-

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00 -

×

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00 -

×

Finserv Corp Complete Course

1 × $4.00

Finserv Corp Complete Course

1 × $4.00 -

×

The 4 Horsemen CD with David Elliott

1 × $6.00

The 4 Horsemen CD with David Elliott

1 × $6.00 -

×

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00 -

×

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00 -

×

Candlestick Charting Explained with Greg Morris

1 × $8.00

Candlestick Charting Explained with Greg Morris

1 × $8.00 -

×

Geometry of Markets I with Bruce Gilmore

1 × $6.00

Geometry of Markets I with Bruce Gilmore

1 × $6.00 -

×

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Trading Against the Crowd with John Summa

1 × $6.00

Trading Against the Crowd with John Summa

1 × $6.00 -

×

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Financial Astrology Course with Brian James Sklenka

1 × $6.00

Financial Astrology Course with Brian James Sklenka

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

How to avoid the GAP

1 × $6.00

How to avoid the GAP

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Trading Masterclass with Chris Capre

1 × $23.00

The Trading Masterclass with Chris Capre

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Spartan Renko 2.0 Workshop 2017

1 × $23.00

Spartan Renko 2.0 Workshop 2017

1 × $23.00 -

×

Core Concepts Mastery with DreamsFX

1 × $5.00

Core Concepts Mastery with DreamsFX

1 × $5.00 -

×

Equity Trader 101 Course with KeyStone Trading

1 × $6.00

Equity Trader 101 Course with KeyStone Trading

1 × $6.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

Cwesi Forex Trading Bootcamp (Algo Trading)

1 × $13.00

Cwesi Forex Trading Bootcamp (Algo Trading)

1 × $13.00 -

×

Russell Futures Scalping Course with Bill McDowell

1 × $6.00

Russell Futures Scalping Course with Bill McDowell

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00 -

×

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00 -

×

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Follow the Leader Trading System with Anthony Gibson

1 × $6.00

Follow the Leader Trading System with Anthony Gibson

1 × $6.00 -

×

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

The Practical Fractal with Bill Williams

1 × $6.00

The Practical Fractal with Bill Williams

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Full-Day Premium Pitchfork Class with Forex Pitchfork Master Trader

1 × $15.00

Full-Day Premium Pitchfork Class with Forex Pitchfork Master Trader

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

11 Elements of Prudent Investing with Andy Karabinos

1 × $6.00

11 Elements of Prudent Investing with Andy Karabinos

1 × $6.00 -

×

Ultimate Breakout

1 × $54.00

Ultimate Breakout

1 × $54.00 -

×

Explosive Growth Options & Stocks with Base Camp Trading

1 × $5.00

Explosive Growth Options & Stocks with Base Camp Trading

1 × $5.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

Trading Ist Ein Geschaft (German) (tradingeducators.com)

1 × $6.00

Trading Ist Ein Geschaft (German) (tradingeducators.com)

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00

Wolfe Waves

$3,000.00 Original price was: $3,000.00.$15.00Current price is: $15.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Master Wolfe Waves Trading Strategy with Ease

Introduction

Wolfe Waves are a powerful and reliable chart pattern used by traders to predict price movements and potential reversals in the market. This advanced trading strategy, developed by Bill Wolfe, offers a unique approach to identifying market trends and making profitable trades. In this article, we will explore the intricacies of Wolfe Waves, how to identify them, and how to effectively incorporate them into your trading strategy.

What are Wolfe Waves?

Definition

Wolfe Waves are a natural and harmonic market pattern that reflects the equilibrium between supply and demand. These patterns typically consist of five waves that signal potential price reversals or continuations.

Origin

Bill Wolfe, a seasoned trader, and analyst, developed the Wolfe Waves theory. His method focuses on recognizing these patterns to anticipate future market movements.

Key Characteristics of Wolfe Waves

1. Five-Wave Structure

Wolfe Waves consist of five distinct waves that form a specific pattern on the price chart.

2. Symmetry

The pattern usually exhibits a symmetrical structure, with the waves mirroring each other in length and duration.

3. Predictive Nature

Wolfe Waves can predict price targets and reversal points with a high degree of accuracy.

Identifying Wolfe Waves

1. Wave Counting

a. Wave 1 and Wave 2

Wave 1 is the initial movement, followed by Wave 2, which retraces Wave 1. Wave 2 should be smaller than Wave 1.

b. Wave 3

Wave 3 extends beyond the endpoint of Wave 1 and is usually the longest wave.

c. Wave 4

Wave 4 retraces Wave 3 but does not overlap with Wave 1’s endpoint.

d. Wave 5

Wave 5 is the final wave and extends beyond the endpoint of Wave 3.

2. Trendlines

Connect Waves 1 and 3 with a trendline and Waves 2 and 4 with another trendline. These trendlines help in identifying the pattern and potential breakout points.

3. Target Line

Draw a line from the starting point of Wave 1 to the endpoint of Wave 4. This target line helps predict the potential price movement upon the breakout of Wave 5.

Trading Wolfe Waves

1. Entry Points

Enter a trade at the completion of Wave 5, when the price touches or moves beyond the trendline connecting Waves 1 and 3.

2. Stop-Loss Placement

Place a stop-loss order just beyond the endpoint of Wave 5 to minimize potential losses.

3. Profit Targets

Use the target line to set your profit targets. This line indicates the expected price movement based on the Wolfe Waves pattern.

Examples of Wolfe Waves in Trading

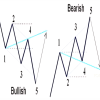

1. Bullish Wolfe Waves

A bullish Wolfe Wave pattern indicates a potential upward price movement. This pattern typically forms at the end of a downtrend and signals a reversal to the upside.

2. Bearish Wolfe Waves

A bearish Wolfe Wave pattern suggests a potential downward price movement. This pattern usually forms at the end of an uptrend, indicating a reversal to the downside.

Advantages of Wolfe Waves

1. High Accuracy

Wolfe Waves are known for their precision in predicting price movements, providing traders with reliable signals.

2. Versatility

This pattern can be applied to various financial markets, including stocks, forex, and commodities.

3. Clear Entry and Exit Points

Wolfe Waves offer clear guidelines for entering and exiting trades, making them easy to implement.

Challenges of Trading Wolfe Waves

1. Complexity in Identification

Identifying Wolfe Waves can be challenging, especially for beginners. It requires a keen eye for detail and practice.

2. False Signals

Like any trading strategy, Wolfe Waves can produce false signals, leading to potential losses.

3. Market Conditions

Wolfe Waves work best in stable market conditions. High volatility can affect the pattern’s reliability.

Tips for Trading Wolfe Waves

1. Practice Regularly

Regular practice in identifying and trading Wolfe Waves can enhance your accuracy and confidence.

2. Combine with Other Indicators

Use additional technical indicators, such as moving averages or RSI, to confirm Wolfe Wave patterns and improve your trading decisions.

3. Stay Informed

Keep up with market news and events that might impact price movements, as they can influence the effectiveness of Wolfe Wave patterns.

Conclusion

Wolfe Waves offer a robust and reliable method for predicting price movements and making profitable trades. By understanding and mastering this pattern, traders can enhance their trading strategies and achieve better results. Practice and patience are key to effectively utilizing Wolfe Waves in your trading endeavors.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Wolfe Waves” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.