-

×

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00 -

×

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00 -

×

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00 -

×

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00 -

×

Complete Times Course with Afshin Taghechian

1 × $6.00

Complete Times Course with Afshin Taghechian

1 × $6.00 -

×

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00 -

×

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The Michanics of Futures Trading - Roy Habben

1 × $6.00

The Michanics of Futures Trading - Roy Habben

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Private Mentorship with ANICO Capital

1 × $10.00

Private Mentorship with ANICO Capital

1 × $10.00 -

×

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00 -

×

Systems Mastery Course with Chris Dover - Pollinate Trading

1 × $5.00

Systems Mastery Course with Chris Dover - Pollinate Trading

1 × $5.00 -

×

PayTrading with Eric Shawn

1 × $6.00

PayTrading with Eric Shawn

1 × $6.00 -

×

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00 -

×

Reverse Engineering Deals on Wall Street with Microsoft Excel with Keith Allman

1 × $6.00

Reverse Engineering Deals on Wall Street with Microsoft Excel with Keith Allman

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

AnkhFX Academy Course

1 × $17.00

AnkhFX Academy Course

1 × $17.00 -

×

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00 -

×

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00 -

×

The Sweep Show with Scott Pulcini Trader

1 × $23.00

The Sweep Show with Scott Pulcini Trader

1 × $23.00 -

×

Risk Management with Aswath Damodaran

1 × $6.00

Risk Management with Aswath Damodaran

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Infectious Greed with John Nofsinger & Kenneth Kim

1 × $6.00

Infectious Greed with John Nofsinger & Kenneth Kim

1 × $6.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00 -

×

Selective Forex Trading with Don Snellgrove

1 × $6.00

Selective Forex Trading with Don Snellgrove

1 × $6.00 -

×

Access All Areas with Marwood Research

1 × $54.00

Access All Areas with Marwood Research

1 × $54.00 -

×

Street-Smart Chart Reading – Volume 1 – The Rudiments with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 1 – The Rudiments with Donald G.Worden

1 × $6.00 -

×

How I Trade Options with Jon Najarian

1 × $4.00

How I Trade Options with Jon Najarian

1 × $4.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The 4 Horsemen CD with David Elliott

1 × $6.00

The 4 Horsemen CD with David Elliott

1 × $6.00 -

×

3 Day WorkShop with HYDRA

1 × $13.00

3 Day WorkShop with HYDRA

1 × $13.00 -

×

New Market Mavericks with Geoff Cutmore

1 × $6.00

New Market Mavericks with Geoff Cutmore

1 × $6.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

Vaga Academy with VAGAFX

1 × $5.00

Vaga Academy with VAGAFX

1 × $5.00 -

×

Applied Quantitative Methods for Trading and Investment with Christian Dunis, Jason Laws & Patrick Na¿m

1 × $6.00

Applied Quantitative Methods for Trading and Investment with Christian Dunis, Jason Laws & Patrick Na¿m

1 × $6.00 -

×

Option Strategies with Courtney Smith

1 × $6.00

Option Strategies with Courtney Smith

1 × $6.00 -

×

TraderSumo Academy Course

1 × $13.00

TraderSumo Academy Course

1 × $13.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

Trading Forex With Market Profile

1 × $15.00

Trading Forex With Market Profile

1 × $15.00 -

×

PowerWave Trading with Dar Wong

1 × $4.00

PowerWave Trading with Dar Wong

1 × $4.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00 -

×

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

Project Gorilla

1 × $5.00

Project Gorilla

1 × $5.00 -

×

All About Technical Analysis with Constance Brown

1 × $6.00

All About Technical Analysis with Constance Brown

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Beating the Financial Futures Market

