-

×

Quarterly Theory with Trader Daye

1 × $20.00

Quarterly Theory with Trader Daye

1 × $20.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Sensitivity Analysis in Practice

1 × $6.00

Sensitivity Analysis in Practice

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00 -

×

E75 Forex System with James de Wet

1 × $6.00

E75 Forex System with James de Wet

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Volatility Trading with Fractal Flow Pro

1 × $15.00

Volatility Trading with Fractal Flow Pro

1 × $15.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00 -

×

The Hindenburg Strategy with Todd Mitchell

1 × $23.00

The Hindenburg Strategy with Todd Mitchell

1 × $23.00 -

×

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00 -

×

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Trade the OEX with Arthur Darack

1 × $6.00

Trade the OEX with Arthur Darack

1 × $6.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00 -

×

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00 -

×

Cash Flow Investing Course

1 × $20.00

Cash Flow Investing Course

1 × $20.00 -

×

ALGO™ Online Retail - Version 2.9

1 × $155.00

ALGO™ Online Retail - Version 2.9

1 × $155.00 -

×

Pattern Picking with Charles Drummond

1 × $6.00

Pattern Picking with Charles Drummond

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Yarimi University Course

1 × $56.00

Yarimi University Course

1 × $56.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

Supply And Demand Zone Trading Course with Trading180

1 × $5.00

Supply And Demand Zone Trading Course with Trading180

1 × $5.00 -

×

The 4 Horsemen CD with David Elliott

1 × $6.00

The 4 Horsemen CD with David Elliott

1 × $6.00 -

×

4D Bootcamp with Black Rabbit

1 × $10.00

4D Bootcamp with Black Rabbit

1 × $10.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00

5 Essential Building Blocks to Successful Trading Workshop with Steve "Slim" Miller

1 × $6.00 -

×

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00 -

×

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Futures Commodity Trading with G. Scott Martin

1 × $6.00

Futures Commodity Trading with G. Scott Martin

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Pristine Seminar - Options Trading the Pristine Way

1 × $6.00

Pristine Seminar - Options Trading the Pristine Way

1 × $6.00 -

×

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00 -

×

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00 -

×

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00 -

×

Future DayTrading (German)

1 × $6.00

Future DayTrading (German)

1 × $6.00 -

×

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00 -

×

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Professional Chart Reading Bootcamp - 2 CDs

1 × $6.00

Professional Chart Reading Bootcamp - 2 CDs

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00 -

×

Mastering the Orderbook with Rowan Crawford

1 × $6.00

Mastering the Orderbook with Rowan Crawford

1 × $6.00 -

×

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00 -

×

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00 -

×

Futures Trading (German)

1 × $6.00

Futures Trading (German)

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00 -

×

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

Learn Investing & Trading with Danny Devan

1 × $23.00

Learn Investing & Trading with Danny Devan

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 962 MB

Delivery Time: 1–12 hours

Media Type: Online Course

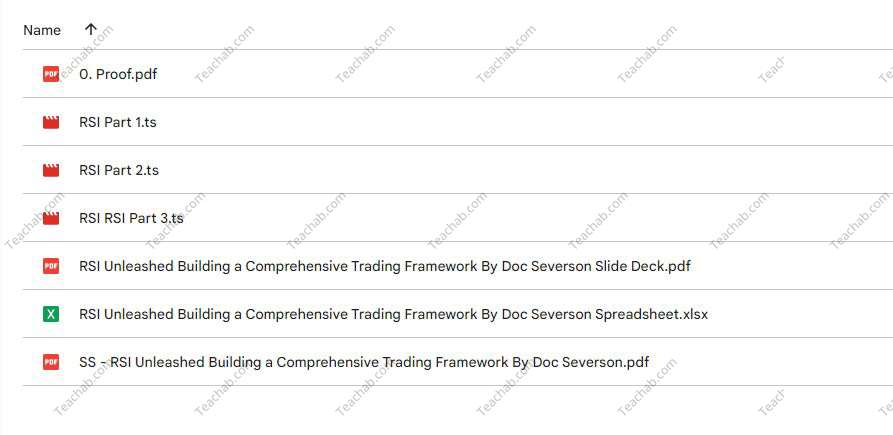

Content Proof: Watch Here!

