-

×

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00 -

×

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles (Wiley Trading) 2nd Edition - Jack Schwager

1 × $6.00 -

×

Follow the Leader Trading System with Anthony Gibson

1 × $6.00

Follow the Leader Trading System with Anthony Gibson

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00 -

×

The Day Traders Fast Track Program

1 × $23.00

The Day Traders Fast Track Program

1 × $23.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Floor Traders Edge Mentorship Program with Market Geeks

1 × $6.00

Floor Traders Edge Mentorship Program with Market Geeks

1 × $6.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Geometry of Markets I with Bruce Gilmore

1 × $6.00

Geometry of Markets I with Bruce Gilmore

1 × $6.00 -

×

MorningSwing Method with Austin Passamonte

1 × $6.00

MorningSwing Method with Austin Passamonte

1 × $6.00 -

×

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

Futures Commodity Trading with G. Scott Martin

1 × $6.00

Futures Commodity Trading with G. Scott Martin

1 × $6.00 -

×

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00 -

×

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00 -

×

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

TECHNICAL ANALYSIS MODULE

1 × $6.00

TECHNICAL ANALYSIS MODULE

1 × $6.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00 -

×

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00 -

×

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00 -

×

Trade the OEX with Arthur Darack

1 × $6.00

Trade the OEX with Arthur Darack

1 × $6.00 -

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00 -

×

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00 -

×

Pro Trader Boot Camp Home Study with Derrick Oldensmith - T3 Live

1 × $31.00

Pro Trader Boot Camp Home Study with Derrick Oldensmith - T3 Live

1 × $31.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Complete Foundation Stock Trading Course

1 × $62.00

The Complete Foundation Stock Trading Course

1 × $62.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

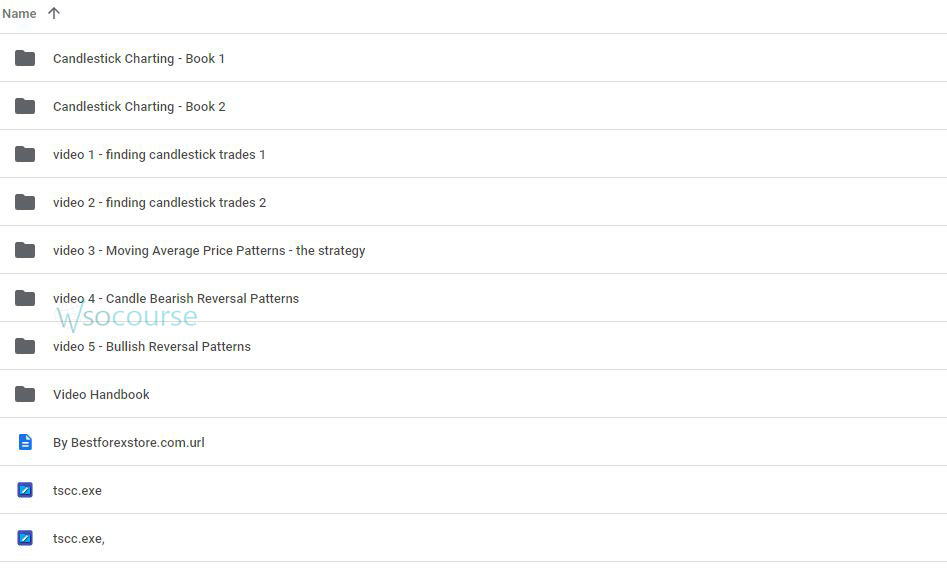

You may check content proof of “Candlestick Trading for Maximum Profitsn with B.M.Davis” below:

Candlestick Trading for Maximum Profits by B.M. Davis

Candlestick trading is not just a technique but an art form that B.M. Davis has mastered to maximize profits in the financial markets. This comprehensive guide breaks down the fundamentals of candlestick trading, providing actionable strategies for traders at all levels. Whether you’re a beginner or an experienced trader, understanding the nuances of candlestick patterns can significantly enhance your trading performance.

Introduction to Candlestick Trading

Candlestick patterns are a cornerstone of technical analysis, offering deep insights into market psychology and potential price movements.

What is Candlestick Trading?

Candlestick trading involves analyzing specific price patterns to forecast future market behavior.

History of Candlesticks

Originating from Japan over 200 years ago, candlestick patterns have been a reliable tool for traders ever since.

The Basics of Candlestick Patterns

Understanding the building blocks of candlestick patterns is essential for their effective application.

Single Candlestick Patterns

These include simple patterns like the Hammer, Doji, and Spinning Tops, each providing unique market insights.

Multi-Candlestick Patterns

More complex formations like the Engulfing, Piercing Line, and Harami play critical roles in predicting market reversals.

Strategies for Maximum Profits

B.M. Davis emphasizes strategies that capitalize on the predictive power of candlestick patterns.

Trend Identification

Identifying trends using candlestick patterns can guide traders in making profitable trading decisions.

Entry and Exit Points

Learn how to determine the best times to enter and exit trades based on candlestick formations.

Advanced Candlestick Trading Techniques

For those looking to refine their trading skills, advanced techniques provide greater precision and control.

Combining with Technical Indicators

Integrating candlestick patterns with indicators like RSI, MACD, and moving averages enhances accuracy.

Breakout Strategies

Recognizing and acting on breakout patterns can lead to significant profits.

Risk Management in Candlestick Trading

Effective risk management is crucial to maximizing profits and minimizing losses.

Setting Stop-Loss Orders

Learn how to set stop-loss orders strategically based on candlestick patterns.

Managing Trade Size

Adjusting trade size according to the strength of the candlestick signal is a key tactic.

Psychological Aspects of Trading

Understanding the psychology behind market movements can provide a competitive edge.

Market Sentiment Analysis

Candlestick patterns often reflect the psychological state of the market, providing clues about future movements.

Trader Behavior

Recognizing common behavioral patterns can help anticipate market reactions.

Candlestick Trading in Different Markets

Candlestick patterns are versatile and can be applied across various financial markets.

Stocks and Forex

Specific strategies for stocks and Forex markets using candlesticks.

Commodities and Cryptocurrencies

Adapting candlestick strategies for commodities and cryptocurrencies.

Conclusion

Candlestick trading offers a robust framework for understanding market dynamics and enhancing trading decisions. With the strategies discussed by B.M. Davis, traders can harness these patterns for maximum profit while effectively managing risk.

Frequently Asked Questions:

- What are the best candlestick patterns for beginners to learn?

The Hammer, Doji, and Engulfing patterns are ideal for beginners due to their simplicity and effectiveness. - How can candlestick patterns be used for day trading?

Candlestick patterns are extremely useful in day trading for identifying short-term price movements. - Can candlestick patterns be the sole basis for trading decisions?

While powerful, it’s advisable to use candlestick patterns in conjunction with other forms of analysis. - What is the biggest mistake traders make with candlestick patterns?

Over-reliance without considering market context or other technical indicators can lead to poor trading decisions. - How important is timing in trading with candlestick patterns?

Timing is crucial; accurate interpretation of patterns can significantly impact the success of trades.

Be the first to review “Candlestick Trading for Maximum Profitsn with B.M.Davis” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.