Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

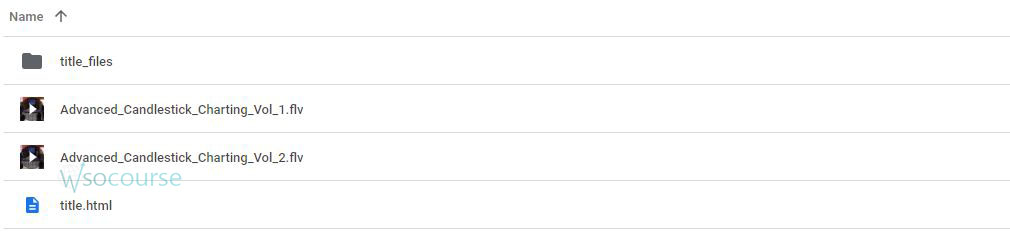

Content Proof: Watch Here!

You may check content proof of “Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny” below:

Advanced Trading Applications of Candlestick Charting with Gary S. Wagner & Bradley L. Matheny

Candlestick charting is an invaluable tool for traders, providing visual insights into market trends and potential price movements. Gary S. Wagner and Bradley L. Matheny, renowned experts in technical analysis, offer advanced strategies to maximize the effectiveness of candlestick charting. This article delves into these advanced applications, equipping you with the knowledge to enhance your trading strategies.

Introduction to Candlestick Charting

What Are Candlestick Charts?

Candlestick charts are a type of financial chart that graphically displays price movements over a specified period. Each candlestick provides information about the opening, closing, high, and low prices.

Who Are Gary S. Wagner & Bradley L. Matheny?

Gary S. Wagner and Bradley L. Matheny are respected technical analysts known for their expertise in Japanese candlestick charting. Their insights have helped many traders navigate the complexities of financial markets.

Fundamental Components of Candlesticks

The Body

Bullish and Bearish Candles

The body of a candlestick represents the range between the opening and closing prices. A bullish candle indicates a price increase, while a bearish candle shows a price decrease.

The Shadows

Upper and Lower Shadows

The shadows, or wicks, represent the highest and lowest prices during the trading period. The upper shadow indicates the high, and the lower shadow shows the low.

Color and Interpretation

Traditional Colors

Typically, a bullish candle is green or white, and a bearish candle is red or black, making it easy to identify market trends.

Advanced Candlestick Patterns

1. Morning Star

Pattern Description

The morning star is a three-candle pattern signaling a bullish reversal. It consists of a long bearish candle, a short-bodied candle (the star), and a long bullish candle.

Significance

This pattern indicates that the selling pressure is decreasing, and buyers are starting to take control.

2. Evening Star

Pattern Description

The evening star is the opposite of the morning star, signaling a bearish reversal. It includes a long bullish candle, a short-bodied candle, and a long bearish candle.

Significance

This pattern suggests that the buying pressure is weakening, and sellers are gaining the upper hand.

Combining Candlestick Patterns with Technical Indicators

Moving Averages

Using Moving Averages

Combining candlestick patterns with moving averages helps confirm trends and potential reversals.

Relative Strength Index (RSI)

RSI Integration

Using RSI alongside candlestick charts can help identify overbought or oversold conditions, providing additional confirmation for trades.

Bollinger Bands

Volatility Indicators

Bollinger Bands measure market volatility and, when used with candlestick patterns, can help identify potential breakouts or reversals.

Advanced Trading Strategies

1. Trend Following

Identifying Trends

Use candlestick patterns to identify the direction of the market trend and follow it to maximize profits.

Trend Confirmation

Confirm trends with technical indicators such as moving averages and RSI.

2. Reversal Trading

Spotting Reversals

Look for key reversal patterns like the morning star and evening star to enter or exit trades at optimal points.

Risk Management

Set stop-loss orders to protect against significant losses during potential reversals.

3. Breakout Trading

Identifying Breakouts

Use patterns and Bollinger Bands to identify potential breakout points.

Entry and Exit Points

Determine entry and exit points based on confirmed breakouts and set appropriate stop-loss levels.

Practical Applications in Daily Trading

Analyzing Market Trends

Daily Market Analysis

Incorporate candlestick patterns into your daily market analysis to stay ahead of market movements.

Setting Up Trades

Entry and Exit Strategies

Use advanced candlestick patterns to set precise entry and exit points for your trades.

Monitoring Trades

Real-Time Adjustments

Continuously monitor your trades and adjust your strategy based on real-time market data and candlestick patterns.

Common Mistakes and How to Avoid Them

Overtrading

Quality Over Quantity

Avoid overtrading by focusing on high-quality setups rather than numerous trades.

Ignoring Confirmation

Importance of Confirmation

Always confirm candlestick patterns with additional technical indicators to reduce the risk of false signals.

Tips for Success

Continuous Learning

Educational Resources

Stay updated with the latest research and strategies in candlestick charting by reading books and attending seminars.

Practice and Patience

Paper Trading

Practice your strategies in a risk-free environment through paper trading to gain confidence and refine your techniques.

Seeking Expert Advice

Mentorship and Guidance

Consider seeking mentorship from experienced traders like Gary S. Wagner and Bradley L. Matheny to enhance your trading skills.

Conclusion

Advanced trading applications of candlestick charting, as taught by Gary S. Wagner and Bradley L. Matheny, provide traders with a robust framework for making informed decisions. By combining these patterns with technical indicators and employing advanced strategies, you can significantly improve your trading performance. Remember to continuously learn, practice, and stay disciplined to succeed in the dynamic world of trading.

FAQs

1. What are the key components of a candlestick?

A candlestick has a body, which shows the range between the opening and closing prices, and shadows, which indicate the highest and lowest prices during the trading period.

2. How can I use candlestick patterns to identify trends?

Candlestick patterns, such as bullish and bearish formations, help identify the overall direction of the market trend.

3. Why should I confirm candlestick patterns with other indicators?

Confirming candlestick patterns with technical indicators like moving averages and RSI reduces the risk of false signals and enhances trading accuracy.

4. What are some advanced candlestick patterns to look for?

Advanced patterns include the morning star and evening star, which signal potential market reversals.

5. How can I manage risk when using candlestick charting?

Implement risk management strategies such as setting stop-loss orders and adjusting position sizes according to your risk tolerance.

Be the first to review “Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

Reviews

There are no reviews yet.