-

×

4D Bootcamp with Black Rabbit

1 × $10.00

4D Bootcamp with Black Rabbit

1 × $10.00 -

×

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00 -

×

Put Option Strategies for Smarter Trading with Michael Thomsett

1 × $6.00

Put Option Strategies for Smarter Trading with Michael Thomsett

1 × $6.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Startup Trading Masterclass with Jack Gleason

1 × $93.00

Startup Trading Masterclass with Jack Gleason

1 × $93.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

How To Backtest Bootcamp

1 × $17.00

How To Backtest Bootcamp

1 × $17.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00 -

×

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Peter Borish Online Trader Program

1 × $15.00

Peter Borish Online Trader Program

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

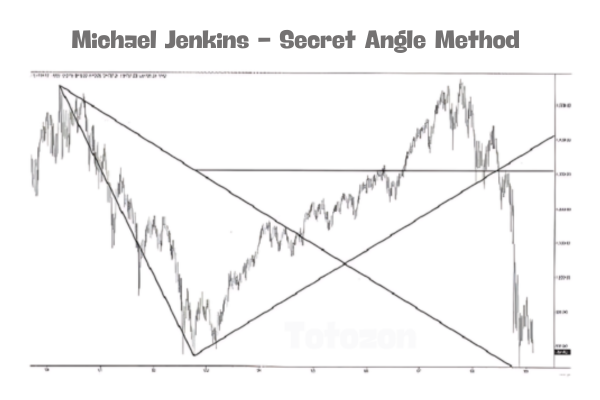

Secret Angle Method with Michael Jenkins

1 × $4.00

Secret Angle Method with Michael Jenkins

1 × $4.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Know Where You Live. Risk Management Toolkit - Seth Gregory & Bob Lambert

1 × $6.00

Know Where You Live. Risk Management Toolkit - Seth Gregory & Bob Lambert

1 × $6.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

Trade the OEX with Arthur Darack

1 × $6.00

Trade the OEX with Arthur Darack

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00 -

×

Pattern Trader Pro with ForexStore

1 × $6.00

Pattern Trader Pro with ForexStore

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

ETF Trading Strategies Revealed with David Vomund

1 × $6.00

ETF Trading Strategies Revealed with David Vomund

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00

Price Headley – Using Williams %R The BigTrends Way

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-31204ia7ev0aS

Category: Forex Trading

You may check content proof of “Price Headley – Using Williams %R The BigTrends Way” below:

Price Headley – Using Williams %R The BigTrends Way

Price Headley’s approach to the Williams %R indicator encapsulates a profound understanding of market dynamics, tailored specifically for those who follow his BigTrends methodology. This article explores how Price Headley utilizes the Williams %R, enhancing its utility to adapt to the rapid swings of the financial markets. Let’s dive into the details of this distinctive technique.

Introduction: Understanding Williams %R

Williams %R, developed by Larry Williams, is a momentum indicator that compares a stock’s closing price to the high-low range over a specific period, typically 14 days.

Part 1: The Basics of Williams %R

How It Works

- The indicator moves between 0 and -100, indicating overbought and oversold levels.

Reading the Indicator

- Values between -20 and 0 suggest overbought conditions; values between -100 and -80 suggest oversold conditions.

Part 2: Price Headley’s BigTrends Modifications

Adjusting the Time Frame

- Price Headley adjusts the standard 14-day period to suit different trading styles, enhancing responsiveness or stability.

Integration with Other Tools

- How Headley integrates Williams %R with other technical tools for a comprehensive analysis.

Part 3: Strategic Implementation

Identifying Entry Points

- Using the modified Williams %R to pinpoint optimal entry points in various market conditions.

Exit Strategies

- Determining exit points using a combination of Williams %R readings and other BigTrends indicators.

Part 4: Case Studies and Examples

Successful Trades Using Williams %R

- Detailed analysis of successful trades that leveraged this approach.

Learning from the Misses

- Reviewing less successful attempts to refine strategy and improve accuracy.

Part 5: Combining Theory with Practice

Practical Tips for Day Traders

- Specific advice for day traders on employing the modified Williams %R in fast-paced markets.

Insights for Long-Term Investors

- Adapting the technique for longer time frames and different market segments.

Part 6: Advanced Techniques and Considerations

Adjustments for Market Volatility

- Customizing the indicator to cope with varying levels of market volatility.

Sector-Specific Applications

- How to apply the modified Williams %R in different sectors such as technology or finance.

Conclusion: Enhancing Your Trading Strategy with Williams %R

Price Headley’s innovative use of the Williams %R indicator demonstrates that even well-established tools can be reimagined and adapted. By integrating these strategies into your trading plan, you can enhance your ability to make informed decisions based on nuanced, real-time data.

FAQs

- What is Williams %R?

- It’s a momentum indicator that measures overbought and oversold levels by comparing the current closing price to the high and low of the past N days.

- How does Price Headley modify the Williams %R?

- Headley may adjust the period settings or integrate it with other tools to improve its effectiveness specific to his BigTrends trading methodology.

- Can Williams %R be used for all types of trading?

- Yes, it can be adapted for short-term day trading, swing trading, and even long-term investment strategies.

- What makes the BigTrends approach unique?

- It emphasizes practical, real-world applications and adjustments tailored to the trader’s specific needs and market conditions.

- How can a trader start using Williams %R in their strategy?

- Begin by understanding the basic mechanics of the indicator, then consider modifications to suit individual trading style and market focus.

Be the first to review “Price Headley – Using Williams %R The BigTrends Way” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.