies according to market movements.

Tools and Resources for Covered Call Trading

Software for Options Traders

Analytical Tools for Optimal Call Selection

Real-Time Market Data Platforms

Educational Resources

Kaufman’s Trading Courses

Online Webinars and Workshops

Case Studies: Real-Life Applications

Kaufman shares examples from his clients and personal trading experiences to demonstrate the effectiveness of covered calls in various market conditions.

Conclusion: Building a Resilient Portfolio

With Don Kaufman’s guidance on covered calls, investors can enhance their portfolios by adding a reliable income stream while managing risk effectively. It’s a strategy that combines discipline with proactive management to achieve long-term financial goals.

Frequently Asked Questions

1. How much capital is needed to start trading covered calls?

The initial capital requirement depends on the stock price, as you must own the stock to sell the calls.

2. Can covered calls be used in a bear market?

Yes, covered calls can be particularly effective in bear markets as they provide income and some level of protection.

3. What is the best time to sell covered calls?

Timing should be based on market analysis, stock performance, and personal income goals.

4. How often should I check my covered call positions?

Regular monitoring, at least weekly, is recommended to adjust positions as needed based on market movements.

5. Are there any specific sectors or industries best suited for covered calls?

Covered calls work best with stocks that have stable prices and are not too volatile, often found in utilities, consumer goods, and technology sectors.

Be the first to review “Covered Calls Income Generation for Your Stocks With Don Kaufman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.