-

×

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00 -

×

CFA Level 3- Examination Morning Session – Essay (2004)

1 × $6.00

CFA Level 3- Examination Morning Session – Essay (2004)

1 × $6.00 -

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

Gold Trading Academy Video Course

1 × $23.00

Gold Trading Academy Video Course

1 × $23.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Square The Range Trading System with Michael Jenkins

1 × $6.00

Square The Range Trading System with Michael Jenkins

1 × $6.00 -

×

Empirical Market Microstructure

1 × $6.00

Empirical Market Microstructure

1 × $6.00 -

×

FXStreet Unrecorded Webinars Sept & Oct, 2011 with Sam Seiden

1 × $6.00

FXStreet Unrecorded Webinars Sept & Oct, 2011 with Sam Seiden

1 × $6.00 -

×

Investment Fables with Aswath Damodaran

1 × $6.00

Investment Fables with Aswath Damodaran

1 × $6.00 -

×

Futures Commodity Trading with G. Scott Martin

1 × $6.00

Futures Commodity Trading with G. Scott Martin

1 × $6.00 -

×

RiskDoctor Slingshot Hedge – Options Trading Strategies – Slingshot Hedge with Charles Cottle

1 × $6.00

RiskDoctor Slingshot Hedge – Options Trading Strategies – Slingshot Hedge with Charles Cottle

1 × $6.00 -

×

Advanced Iron Condor Course in 2021

1 × $6.00

Advanced Iron Condor Course in 2021

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Michanics of Futures Trading - Roy Habben

1 × $6.00

The Michanics of Futures Trading - Roy Habben

1 × $6.00 -

×

Swing Trading College IX 2010 with Larry Connors

1 × $15.00

Swing Trading College IX 2010 with Larry Connors

1 × $15.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00 -

×

Peter Borish Online Trader Program

1 × $15.00

Peter Borish Online Trader Program

1 × $15.00 -

×

Order Flow Trading Advanced Masterclass with The Forex Scalpers

1 × $24.00

Order Flow Trading Advanced Masterclass with The Forex Scalpers

1 × $24.00 -

×

The 10%ers with Trader Mike

1 × $5.00

The 10%ers with Trader Mike

1 × $5.00 -

×

The GBP USD Trading System with A.Heuscher

1 × $6.00

The GBP USD Trading System with A.Heuscher

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

Get to know the VIX Index (aka The Fear Index)

1 × $15.00

Get to know the VIX Index (aka The Fear Index)

1 × $15.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

Arcane 2.0 Course

1 × $6.00

Arcane 2.0 Course

1 × $6.00 -

×

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00 -

×

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00 -

×

New Market Mavericks with Geoff Cutmore

1 × $6.00

New Market Mavericks with Geoff Cutmore

1 × $6.00 -

×

Naked Trading Mastery

1 × $39.00

Naked Trading Mastery

1 × $39.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00 -

×

Masterclass 3.0 with RockzFX Academy

1 × $6.00

Masterclass 3.0 with RockzFX Academy

1 × $6.00 -

×

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00

The 80% Solution S&P Systems with Bruce Babcock

1 × $6.00 -

×

T3 Live - The Simple Art of Trading

1 × $31.00

T3 Live - The Simple Art of Trading

1 × $31.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Elliott Wave Street Course with Juan Maldonado

1 × $17.00

Elliott Wave Street Course with Juan Maldonado

1 × $17.00 -

×

The Complete Guide to Option Selling with James Cordier

1 × $6.00

The Complete Guide to Option Selling with James Cordier

1 × $6.00 -

×

Evolved Trader with Mark Croock

1 × $69.00

Evolved Trader with Mark Croock

1 × $69.00 -

×

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00 -

×

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00 -

×

Play to Win with David La Piana & Michaela Hayes

1 × $6.00

Play to Win with David La Piana & Michaela Hayes

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Advanced Pattern Recognition with John Cameron

