-

×

30 Trading Classics with 3T Live

1 × $5.00

30 Trading Classics with 3T Live

1 × $5.00 -

×

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00 -

×

Squeeze the Markets with Markay Latimer

1 × $6.00

Squeeze the Markets with Markay Latimer

1 × $6.00 -

×

Best of Livestock with Timothy Sykes

1 × $5.00

Best of Livestock with Timothy Sykes

1 × $5.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

OrderFlows Trader Package, (Sep 2015)

1 × $54.00

OrderFlows Trader Package, (Sep 2015)

1 × $54.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00 -

×

Technical Analysis for Short-Term Traders

1 × $6.00

Technical Analysis for Short-Term Traders

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study with Bill McCready

1 × $6.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

Quant Edge with T3 Live

1 × $6.00

Quant Edge with T3 Live

1 × $6.00 -

×

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00 -

×

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Starting Out in Futures Trading with Mark Powers

1 × $6.00

Starting Out in Futures Trading with Mark Powers

1 × $6.00 -

×

Investment Science with David G.Luenberger

1 × $6.00

Investment Science with David G.Luenberger

1 × $6.00 -

×

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00 -

×

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00 -

×

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00 -

×

3 Hour Calendar Class With Bonus 3 Months Daily Analysis!

1 × $23.00

3 Hour Calendar Class With Bonus 3 Months Daily Analysis!

1 × $23.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

The M21 Strategy

1 × $15.00

The M21 Strategy

1 × $15.00 -

×

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Swing Trading Futures & Commodities with the COT

1 × $93.00

Swing Trading Futures & Commodities with the COT

1 × $93.00 -

×

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

Yarimi University Course

1 × $56.00

Yarimi University Course

1 × $56.00 -

×

Foundational Chart Analysis Series: Support / Resistance Techniques of Professional Traders 6 DVD Home Study Course

1 × $54.00

Foundational Chart Analysis Series: Support / Resistance Techniques of Professional Traders 6 DVD Home Study Course

1 × $54.00 -

×

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00 -

×

NASDAQ Level II Trading Strategies

1 × $6.00

NASDAQ Level II Trading Strategies

1 × $6.00 -

×

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Advanced Breakthroughs in Day Trading DVD course with George Angell

1 × $6.00

Advanced Breakthroughs in Day Trading DVD course with George Angell

1 × $6.00 -

×

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Complete Guide to Market Breadth Indicators: How to Analyze and Evaluate market Direction and Strength - Greg Morris

1 × $6.00

The Complete Guide to Market Breadth Indicators: How to Analyze and Evaluate market Direction and Strength - Greg Morris

1 × $6.00 -

×

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00 -

×

4D Bootcamp with Black Rabbit

1 × $10.00

4D Bootcamp with Black Rabbit

1 × $10.00 -

×

The Any Hour Trading System with Markets Mastered

1 × $6.00

The Any Hour Trading System with Markets Mastered

1 × $6.00 -

×

Tech Stock Valuation with Mark Hirschey

1 × $6.00

Tech Stock Valuation with Mark Hirschey

1 × $6.00 -

×

Master Stock Course

1 × $6.00

Master Stock Course

1 × $6.00 -

×

Complete Times Course with Afshin Taghechian

1 × $6.00

Complete Times Course with Afshin Taghechian

1 × $6.00 -

×

Trading Options Effectively with Paul Forchione

1 × $4.00

Trading Options Effectively with Paul Forchione

1 × $4.00 -

×

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00 -

×

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00 -

×

Trading Economic Data System with CopperChips

1 × $6.00

Trading Economic Data System with CopperChips

1 × $6.00 -

×

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00 -

×

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

7 Things You MUST Know about Forex Candlesticks

1 × $4.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

Core Concepts Mastery with DreamsFX

1 × $5.00

Core Concepts Mastery with DreamsFX

1 × $5.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

6 (The Proper BackGround)

1 × $6.00

6 (The Proper BackGround)

