The Age of Turbulence with Alan Greenspan

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

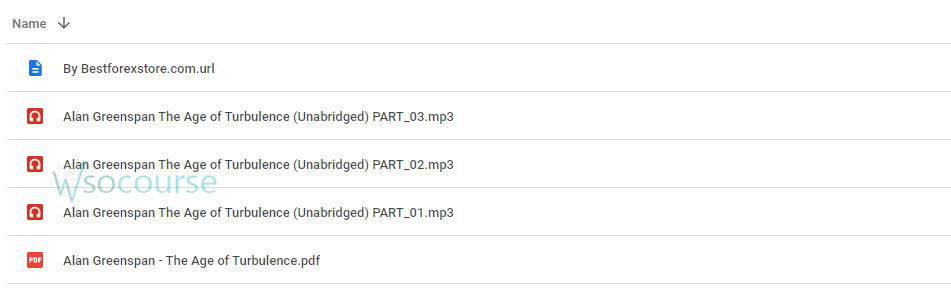

Content Proof: Watch Here!

You may check content proof of “The Age of Turbulence with Alan Greenspan” below:

The Age of Turbulence with Alan Greenspan

Introduction

Navigating the complex landscape of the global economy requires insights from seasoned experts. “The Age of Turbulence,” authored by former Federal Reserve Chairman Alan Greenspan, provides a deep dive into the economic shifts that have shaped our world. This article explores the key themes and lessons from Greenspan’s influential work, offering a roadmap for understanding economic turbulence.

Who is Alan Greenspan?

Background and Career

Alan Greenspan served as the Chairman of the Federal Reserve from 1987 to 2006. His tenure was marked by significant economic events, making him one of the most influential figures in modern economic policy.

Why His Insights Matter

Greenspan’s decisions have had a profound impact on both the U.S. and global economies. His experiences provide valuable lessons for understanding economic dynamics and navigating financial uncertainty.

Understanding “The Age of Turbulence”

Overview of the Book

“The Age of Turbulence” is both an autobiography and an analysis of the economic changes from the late 20th century to the early 21st century. It combines personal anecdotes with in-depth economic theory.

Key Themes

- Globalization

- Technological Advancements

- Economic Policy and Regulation

- Market Dynamics

Globalization and Its Impact

1. The Rise of Global Markets

Globalization has connected economies, making them more interdependent. Greenspan discusses how this interconnectedness affects national economies.

2. Challenges of Globalization

Globalization also brings challenges, such as economic inequality and job displacement. Understanding these issues is crucial for developing effective economic policies.

Technological Advancements

1. The Tech Revolution

Technological innovations have transformed industries and economies. Greenspan highlights the importance of staying ahead of technological trends.

2. Impact on Productivity

Increased productivity through technology has driven economic growth. However, it also requires continuous adaptation and skill development.

Economic Policy and Regulation

1. Role of the Federal Reserve

Greenspan details his experiences at the Federal Reserve, emphasizing the importance of monetary policy in managing economic stability.

2. Regulatory Challenges

Balancing regulation and market freedom is a recurring theme. Effective regulation is necessary to prevent crises without stifling innovation.

Market Dynamics

1. Understanding Market Cycles

Greenspan explains market cycles and their implications for investors. Recognizing these cycles can help in making informed investment decisions.

2. Behavioral Economics

Human behavior significantly impacts market dynamics. Greenspan explores how psychology influences economic decisions and market trends.

Lessons from Economic Crises

1. The 1987 Stock Market Crash

Greenspan’s swift response to the 1987 crash exemplifies crisis management. His actions helped stabilize the market and restore confidence.

2. The Dot-Com Bubble

The late 1990s saw a surge in tech investments, leading to a market bubble. Greenspan discusses the lessons learned from this period.

3. The 2008 Financial Crisis

Though post-Greenspan’s tenure, the 2008 crisis underscores the importance of vigilant economic oversight and sound policy.

Strategies for Navigating Economic Turbulence

1. Diversification

Diversifying investments can mitigate risks. Greenspan advocates for a balanced portfolio to weather economic fluctuations.

2. Staying Informed

Keeping abreast of economic trends and policy changes is essential. Greenspan’s book serves as a valuable resource for understanding these dynamics.

3. Adapting to Change

Flexibility and adaptability are key. Economic landscapes change rapidly, and staying adaptable is crucial for long-term success.

Conclusion

“The Age of Turbulence” by Alan Greenspan offers a wealth of knowledge for anyone interested in understanding the complexities of the global economy. By learning from past economic events and Greenspan’s insights, we can better navigate the future.

FAQs

1. What is the main focus of “The Age of Turbulence”?

The book combines Greenspan’s autobiography with a detailed analysis of economic changes from the late 20th century to the early 21st century.

2. How does Greenspan view globalization?

Greenspan acknowledges the benefits of globalization but also highlights its challenges, such as economic inequality and job displacement.

3. What lessons can be learned from Greenspan’s tenure at the Federal Reserve?

Key lessons include the importance of monetary policy, the need for effective regulation, and strategies for managing economic crises.

4. How can investors apply Greenspan’s insights?

Investors can benefit from understanding market cycles, diversifying their portfolios, and staying informed about economic trends.

5. Why is adaptability important in economic planning?

Economic conditions change rapidly, and being adaptable allows individuals and businesses to respond effectively to new challenges and opportunities.

Be the first to review “The Age of Turbulence with Alan Greenspan” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.