-

×

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00 -

×

Getting New Insights from Old Indicators with Martin Pring

1 × $6.00

Getting New Insights from Old Indicators with Martin Pring

1 × $6.00 -

×

My General Counsel™

1 × $23.00

My General Counsel™

1 × $23.00 -

×

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00 -

×

SO FX Educational Course with SO FX

1 × $5.00

SO FX Educational Course with SO FX

1 × $5.00 -

×

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00 -

×

Key to Speculation on the New York Stock Exchange

1 × $6.00

Key to Speculation on the New York Stock Exchange

1 × $6.00 -

×

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Advanced Swing Trading with John Crane

1 × $6.00

Advanced Swing Trading with John Crane

1 × $6.00 -

×

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00 -

×

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00 -

×

TenfoldFX Academy Course with Kenneth John

1 × $17.00

TenfoldFX Academy Course with Kenneth John

1 × $17.00 -

×

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00 -

×

Trading With DiNapoli Levels

1 × $6.00

Trading With DiNapoli Levels

1 × $6.00 -

×

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00 -

×

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00 -

×

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00 -

×

Forex Essentials in 15 Trades with John Bland, Jay Meisler & Michael Archer

1 × $6.00

Forex Essentials in 15 Trades with John Bland, Jay Meisler & Michael Archer

1 × $6.00 -

×

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00 -

×

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00 -

×

Selling Options for Income, Profits & Opportunistic Hedge Trading Management with Powercycletrading

1 × $69.00

Selling Options for Income, Profits & Opportunistic Hedge Trading Management with Powercycletrading

1 × $69.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Forex Time Machine with Bill Poulos

1 × $6.00

Forex Time Machine with Bill Poulos

1 × $6.00 -

×

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00 -

×

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00 -

×

How To Write High Converting Copy with Tej Dosa

1 × $6.00

How To Write High Converting Copy with Tej Dosa

1 × $6.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

Activedaytrader - Workshop: Practical Money Management

1 × $23.00

Activedaytrader - Workshop: Practical Money Management

1 × $23.00 -

×

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00 -

×

Day Trader Course

1 × $6.00

Day Trader Course

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00 -

×

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Filtered Waves. Basic Theory with Arthur A.Merrill

1 × $7.00

Filtered Waves. Basic Theory with Arthur A.Merrill

1 × $7.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

A-Z Course with InvestiTrade Academy

1 × $5.00

A-Z Course with InvestiTrade Academy

1 × $5.00 -

×

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Brand new for 2017 - “Renko 2.0” with Nikos Mermigas & Jeff Wilde

1 × $23.00

Brand new for 2017 - “Renko 2.0” with Nikos Mermigas & Jeff Wilde

1 × $23.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

How To Flip All Those “Hard To Flip” Deals

1 × $6.00

How To Flip All Those “Hard To Flip” Deals

1 × $6.00 -

×

Trading Non-Farm Payroll Report

1 × $6.00

Trading Non-Farm Payroll Report

1 × $6.00 -

×

Pentagonal Time Cycle Theory

1 × $6.00

Pentagonal Time Cycle Theory

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 962 MB

Delivery Time: 1–12 hours

Media Type: Online Course

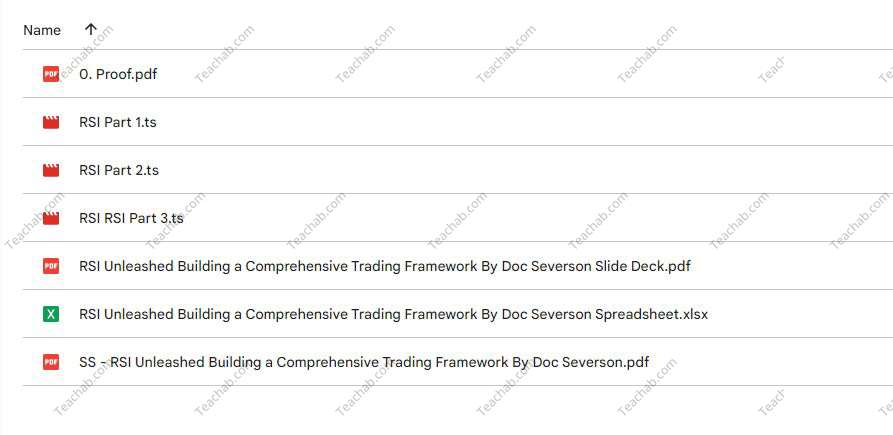

Content Proof: Watch Here!

