-

×

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00 -

×

Futures Commodity Trading with G. Scott Martin

1 × $6.00

Futures Commodity Trading with G. Scott Martin

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00 -

×

Risk Management with Aswath Damodaran

1 × $6.00

Risk Management with Aswath Damodaran

1 × $6.00 -

×

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Evolve MasterClass with Irek Piekarski

1 × $13.00

Evolve MasterClass with Irek Piekarski

1 × $13.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00 -

×

Simple Sector Trading Strategies with John Murphy

1 × $6.00

Simple Sector Trading Strategies with John Murphy

1 × $6.00 -

×

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00 -

×

Price Headley - Using Williams %R The BigTrends Way

1 × $6.00

Price Headley - Using Williams %R The BigTrends Way

1 × $6.00 -

×

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00 -

×

NASDAQ Level II Trading Strategies

1 × $6.00

NASDAQ Level II Trading Strategies

1 × $6.00 -

×

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00 -

×

How I Trade for a Living with Gary Smith

1 × $6.00

How I Trade for a Living with Gary Smith

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00 -

×

Code 6 + 7 Course with Oil Trading Academy

1 × $41.00

Code 6 + 7 Course with Oil Trading Academy

1 × $41.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

I3T3 Complete Course with All Modules

1 × $10.00

I3T3 Complete Course with All Modules

1 × $10.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

SO FX Educational Course with SO FX

1 × $5.00

SO FX Educational Course with SO FX

1 × $5.00 -

×

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00 -

×

DaVinci FX Course

1 × $6.00

DaVinci FX Course

1 × $6.00 -

×

Options, Futures & Other Derivatives (5th Ed.)

1 × $6.00

Options, Futures & Other Derivatives (5th Ed.)

1 × $6.00 -

×

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00 -

×

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00 -

×

The Market Maker’s Edge with Josh Lukeman

1 × $6.00

The Market Maker’s Edge with Josh Lukeman

1 × $6.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00 -

×

The Inner Circle Seminar

1 × $15.00

The Inner Circle Seminar

1 × $15.00 -

×

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00 -

×

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00 -

×

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00 -

×

Complete Trading Course with Sean Dekmar

1 × $5.00

Complete Trading Course with Sean Dekmar

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00 -

×

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

Applied Quantitative Methods for Trading and Investment with Christian Dunis, Jason Laws & Patrick Na¿m

1 × $6.00

Applied Quantitative Methods for Trading and Investment with Christian Dunis, Jason Laws & Patrick Na¿m

1 × $6.00 -

×

ETF Strategies & Tactics: Hedge Your Portfolio in a Changing Marke with Laurence Rosenberg

1 × $6.00

ETF Strategies & Tactics: Hedge Your Portfolio in a Changing Marke with Laurence Rosenberg

1 × $6.00 -

×

The Aime Workshop with Clay Marafiote

1 × $6.00

The Aime Workshop with Clay Marafiote

1 × $6.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

Future DayTrading (German)

1 × $6.00

Future DayTrading (German)

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

System Building Masterclass

1 × $31.00

System Building Masterclass

1 × $31.00 -

×

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00 -

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

Advanced Day Trading Course with Doyle Exchange

1 × $8.00

Advanced Day Trading Course with Doyle Exchange

1 × $8.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Futures & Options for Dummies with Joe Duarte

1 × $6.00

Futures & Options for Dummies with Joe Duarte

1 × $6.00 -

×

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00 -

×

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

TOP Gamma Bundle with TopTrade Tools

1 × $69.00

TOP Gamma Bundle with TopTrade Tools

1 × $69.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00 -

×

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00 -

×

The Practical Fractal with Bill Williams

1 × $6.00

The Practical Fractal with Bill Williams

1 × $6.00 -

×

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00 -

×

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00

Sacredscience - Sepharial Arcana – Rubber

1 × $6.00 -

×

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00 -

×

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00 -

×

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Psychology of Investing with John Nofsinger

1 × $6.00

The Psychology of Investing with John Nofsinger

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

Investment Fables with Aswath Damodaran

1 × $6.00

Investment Fables with Aswath Damodaran

1 × $6.00 -

×

Trading Blox Builder 4.3.2.1

1 × $31.00

Trading Blox Builder 4.3.2.1

1 × $31.00 -

×

KASH-FX JOURNAL

1 × $10.00

KASH-FX JOURNAL

1 × $10.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Sell & Sell Short with Alexander Elder

