-

×

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00 -

×

Master Trader - Advander Management Strategies

1 × $39.00

Master Trader - Advander Management Strategies

1 × $39.00 -

×

Price Action Room - The Scalper’s Boot Camp

1 × $15.00

Price Action Room - The Scalper’s Boot Camp

1 × $15.00 -

×

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00 -

×

Investment Fables with Aswath Damodaran

1 × $6.00

Investment Fables with Aswath Damodaran

1 × $6.00 -

×

Passages To Profitability: A Comprehensive Guide To Channel Trading with Professor Jeff Bierman, CMT

1 × $6.00

Passages To Profitability: A Comprehensive Guide To Channel Trading with Professor Jeff Bierman, CMT

1 × $6.00 -

×

3 Day WorkShop with HYDRA

1 × $13.00

3 Day WorkShop with HYDRA

1 × $13.00 -

×

How To Backtest Bootcamp

1 × $17.00

How To Backtest Bootcamp

1 × $17.00 -

×

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00 -

×

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

ICT Mentorship – 2019

1 × $13.00

ICT Mentorship – 2019

1 × $13.00 -

×

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00 -

×

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

Earnings Power Play with Dave Aquino

1 × $15.00

Earnings Power Play with Dave Aquino

1 × $15.00 -

×

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00 -

×

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00 -

×

The Hindenburg Strategy with Todd Mitchell

1 × $23.00

The Hindenburg Strategy with Todd Mitchell

1 × $23.00 -

×

The 10%ers with Trader Mike

1 × $5.00

The 10%ers with Trader Mike

1 × $5.00 -

×

THE ART OF ADJUSTING IN 2017

1 × $6.00

THE ART OF ADJUSTING IN 2017

1 × $6.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00 -

×

Sure Fire Forex Trading with Mark McRae

1 × $6.00

Sure Fire Forex Trading with Mark McRae

1 × $6.00 -

×

The Market Maker’s Edge with Josh Lukeman

1 × $6.00

The Market Maker’s Edge with Josh Lukeman

1 × $6.00 -

×

Options Bootcamp with Sid Woolfolk

1 × $6.00

Options Bootcamp with Sid Woolfolk

1 × $6.00 -

×

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

Startup Trading Masterclass with Jack Gleason

1 × $93.00

Startup Trading Masterclass with Jack Gleason

1 × $93.00 -

×

Renko Profits Accelerator

1 × $15.00

Renko Profits Accelerator

1 × $15.00 -

×

Options Trading with Nick & Gareth - Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $31.00

Options Trading with Nick & Gareth - Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $31.00 -

×

Sami Abusaad Elite Mentorship

1 × $31.00

Sami Abusaad Elite Mentorship

1 × $31.00 -

×

ENG Renko Mastery with International Scalpers

1 × $10.00

ENG Renko Mastery with International Scalpers

1 × $10.00 -

×

The AB-CD Secret Pattern

1 × $4.00

The AB-CD Secret Pattern

1 × $4.00 -

×

Level 1 - Japanese Candlesticks Trading Mastery Program with Rohit Musale & Rashmi Musale

1 × $5.00

Level 1 - Japanese Candlesticks Trading Mastery Program with Rohit Musale & Rashmi Musale

