-

×

Signals

1 × $6.00

Signals

1 × $6.00 -

×

The Master Trader Bundle with Gareth Soloway

1 × $39.00

The Master Trader Bundle with Gareth Soloway

1 × $39.00 -

×

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00 -

×

Developing a Forex Trading Plan Webinar

1 × $6.00

Developing a Forex Trading Plan Webinar

1 × $6.00 -

×

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00

Mastering the Complex Sale: How to Compete and Win When the Stakes are High! with Jeff Thull

1 × $6.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

Getting New Insights from Old Indicators with Martin Pring

1 × $6.00

Getting New Insights from Old Indicators with Martin Pring

1 × $6.00 -

×

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00 -

×

Mastering Amibroker Formula Language

1 × $15.00

Mastering Amibroker Formula Language

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00 -

×

How the Stock Market Works with Ramon DeGennaro

1 × $5.00

How the Stock Market Works with Ramon DeGennaro

1 × $5.00 -

×

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00 -

×

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00 -

×

The Psychology of the Foreign Exchange Market with Thomas Oberlechner

1 × $6.00

The Psychology of the Foreign Exchange Market with Thomas Oberlechner

1 × $6.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

Forex EURUSD Trader Live Training (2012)

1 × $6.00

Forex EURUSD Trader Live Training (2012)

1 × $6.00 -

×

Investing Under Fire with Alan R.Ackerman

1 × $6.00

Investing Under Fire with Alan R.Ackerman

1 × $6.00 -

×

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00 -

×

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

Measuring Risk in Complex Stochastic Systems with J.Franke, W. Hardle, G. Stahl

1 × $6.00

Measuring Risk in Complex Stochastic Systems with J.Franke, W. Hardle, G. Stahl

1 × $6.00 -

×

Master Trader - Advander Management Strategies

1 × $39.00

Master Trader - Advander Management Strategies

1 × $39.00 -

×

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00

SATYA 2 - Online Immersion - January 2023 By Tias Little

1 × $225.00 -

×

Letal Forex System with Alex Seeni

1 × $6.00

Letal Forex System with Alex Seeni

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

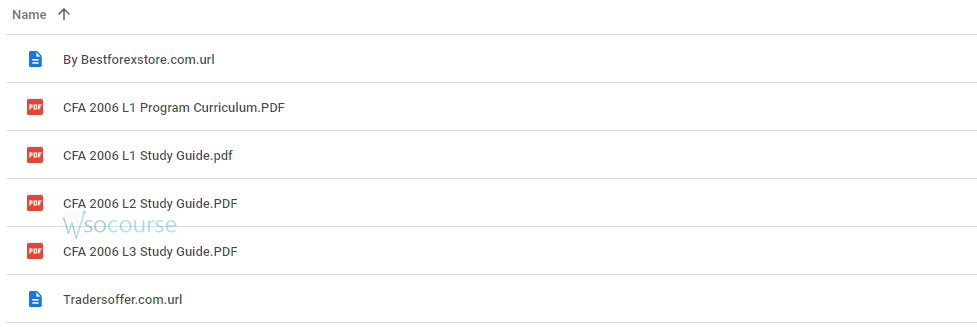

CFA Level 1,2,3 – Study Guides 2006

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “ CFA Level 1,2,3 – Study Guides 2006” below:

Mastering the CFA Level 1, 2, and 3: Comprehensive Study Guides from 2006

Introduction

When preparing for the Chartered Financial Analyst (CFA) exams, access to comprehensive study materials is crucial. The 2006 editions of the CFA Level 1, 2, and 3 study guides remain invaluable resources for candidates aiming to understand the vast landscape of financial analysis and investment management.

Understanding the Structure of CFA Exams

Overview of Levels

The CFA program is structured into three levels, each focusing on integrating a broad range of financial knowledge and practical skills.

Level 1: The Foundation

Level 1 focuses on essential tools and concepts that apply to investment valuation and management.

Level 2: The Application

Level 2 dives deeper into the complex analysis with a focus on asset valuation.

Level 3: The Synthesis

Level 3 synthesizes all knowledge to apply it in a portfolio management and wealth planning context.

Key Features of the 2006 Study Guides

Comprehensiveness

Each guide covers an extensive array of topics, from ethical standards to financial reporting and analysis, ensuring no stone is left unturned.

Practice Questions

End-of-chapter questions in these guides help reinforce the material by testing candidates’ comprehension and retention.

Effective Study Strategies

Create a Study Schedule

Organizing study time efficiently can dramatically increase the retention of complex materials.

Focus on High-Weight Subjects

Prioritizing subjects based on their weight in the exam can yield better results.

Utilizing Study Guides for Each Level

Level 1 Guide: Building the Base

The Level 1 guide is your roadmap to mastering the fundamentals.

Level 2 Guide: Enhancing Analytical Skills

The Level 2 guide enhances your ability to perform detailed investment analysis.

Level 3 Guide: Mastering Management

The Level 3 guide focuses on portfolio management and wealth planning strategies.

Tips for Passing CFA Exams

Master the Ethics Section

Ethical practices form the backbone of the CFA curriculum and are heavily tested.

Practice Regularly

Regular practice using the study guides and mock exams is essential.

Stay Updated

Although the guides are from 2006, it is crucial to complement them with current updates from the CFA Institute.

Challenges and Solutions

Outdated Information

While some information might be outdated, the core principles remain relevant. Supplementing these guides with recent materials can provide a more comprehensive understanding.

Volume of Content

The sheer volume can be overwhelming; breaking down the study sessions into manageable parts can help.

Conclusion

Utilizing the CFA Level 1, 2, and 3 study guides from 2006 can greatly enhance your understanding and preparation for the exams. By integrating these guides with current updates and effective study techniques, you can approach the exams with confidence and clarity.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “CFA Level 1,2,3 – Study Guides 2006” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.