-

×

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00 -

×

Principles of Artificial Neural Networks (2nd Ed.) with Daniel Graupe

1 × $6.00

Principles of Artificial Neural Networks (2nd Ed.) with Daniel Graupe

1 × $6.00 -

×

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00 -

×

Fractal Markets SFX with Tyson Bieniek

1 × $5.00

Fractal Markets SFX with Tyson Bieniek

1 × $5.00 -

×

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00 -

×

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00 -

×

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00 -

×

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00 -

×

Adz Trading Academy

1 × $5.00

Adz Trading Academy

1 × $5.00 -

×

Pro Indicator Pack with Trade Confident

1 × $15.00

Pro Indicator Pack with Trade Confident

1 × $15.00 -

×

Passages To Profitability: A Comprehensive Guide To Channel Trading with Professor Jeff Bierman, CMT

1 × $6.00

Passages To Profitability: A Comprehensive Guide To Channel Trading with Professor Jeff Bierman, CMT

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

The Ultimate Forex Structure Course

1 × $31.00

The Ultimate Forex Structure Course

1 × $31.00 -

×

Trading MoneyTides & Chaos in the Stock Market with Hans Hannula

1 × $6.00

Trading MoneyTides & Chaos in the Stock Market with Hans Hannula

1 × $6.00 -

×

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00 -

×

Perfect Strategy - SPX Daily Options Income with Peter Titus - Marwood Research

1 × $15.00

Perfect Strategy - SPX Daily Options Income with Peter Titus - Marwood Research

1 × $15.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Naked Trading Part 1 with Base Camp Trading

1 × $6.00

Naked Trading Part 1 with Base Camp Trading

1 × $6.00 -

×

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

How I Trade for a Living with Gary Smith

1 × $6.00

How I Trade for a Living with Gary Smith

1 × $6.00 -

×

Master The Markets 2.0 with French Trader

1 × $6.00

Master The Markets 2.0 with French Trader

1 × $6.00 -

×

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00 -

×

SOAP. Served On A Platter CD with David Elliott

1 × $6.00

SOAP. Served On A Platter CD with David Elliott

1 × $6.00 -

×

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

Quantum Stone Capital

1 × $15.00

Quantum Stone Capital

1 × $15.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

Market Mindfields. Dancing with Gorilla

1 × $6.00

Market Mindfields. Dancing with Gorilla

1 × $6.00 -

×

Algohub 2023 Full Completed with Algohub

1 × $5.00

Algohub 2023 Full Completed with Algohub

1 × $5.00 -

×

MTI - Trend Trader Course (Feb 2014)

1 × $23.00

MTI - Trend Trader Course (Feb 2014)

1 × $23.00 -

×

The Art and Application of Technical Analysis with Cynthia Kase

1 × $6.00

The Art and Application of Technical Analysis with Cynthia Kase

1 × $6.00 -

×

2 Trades A Day with Jason Hale

1 × $15.00

2 Trades A Day with Jason Hale

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

101 Option Trading Secrets with Kenneth Trester

1 × $6.00

101 Option Trading Secrets with Kenneth Trester

1 × $6.00 -

×

3 Day Bootcamp EXPERT LEVEL with FX Savages

1 × $6.00

3 Day Bootcamp EXPERT LEVEL with FX Savages

1 × $6.00 -

×

10 Best Swing Trading Patterns & Strategies with Dave Landry

1 × $4.00

10 Best Swing Trading Patterns & Strategies with Dave Landry

1 × $4.00 -

×

11 Elements of Prudent Investing with Andy Karabinos

1 × $6.00

11 Elements of Prudent Investing with Andy Karabinos

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Volume Cycles in the stock Market

1 × $6.00

Volume Cycles in the stock Market

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

14-Day Options Trading Bootcamp (Jule 2014)

1 × $15.00

14-Day Options Trading Bootcamp (Jule 2014)

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00 -

×

12 Strategies for Picking Tops & Bottoms

1 × $23.00

12 Strategies for Picking Tops & Bottoms

1 × $23.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

10-Week Stock Trading Program with Stock Market Lab

1 × $6.00

10-Week Stock Trading Program with Stock Market Lab

1 × $6.00 -

×

2014 Advanced Swing Trading Summit

1 × $31.00

2014 Advanced Swing Trading Summit

1 × $31.00 -

×

'Smart Money' Institutional Forex Trading with Jeffrey Edahs

1 × $6.00

'Smart Money' Institutional Forex Trading with Jeffrey Edahs

1 × $6.00

Mastering the Stock Market with Andrew Baxter

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

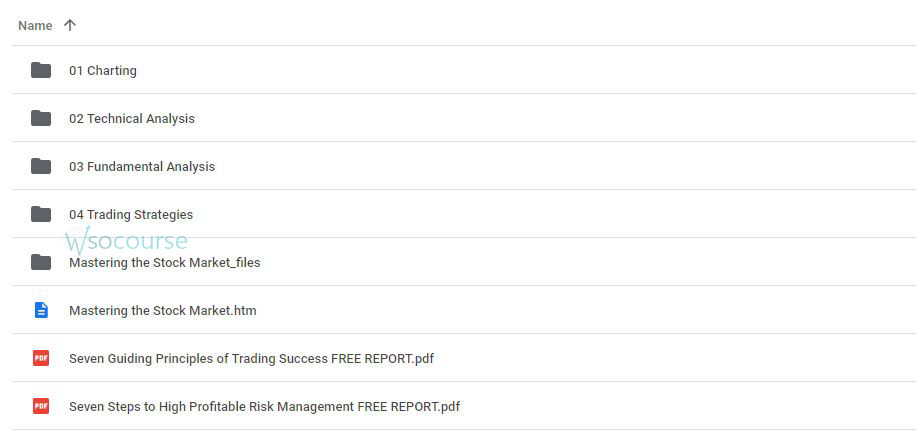

You may check content proof of “Mastering the Stock Market with Andrew Baxter” below:

Mastering the Stock Market with Andrew Baxter

Introduction to Stock Market Mastery

Mastering the stock market requires a blend of knowledge, strategy, and discipline. Andrew Baxter, a seasoned trader and educator, provides valuable insights on how to navigate the complexities of the stock market. This article delves into essential concepts and strategies to help you achieve success in stock trading.