1 × $23.00

Advanced Pattern Recognition with John Cameron

1 × $23.00 -

×

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00 -

×

Master Trader - Advander Management Strategies

1 × $39.00

Master Trader - Advander Management Strategies

1 × $39.00 -

×

Rule Based Price Action with Trader Divergent

1 × $5.00

Rule Based Price Action with Trader Divergent

1 × $5.00 -

×

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

Swing Trader Pro with Top Trade Tools

1 × $54.00

Swing Trader Pro with Top Trade Tools

1 × $54.00 -

×

Best of Livestock with Timothy Sykes

1 × $5.00

Best of Livestock with Timothy Sykes

1 × $5.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

Professional Trader Course

1 × $5.00

Professional Trader Course

1 × $5.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00 -

×

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Iron Condors in a Volatile Market 2022 with Dan Sheridan - Sheridan Options Mentoring

1 × $46.00

Iron Condors in a Volatile Market 2022 with Dan Sheridan - Sheridan Options Mentoring

1 × $46.00 -

×

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00 -

×

How to Spot Trading Opportunities

1 × $6.00

How to Spot Trading Opportunities

1 × $6.00 -

×

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00 -

×

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

TradingMind Course with Jack Bernstein

1 × $6.00

TradingMind Course with Jack Bernstein

1 × $6.00 -

×

Level II Trading Warfare - The Undergroundtrader's Powerful Weapons for Winning - Jea Yu

1 × $6.00

Level II Trading Warfare - The Undergroundtrader's Powerful Weapons for Winning - Jea Yu

1 × $6.00 -

×

Learn To Fish Part II - Generating Consistent Income Through Day Trading with Daniel

1 × $6.00

Learn To Fish Part II - Generating Consistent Income Through Day Trading with Daniel

1 × $6.00 -

×

The Complete Guide to Spread Trading

1 × $6.00

The Complete Guide to Spread Trading

1 × $6.00 -

×

4 Day Trading Bootcamp

1 × $31.00

4 Day Trading Bootcamp

1 × $31.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Capital with Charles D.Ellis

1 × $6.00

Capital with Charles D.Ellis

1 × $6.00 -

×

High Probability Option Trading - Seasonal Straddles

1 × $6.00

High Probability Option Trading - Seasonal Straddles

1 × $6.00 -

×

The Newly Revised Hal Method of Cyclic Analysis with Walter Bressert

1 × $5.00

The Newly Revised Hal Method of Cyclic Analysis with Walter Bressert

1 × $5.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00 -

×

How To Flip All Those “Hard To Flip” Deals

1 × $6.00

How To Flip All Those “Hard To Flip” Deals

1 × $6.00 -

×

Investment Performance Measurement with Bruce Feibel

1 × $6.00

Investment Performance Measurement with Bruce Feibel

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

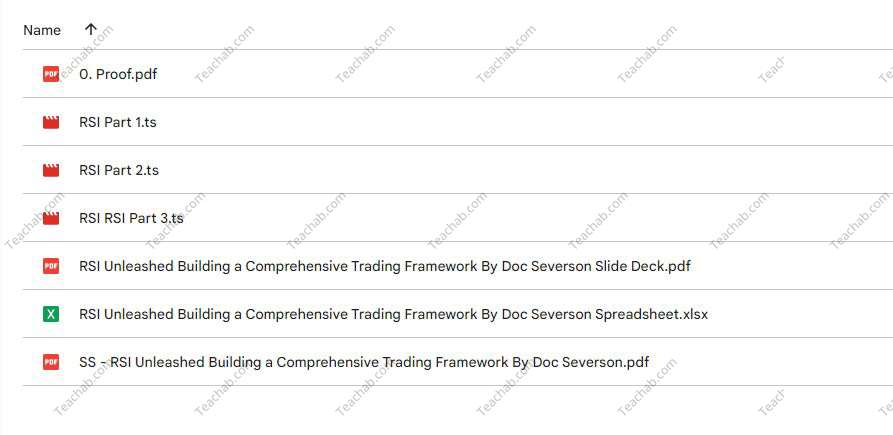

File Size: 962 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Weekly Diagonal Spreads for Consistent Income By Doc Severson” below:

Weekly Diagonal Spreads for Consistent Income by Doc Severson

Introduction

In the dynamic world of options trading, finding strategies that yield consistent income while managing risk is a priority for many investors. Doc Severson’s approach to using weekly diagonal spreads offers a structured path to achieving this goal.