1 × $5.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

The Dynamic Trading Master Course with Robert Miner

1 × $54.00

The Dynamic Trading Master Course with Robert Miner

1 × $54.00 -

×

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00 -

×

Cotton Trading Manual with Terry Townsend

1 × $6.00

Cotton Trading Manual with Terry Townsend

1 × $6.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

Master Forex Fundamentals

1 × $15.00

Master Forex Fundamentals

1 × $15.00 -

×

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00 -

×

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00 -

×

Pairs Trading The Final Frontier with Don Kaufman

1 × $6.00

Pairs Trading The Final Frontier with Don Kaufman

1 × $6.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00 -

×

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

Letal Forex System with Alex Seeni

1 × $6.00

Letal Forex System with Alex Seeni

1 × $6.00 -

×

Pattern Picking with Charles Drummond

1 × $6.00

Pattern Picking with Charles Drummond

1 × $6.00 -

×

FluxOrion By Back To The Future Trading

1 × $6.00

FluxOrion By Back To The Future Trading

1 × $6.00 -

×

Active Investing courses notes with Alan Hull

1 × $6.00

Active Investing courses notes with Alan Hull

1 × $6.00 -

×

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00 -

×

How the Stock Market Works with Ramon DeGennaro

1 × $5.00

How the Stock Market Works with Ramon DeGennaro

1 × $5.00 -

×

Pyrapoint with D.E.Hall

1 × $6.00

Pyrapoint with D.E.Hall

1 × $6.00 -

×

Harmonic Vibrations with Larry Pesavento

1 × $6.00

Harmonic Vibrations with Larry Pesavento

1 × $6.00 -

×

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00 -

×

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

How I Trade the QQQs with Don Miller

1 × $6.00

How I Trade the QQQs with Don Miller

1 × $6.00 -

×

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00 -

×

High Probability Option Trading - Seasonal Straddles

1 × $6.00

High Probability Option Trading - Seasonal Straddles

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

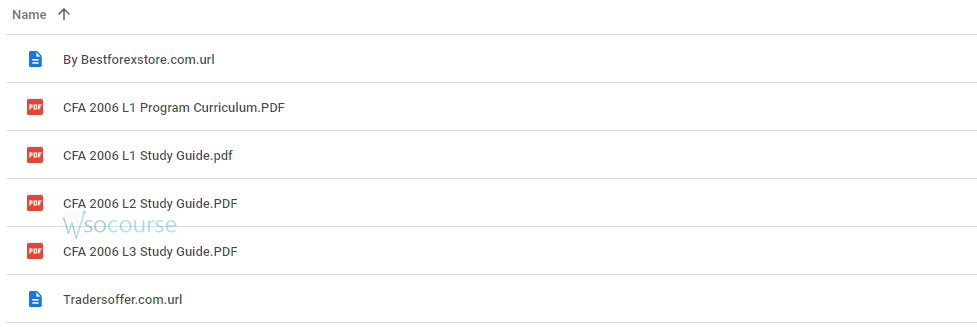

CFA Level 1,2,3 – Study Guides 2006

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “ CFA Level 1,2,3 – Study Guides 2006” below:

Mastering the CFA Level 1, 2, and 3: Comprehensive Study Guides from 2006

Introduction

When preparing for the Chartered Financial Analyst (CFA) exams, access to comprehensive study materials is crucial. The 2006 editions of the CFA Level 1, 2, and 3 study guides remain invaluable resources for candidates aiming to understand the vast landscape of financial analysis and investment management.

Understanding the Structure of CFA Exams

Overview of Levels

The CFA program is structured into three levels, each focusing on integrating a broad range of financial knowledge and practical skills.

Level 1: The Foundation

Level 1 focuses on essential tools and concepts that apply to investment valuation and management.

Level 2: The Application

Level 2 dives deeper into the complex analysis with a focus on asset valuation.

Level 3: The Synthesis

Level 3 synthesizes all knowledge to apply it in a portfolio management and wealth planning context.

Key Features of the 2006 Study Guides

Comprehensiveness

Each guide covers an extensive array of topics, from ethical standards to financial reporting and analysis, ensuring no stone is left unturned.

Practice Questions

End-of-chapter questions in these guides help reinforce the material by testing candidates’ comprehension and retention.

Effective Study Strategies

Create a Study Schedule

Organizing study time efficiently can dramatically increase the retention of complex materials.

Focus on High-Weight Subjects

Prioritizing subjects based on their weight in the exam can yield better results.

Utilizing Study Guides for Each Level

Level 1 Guide: Building the Base

The Level 1 guide is your roadmap to mastering the fundamentals.

Level 2 Guide: Enhancing Analytical Skills

The Level 2 guide enhances your ability to perform detailed investment analysis.

Level 3 Guide: Mastering Management

The Level 3 guide focuses on portfolio management and wealth planning strategies.

Tips for Passing CFA Exams

Master the Ethics Section

Ethical practices form the backbone of the CFA curriculum and are heavily tested.

Practice Regularly

Regular practice using the study guides and mock exams is essential.

Stay Updated

Although the guides are from 2006, it is crucial to complement them with current updates from the CFA Institute.

Challenges and Solutions

Outdated Information

While some information might be outdated, the core principles remain relevant. Supplementing these guides with recent materials can provide a more comprehensive understanding.

Volume of Content

The sheer volume can be overwhelming; breaking down the study sessions into manageable parts can help.

Conclusion

Utilizing the CFA Level 1, 2, and 3 study guides from 2006 can greatly enhance your understanding and preparation for the exams. By integrating these guides with current updates and effective study techniques, you can approach the exams with confidence and clarity.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “CFA Level 1,2,3 – Study Guides 2006” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.