1 × $6.00

Sell & Sell Short with Alexander Elder

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 962 MB

Delivery Time: 1–12 hours

Media Type: Online Course

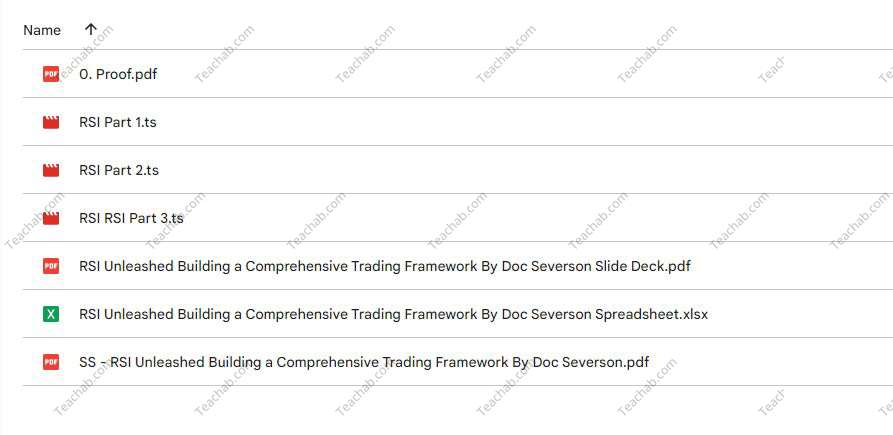

Content Proof: Watch Here!

You may check content proof of “Weekly Diagonal Spreads for Consistent Income By Doc Severson” below:

Weekly Diagonal Spreads for Consistent Income by Doc Severson

Introduction

In the dynamic world of options trading, finding strategies that yield consistent income while managing risk is a priority for many investors. Doc Severson’s approach to using weekly diagonal spreads offers a structured path to achieving this goal.

Understanding Options Trading

Basics of Options

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

What are Diagonal Spreads?

Diagonal spreads are an options strategy involving two options of the same type but different strike prices and expiration dates.

Why Use Weekly Diagonal Spreads?

Benefits of Weekly Spreads

This section highlights the benefits of using weekly spreads such as flexibility, potential for regular income, and lower exposure to time decay.

Choosing Weekly Diagonal Spreads

Discussion on why weekly spreads can be particularly advantageous for generating consistent income.

Setting Up a Weekly Diagonal Spread

Selecting the Right Stocks

Criteria for choosing stocks that are suitable for implementing weekly diagonal spreads, focusing on volatility and liquidity.

Determining Strike Prices and Expirations

How to select appropriate strike prices and expiration dates to optimize the trade setup.

Risk Management

Managing Trade Risks

Strategies to mitigate risks associated with diagonal spreads, including adjustments based on market movements.

Importance of Exit Strategies

Developing clear exit strategies to maximize gains or cut losses.

Calculating Potential Returns

Expected Returns from Diagonal Spreads

An overview of how returns are calculated in diagonal spread setups.

Comparing Returns to Other Strategies

Comparison of potential returns from weekly diagonal spreads versus other options strategies.

Tools and Resources for Trading

Software for Options Trading

Recommendations for the best software tools that can aid in trading diagonal spreads.

Educational Resources

Pointing to educational materials and resources that can help deepen understanding of options trading.

Advanced Techniques in Diagonal Spreads

Adjusting Spreads for Market Conditions

How to adjust your spreads in response to changing market conditions to maintain profitability.

Using Greeks in Diagonal Spreads

How options ‘Greeks’ can be used to fine-tune the strategy for better results.

Live Trading Examples

Case Studies from Doc Severson

Sharing real-life examples from Doc Severson’s own trading to illustrate the effectiveness of the strategy.

Weekly Trading Routine

Outline of a typical weekly routine for setting up, managing, and reviewing diagonal spreads.

Common Mistakes and How to Avoid Them

Pitfalls in Diagonal Spread Trading

Discussing common errors traders make when using diagonal spreads and tips on how to avoid them.

Learning from Losses

How to learn effectively from unsuccessful trades to improve future strategy.

Conclusion

Doc Severson’s method of using weekly diagonal spreads for consistent income is a nuanced strategy that balances risk with the potential for regular returns. By understanding and applying the principles of diagonal spread trading, investors can enhance their trading repertoire significantly.

FAQs

1. Who should consider using weekly diagonal spreads?

Traders with an intermediate understanding of options who seek regular income and have the ability to monitor and adjust their positions frequently.

2. What is the minimum investment required for trading diagonal spreads?

While the investment can vary, traders should be prepared to invest enough to cover the potential margin requirements and manage risk effectively.

3. How time-consuming is this strategy?

Weekly diagonal spreads require regular monitoring and adjustment, making it somewhat time-consuming compared to more passive strategies.

4. Can weekly diagonal spreads be automated?

Certain aspects of trade management can be automated with sophisticated trading software, though manual oversight is still recommended.

5. What are the key factors for success with diagonal spreads?

Success with diagonal spreads often depends on choosing the right underlying stocks, managing risks effectively, and staying adaptable to market changes.

Be the first to review “Weekly Diagonal Spreads for Consistent Income By Doc Severson” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.