Understanding Options Trading

Basics of Options

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

What are Diagonal Spreads?

Diagonal spreads are an options strategy involving two options of the same type but different strike prices and expiration dates.

Why Use Weekly Diagonal Spreads?

Benefits of Weekly Spreads

This section highlights the benefits of using weekly spreads such as flexibility, potential for regular income, and lower exposure to time decay.

Choosing Weekly Diagonal Spreads

Discussion on why weekly spreads can be particularly advantageous for generating consistent income.

Setting Up a Weekly Diagonal Spread

Selecting the Right Stocks

Criteria for choosing stocks that are suitable for implementing weekly diagonal spreads, focusing on volatility and liquidity.

Determining Strike Prices and Expirations

How to select appropriate strike prices and expiration dates to optimize the trade setup.

Risk Management

Managing Trade Risks

Strategies to mitigate risks associated with diagonal spreads, including adjustments based on market movements.

Importance of Exit Strategies

Developing clear exit strategies to maximize gains or cut losses.

Calculating Potential Returns

Expected Returns from Diagonal Spreads

An overview of how returns are calculated in diagonal spread setups.

Comparing Returns to Other Strategies

Comparison of potential returns from weekly diagonal spreads versus other options strategies.

Tools and Resources for Trading

Software for Options Trading

Recommendations for the best software tools that can aid in trading diagonal spreads.

Educational Resources

Pointing to educational materials and resources that can help deepen understanding of options trading.

Advanced Techniques in Diagonal Spreads

Adjusting Spreads for Market Conditions

How to adjust your spreads in response to changing market conditions to maintain profitability.

Using Greeks in Diagonal Spreads

How options ‘Greeks’ can be used to fine-tune the strategy for better results.

Live Trading Examples

Case Studies from Doc Severson

Sharing real-life examples from Doc Severson’s own trading to illustrate the effectiveness of the strategy.

Weekly Trading Routine

Outline of a typical weekly routine for setting up, managing, and reviewing diagonal spreads.

Common Mistakes and How to Avoid Them

Pitfalls in Diagonal Spread Trading

Discussing common errors traders make when using diagonal spreads and tips on how to avoid them.

Learning from Losses

How to learn effectively from unsuccessful trades to improve future strategy.

Conclusion

Doc Severson’s method of using weekly diagonal spreads for consistent income is a nuanced strategy that balances risk with the potential for regular returns. By understanding and applying the principles of diagonal spread trading, investors can enhance their trading repertoire significantly.

FAQs

1. Who should consider using weekly diagonal spreads?

Traders with an intermediate understanding of options who seek regular income and have the ability to monitor and adjust their positions frequently.

2. What is the minimum investment required for trading diagonal spreads?

While the investment can vary, traders should be prepared to invest enough to cover the potential margin requirements and manage risk effectively.

3. How time-consuming is this strategy?

Weekly diagonal spreads require regular monitoring and adjustment, making it somewhat time-consuming compared to more passive strategies.

4. Can weekly diagonal spreads be automated?

Certain aspects of trade management can be automated with sophisticated trading software, though manual oversight is still recommended.

5. What are the key factors for success with diagonal spreads?

Success with diagonal spreads often depends on choosing the right underlying stocks, managing risks effectively, and staying adaptable to market changes.

Be the first to review “Weekly Diagonal Spreads for Consistent Income By Doc Severson” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.