1 × $6.00

Beating the Financial Futures Market

1 × $6.00 -

×

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00

Guidelines for Analysis and Establishing a Trading Plan with Charles Drummond

1 × $6.00 -

×

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00 -

×

Sell Premium & Minimize Risk Class with Don Kaufman

1 × $6.00

Sell Premium & Minimize Risk Class with Don Kaufman

1 × $6.00 -

×

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00 -

×

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 962 MB

Delivery Time: 1–12 hours

Media Type: Online Course

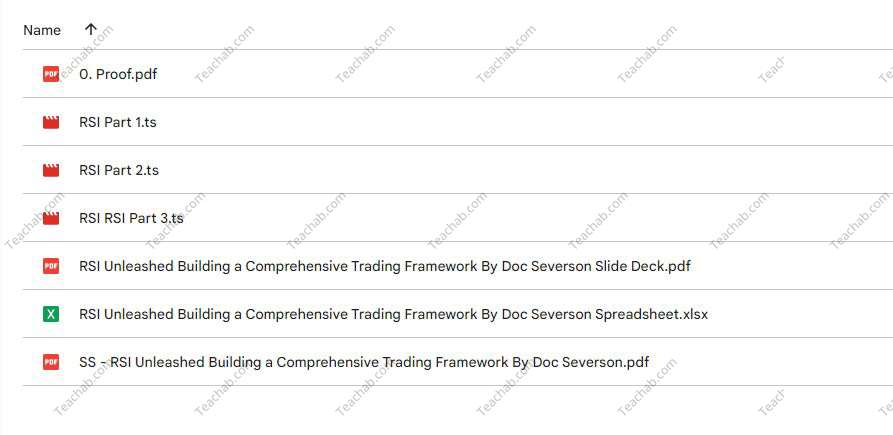

Content Proof: Watch Here!

You may check content proof of “Weekly Diagonal Spreads for Consistent Income By Doc Severson” below:

Weekly Diagonal Spreads for Consistent Income by Doc Severson

Introduction

In the dynamic world of options trading, finding strategies that yield consistent income while managing risk is a priority for many investors. Doc Severson’s approach to using weekly diagonal spreads offers a structured path to achieving this goal.

Understanding Options Trading

Basics of Options

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

What are Diagonal Spreads?

Diagonal spreads are an options strategy involving two options of the same type but different strike prices and expiration dates.

Why Use Weekly Diagonal Spreads?

Benefits of Weekly Spreads

This section highlights the benefits of using weekly spreads such as flexibility, potential for regular income, and lower exposure to time decay.

Choosing Weekly Diagonal Spreads

Discussion on why weekly spreads can be particularly advantageous for generating consistent income.

Setting Up a Weekly Diagonal Spread

Selecting the Right Stocks

Criteria for choosing stocks that are suitable for implementing weekly diagonal spreads, focusing on volatility and liquidity.

Determining Strike Prices and Expirations

How to select appropriate strike prices and expiration dates to optimize the trade setup.

Risk Management

Managing Trade Risks

Strategies to mitigate risks associated with diagonal spreads, including adjustments based on market movements.

Importance of Exit Strategies

Developing clear exit strategies to maximize gains or cut losses.

Calculating Potential Returns

Expected Returns from Diagonal Spreads

An overview of how returns are calculated in diagonal spread setups.

Comparing Returns to Other Strategies

Comparison of potential returns from weekly diagonal spreads versus other options strategies.

Tools and Resources for Trading

Software for Options Trading

Recommendations for the best software tools that can aid in trading diagonal spreads.

Educational Resources

Pointing to educational materials and resources that can help deepen understanding of options trading.

Advanced Techniques in Diagonal Spreads

Adjusting Spreads for Market Conditions

How to adjust your spreads in response to changing market conditions to maintain profitability.

Using Greeks in Diagonal Spreads

How options ‘Greeks’ can be used to fine-tune the strategy for better results.

Live Trading Examples

Case Studies from Doc Severson

Sharing real-life examples from Doc Severson’s own trading to illustrate the effectiveness of the strategy.

Weekly Trading Routine

Outline of a typical weekly routine for setting up, managing, and reviewing diagonal spreads.

Common Mistakes and How to Avoid Them

Pitfalls in Diagonal Spread Trading

Discussing common errors traders make when using diagonal spreads and tips on how to avoid them.

Learning from Losses

How to learn effectively from unsuccessful trades to improve future strategy.

Conclusion

Doc Severson’s method of using weekly diagonal spreads for consistent income is a nuanced strategy that balances risk with the potential for regular returns. By understanding and applying the principles of diagonal spread trading, investors can enhance their trading repertoire significantly.

FAQs

1. Who should consider using weekly diagonal spreads?

Traders with an intermediate understanding of options who seek regular income and have the ability to monitor and adjust their positions frequently.

2. What is the minimum investment required for trading diagonal spreads?

While the investment can vary, traders should be prepared to invest enough to cover the potential margin requirements and manage risk effectively.

3. How time-consuming is this strategy?

Weekly diagonal spreads require regular monitoring and adjustment, making it somewhat time-consuming compared to more passive strategies.

4. Can weekly diagonal spreads be automated?

Certain aspects of trade management can be automated with sophisticated trading software, though manual oversight is still recommended.

5. What are the key factors for success with diagonal spreads?

Success with diagonal spreads often depends on choosing the right underlying stocks, managing risks effectively, and staying adaptable to market changes.

Be the first to review “Weekly Diagonal Spreads for Consistent Income By Doc Severson” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.