Understanding the Stock Market

What is the Stock Market?

The stock market is a platform where investors buy and sell shares of publicly traded companies. It reflects the collective sentiment of investors about the prospects of individual companies and the economy as a whole.

Importance of Stock Market

Investing in the stock market can provide significant returns over time. It’s an essential component of a diversified investment portfolio, helping to grow wealth and achieve financial goals.

Getting Started with Stock Trading

1. Setting Financial Goals

Before diving into stock trading, it’s crucial to define your financial goals. Are you looking for short-term gains or long-term wealth accumulation?

Short-Term Goals

Short-term goals might include saving for a vacation, buying a car, or building an emergency fund.

Long-Term Goals

Long-term goals could involve retirement planning, funding your child’s education, or buying a home.

2. Choosing a Brokerage Account

Selecting the right brokerage account is vital. Look for a platform that offers low fees, a user-friendly interface, and robust research tools.

3. Understanding Risk Tolerance

Knowing your risk tolerance helps in choosing the right stocks and strategies. Are you a conservative investor or willing to take higher risks for potentially higher rewards?

Fundamental Analysis

1. Analyzing Financial Statements

Financial statements provide a snapshot of a company’s health. Key documents include the balance sheet, income statement, and cash flow statement.

Balance Sheet

The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time.

Income Statement

The income statement highlights a company’s revenues, expenses, and profits over a period.

Cash Flow Statement

The cash flow statement tracks the flow of cash in and out of the company, indicating its liquidity.

2. Evaluating Company Performance

Assess a company’s performance by examining its profitability, growth potential, and competitive position.

Profitability Ratios

Key ratios include the profit margin, return on assets (ROA), and return on equity (ROE).

Growth Indicators

Look for revenue growth, earnings growth, and market share expansion.

3. Industry and Market Analysis

Understanding the industry and market trends helps in making informed investment decisions.

Technical Analysis

1. Reading Price Charts

Price charts visualize a stock’s price movements over time. Common types include line charts, bar charts, and candlestick charts.

2. Using Technical Indicators

Technical indicators help identify trends, momentum, and potential reversal points.

Moving Averages

Moving averages smooth out price data to identify trends. The Simple Moving Average (SMA) and Exponential Moving Average (EMA) are popular choices.

Relative Strength Index (RSI)

RSI measures the speed and change of price movements, indicating overbought or oversold conditions.

MACD (Moving Average Convergence Divergence)

MACD shows the relationship between two moving averages, helping to identify potential buy and sell signals.

Developing a Trading Strategy

1. Day Trading

Day trading involves buying and selling stocks within the same day to capitalize on short-term price movements.

Benefits of Day Trading

- Quick profit potential

- No overnight risk

Challenges of Day Trading

- Requires significant time and attention

- High risk due to rapid market movements

2. Swing Trading

Swing trading involves holding stocks for several days to weeks to profit from short-term price swings.

Benefits of Swing Trading

- Less time-consuming than day trading

- Potential for significant gains

Challenges of Swing Trading

- Exposure to overnight market risks

- Requires patience and discipline

3. Long-Term Investing

Long-term investing focuses on buying and holding stocks for several years, benefiting from the company’s growth and compounding returns.

Benefits of Long-Term Investing

- Lower transaction costs

- Potential for substantial wealth accumulation

Challenges of Long-Term Investing

- Requires patience and a long-term perspective

- Market volatility can impact short-term performance

Risk Management

1. Diversification

Diversifying your portfolio reduces risk by spreading investments across different sectors and asset classes.

2. Stop-Loss Orders

Using stop-loss orders helps limit potential losses by automatically selling a stock when it reaches a predetermined price.

3. Position Sizing

Determining the right amount to invest in each stock helps manage risk and avoid overexposure to any single investment.

Continuous Learning and Adaptation

1. Staying Informed

Keep up with market news, economic indicators, and company reports to make informed decisions.

2. Analyzing Performance

Regularly review and analyze your trading performance to identify strengths and areas for improvement.

3. Adapting Strategies

Be flexible and ready to adapt your strategies based on changing market conditions and new information.

Conclusion

Mastering the stock market with insights from Andrew Baxter involves a combination of fundamental analysis, technical analysis, strategic planning, and continuous learning. By setting clear goals, managing risk, and staying informed, you can navigate the complexities of the stock market and achieve your financial objectives. Embrace these principles, refine your approach, and watch your trading performance improve over time.

Frequently Asked Questions:

What are the key components of stock market mastery?

The key components include fundamental analysis, technical analysis, strategic planning, and risk management.

How do I start trading stocks?

Start by setting financial goals, choosing a brokerage account, and understanding your risk tolerance.

What is the difference between day trading and swing trading?

Day trading involves buying and selling stocks within the same day, while swing trading involves holding stocks for several days to weeks.

Why is diversification important in stock trading?

Diversification reduces risk by spreading investments across different sectors and asset classes.

How can I continuously improve my trading performance?

Stay informed, regularly analyze your performance, and adapt your strategies based on new information and market conditions.

Be the first to review “Mastering the Stock Market with Andrew Baxter” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.