You may check content proof of “Weekly Diagonal Spreads for Consistent Income By Doc Severson” below:

Weekly Diagonal Spreads for Consistent Income by Doc Severson

Introduction

In the dynamic world of options trading, finding strategies that yield consistent income while managing risk is a priority for many investors. Doc Severson’s approach to using weekly diagonal spreads offers a structured path to achieving this goal.

Understanding Options Trading

Basics of Options

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

What are Diagonal Spreads?

Diagonal spreads are an options strategy involving two options of the same type but different strike prices and expiration dates.

Why Use Weekly Diagonal Spreads?

Benefits of Weekly Spreads

This section highlights the benefits of using weekly spreads such as flexibility, potential for regular income, and lower exposure to time decay.

Choosing Weekly Diagonal Spreads

Discussion on why weekly spreads can be particularly advantageous for generating consistent income.

Setting Up a Weekly Diagonal Spread

Selecting the Right Stocks

Criteria for choosing stocks that are suitable for implementing weekly diagonal spreads, focusing on volatility and liquidity.

Determining Strike Prices and Expirations

How to select appropriate strike prices and expiration dates to optimize the trade setup.

Risk Management

Managing Trade Risks

Strategies to mitigate risks associated with diagonal spreads, including adjustments based on market movements.

Importance of Exit Strategies

Developing clear exit strategies to maximize gains or cut losses.

Calculating Potential Returns

Expected Returns from Diagonal Spreads

An overview of how returns are calculated in diagonal spread setups.

Comparing Returns to Other Strategies

Comparison of potential returns from weekly diagonal spreads versus other options strategies.

Tools and Resources for Trading

Software for Options Trading

Recommendations for the best software tools that can aid in trading diagonal spreads.

Educational Resources

Pointing to educational materials and resources that can help deepen understanding of options trading.

Advanced Techniques in Diagonal Spreads

Adjusting Spreads for Market Conditions

How to adjust your spreads in response to changing market conditions to maintain profitability.

Using Greeks in Diagonal Spreads

How options ‘Greeks’ can be used to fine-tune the strategy for better results.

Live Trading Examples

Case Studies from Doc Severson

Sharing real-life examples from Doc Severson’s own trading to illustrate the effectiveness of the strategy.

Weekly Trading Routine

Outline of a typical weekly routine for setting up, managing, and reviewing diagonal spreads.

Common Mistakes and How to Avoid Them

Pitfalls in Diagonal Spread Trading

Discussing common errors traders make when using diagonal spreads and tips on how to avoid them.

Learning from Losses

How to learn effectively from unsuccessful trades to improve future strategy.

Conclusion

Doc Severson’s method of using weekly diagonal spreads for consistent income is a nuanced strategy that balances risk with the potential for regular returns. By understanding and applying the principles of diagonal spread trading, investors can enhance their trading repertoire significantly.

FAQs

1. Who should consider using weekly diagonal spreads?

Traders with an intermediate understanding of options who seek regular income and have the ability to monitor and adjust their positions frequently.

2. What is the minimum investment required for trading diagonal spreads?

While the investment can vary, traders should be prepared to invest enough to cover the potential margin requirements and manage risk effectively.

3. How time-consuming is this strategy?

Weekly diagonal spreads require regular monitoring and adjustment, making it somewhat time-consuming compared to more passive strategies.

4. Can weekly diagonal spreads be automated?

Certain aspects of trade management can be automated with sophisticated trading software, though manual oversight is still recommended.

5. What are the key factors for success with diagonal spreads?

Success with diagonal spreads often depends on choosing the right underlying stocks, managing risks effectively, and staying adaptable to market changes.

Be the first to review “Weekly Diagonal Spreads for Consistent Income By Doc Severson” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.