1 × $6.00 -

×

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

Fundamentals Trading

1 × $6.00

Fundamentals Trading

1 × $6.00 -

×

Complete Forex Training Series with 4 x Made Easy

1 × $6.00

Complete Forex Training Series with 4 x Made Easy

1 × $6.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 962 MB

Delivery Time: 1–12 hours

Media Type: Online Course

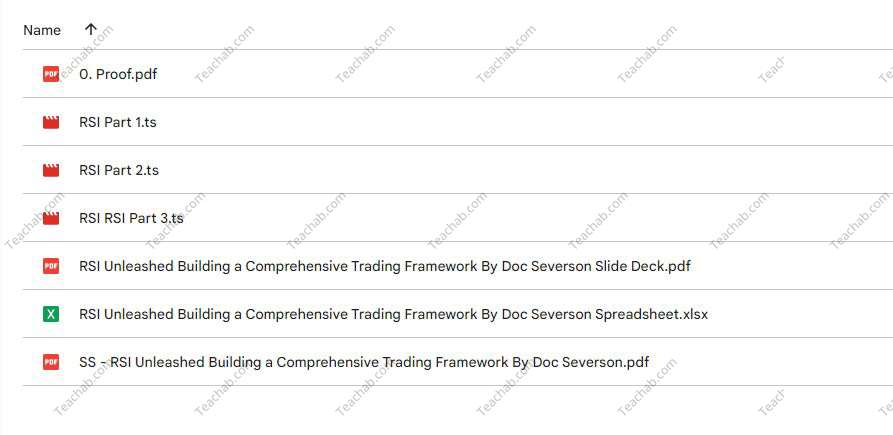

Content Proof: Watch Here!

You may check content proof of “Weekly Diagonal Spreads for Consistent Income By Doc Severson” below:

Weekly Diagonal Spreads for Consistent Income by Doc Severson

Introduction

In the dynamic world of options trading, finding strategies that yield consistent income while managing risk is a priority for many investors. Doc Severson’s approach to using weekly diagonal spreads offers a structured path to achieving this goal.

Understanding Options Trading

Basics of Options

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

What are Diagonal Spreads?

Diagonal spreads are an options strategy involving two options of the same type but different strike prices and expiration dates.

Why Use Weekly Diagonal Spreads?

Benefits of Weekly Spreads

This section highlights the benefits of using weekly spreads such as flexibility, potential for regular income, and lower exposure to time decay.

Choosing Weekly Diagonal Spreads

Discussion on why weekly spreads can be particularly advantageous for generating consistent income.

Setting Up a Weekly Diagonal Spread

Selecting the Right Stocks

Criteria for choosing stocks that are suitable for implementing weekly diagonal spreads, focusing on volatility and liquidity.

Determining Strike Prices and Expirations

How to select appropriate strike prices and expiration dates to optimize the trade setup.

Risk Management

Managing Trade Risks

Strategies to mitigate risks associated with diagonal spreads, including adjustments based on market movements.

Importance of Exit Strategies

Developing clear exit strategies to maximize gains or cut losses.

Calculating Potential Returns

Expected Returns from Diagonal Spreads

An overview of how returns are calculated in diagonal spread setups.

Comparing Returns to Other Strategies

Comparison of potential returns from weekly diagonal spreads versus other options strategies.

Tools and Resources for Trading

Software for Options Trading

Recommendations for the best software tools that can aid in trading diagonal spreads.

Educational Resources

Pointing to educational materials and resources that can help deepen understanding of options trading.

Advanced Techniques in Diagonal Spreads

Adjusting Spreads for Market Conditions

How to adjust your spreads in response to changing market conditions to maintain profitability.

Using Greeks in Diagonal Spreads

How options ‘Greeks’ can be used to fine-tune the strategy for better results.

Live Trading Examples

Case Studies from Doc Severson

Sharing real-life examples from Doc Severson’s own trading to illustrate the effectiveness of the strategy.

Weekly Trading Routine

Outline of a typical weekly routine for setting up, managing, and reviewing diagonal spreads.

Common Mistakes and How to Avoid Them

Pitfalls in Diagonal Spread Trading

Discussing common errors traders make when using diagonal spreads and tips on how to avoid them.

Learning from Losses

How to learn effectively from unsuccessful trades to improve future strategy.

Conclusion

Doc Severson’s method of using weekly diagonal spreads for consistent income is a nuanced strategy that balances risk with the potential for regular returns. By understanding and applying the principles of diagonal spread trading, investors can enhance their trading repertoire significantly.

FAQs

1. Who should consider using weekly diagonal spreads?

Traders with an intermediate understanding of options who seek regular income and have the ability to monitor and adjust their positions frequently.

2. What is the minimum investment required for trading diagonal spreads?

While the investment can vary, traders should be prepared to invest enough to cover the potential margin requirements and manage risk effectively.

3. How time-consuming is this strategy?

Weekly diagonal spreads require regular monitoring and adjustment, making it somewhat time-consuming compared to more passive strategies.

4. Can weekly diagonal spreads be automated?

Certain aspects of trade management can be automated with sophisticated trading software, though manual oversight is still recommended.

5. What are the key factors for success with diagonal spreads?

Success with diagonal spreads often depends on choosing the right underlying stocks, managing risks effectively, and staying adaptable to market changes.

Be the first to review “Weekly Diagonal Spreads for Consistent Income By Doc Severson” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.