You may check content proof of “Weekly Diagonal Spreads for Consistent Income By Doc Severson” below:

Weekly Diagonal Spreads for Consistent Income by Doc Severson

Introduction

In the dynamic world of options trading, finding strategies that yield consistent income while managing risk is a priority for many investors. Doc Severson’s approach to using weekly diagonal spreads offers a structured path to achieving this goal.

Understanding Options Trading

Basics of Options

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

What are Diagonal Spreads?

Diagonal spreads are an options strategy involving two options of the same type but different strike prices and expiration dates.

Why Use Weekly Diagonal Spreads?

Benefits of Weekly Spreads

This section highlights the benefits of using weekly spreads such as flexibility, potential for regular income, and lower exposure to time decay.

Choosing Weekly Diagonal Spreads

Discussion on why weekly spreads can be particularly advantageous for generating consistent income.

Setting Up a Weekly Diagonal Spread

Selecting the Right Stocks

Criteria for choosing stocks that are suitable for implementing weekly diagonal spreads, focusing on volatility and liquidity.

Determining Strike Prices and Expirations

How to select appropriate strike prices and expiration dates to optimize the trade setup.

Risk Management

Managing Trade Risks

Strategies to mitigate risks associated with diagonal spreads, including adjustments based on market movements.

Importance of Exit Strategies

Developing clear exit strategies to maximize gains or cut losses.

Calculating Potential Returns

Expected Returns from Diagonal Spreads

An overview of how returns are calculated in diagonal spread setups.

Comparing Returns to Other Strategies

Comparison of potential returns from weekly diagonal spreads versus other options strategies.

Tools and Resources for Trading

Software for Options Trading

Recommendations for the best software tools that can aid in trading diagonal spreads.

Educational Resources

Pointing to educational materials and resources that can help deepen understanding of options trading.

Advanced Techniques in Diagonal Spreads

Adjusting Spreads for Market Conditions

How to adjust your spreads in response to changing market conditions to maintain profitability.

Using Greeks in Diagonal Spreads

How options ‘Greeks’ can be used to fine-tune the strategy for better results.

Live Trading Examples

Case Studies from Doc Severson

Sharing real-life examples from Doc Severson’s own trading to illustrate the effectiveness of the strategy.

Weekly Trading Routine

Outline of a typical weekly routine for setting up, managing, and reviewing diagonal spreads.

Common Mistakes and How to Avoid Them

Pitfalls in Diagonal Spread Trading

Discussing common errors traders make when using diagonal spreads and tips on how to avoid them.

Learning from Losses

How to learn effectively from unsuccessful trades to improve future strategy.

Conclusion

Doc Severson’s method of using weekly diagonal spreads for consistent income is a nuanced strategy that balances risk with the potential for regular returns. By understanding and applying the principles of diagonal spread trading, investors can enhance their trading repertoire significantly.

FAQs

1. Who should consider using weekly diagonal spreads?

Traders with an intermediate understanding of options who seek regular income and have the ability to monitor and adjust their positions frequently.

2. What is the minimum investment required for trading diagonal spreads?

While the investment can vary, traders should be prepared to invest enough to cover the potential margin requirements and manage risk effectively.

3. How time-consuming is this strategy?

Weekly diagonal spreads require regular monitoring and adjustment, making it somewhat time-consuming compared to more passive strategies.

4. Can weekly diagonal spreads be automated?

Certain aspects of trade management can be automated with sophisticated trading software, though manual oversight is still recommended.

5. What are the key factors for success with diagonal spreads?

Success with diagonal spreads often depends on choosing the right underlying stocks, managing risks effectively, and staying adaptable to market changes.

Be the first to review “Weekly Diagonal Spreads for Consistent Income By Doc Severson” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.