-

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00 -

×

Programming in Python For Traders with Trading Markets

1 × $15.00

Programming in Python For Traders with Trading Markets

1 × $15.00 -

×

Volatility Trading with Fractal Flow Pro

1 × $15.00

Volatility Trading with Fractal Flow Pro

1 × $15.00 -

×

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00 -

×

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00 -

×

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00 -

×

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

HectorTrader.com – Forex Trading Course with Hector DeVille

1 × $6.00

HectorTrader.com – Forex Trading Course with Hector DeVille

1 × $6.00 -

×

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00 -

×

My General Counsel™

1 × $23.00

My General Counsel™

1 × $23.00 -

×

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00 -

×

Day Trader Course

1 × $6.00

Day Trader Course

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

7 Things You MUST Know about Forex Candlesticks

1 × $4.00 -

×

Traders Secret Code Complete Course with Mark McRae

1 × $6.00

Traders Secret Code Complete Course with Mark McRae

1 × $6.00 -

×

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00 -

×

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00 -

×

Range Trading with D.Singleton

1 × $6.00

Range Trading with D.Singleton

1 × $6.00 -

×

Secret $100k Meeting with Russell Brunson

1 × $6.00

Secret $100k Meeting with Russell Brunson

1 × $6.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00 -

×

Advanced Trading Course with DovyFX

1 × $5.00

Advanced Trading Course with DovyFX

1 × $5.00 -

×

Japanese Trading Systems with Tradesmart University

1 × $9.00

Japanese Trading Systems with Tradesmart University

1 × $9.00 -

×

The Day Traders Fast Track Program

1 × $23.00

The Day Traders Fast Track Program

1 × $23.00 -

×

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00 -

×

Infectious Greed with John Nofsinger & Kenneth Kim

1 × $6.00

Infectious Greed with John Nofsinger & Kenneth Kim

1 × $6.00 -

×

Full Members Area (Icludes 2006 Seminar & Webinars) with Tom Yeomans

1 × $6.00

Full Members Area (Icludes 2006 Seminar & Webinars) with Tom Yeomans

1 × $6.00 -

×

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00 -

×

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00 -

×

Bulletproof Butterflies 2.0 2022 (PREMIUM) with Bruce Marshall

1 × $23.00

Bulletproof Butterflies 2.0 2022 (PREMIUM) with Bruce Marshall

1 × $23.00 -

×

NASDAQ Level II Trading Strategies

1 × $6.00

NASDAQ Level II Trading Strategies

1 × $6.00 -

×

Earnings Power Play with Dave Aquino

1 × $15.00

Earnings Power Play with Dave Aquino

1 × $15.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00 -

×

Failure Rate Modelling for Reliabiliy & Risk with Maxim Finkelstein

1 × $6.00

Failure Rate Modelling for Reliabiliy & Risk with Maxim Finkelstein

1 × $6.00 -

×

Options Bootcamp with Sid Woolfolk

1 × $6.00

Options Bootcamp with Sid Woolfolk

1 × $6.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00 -

×

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00 -

×

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00 -

×

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00 -

×

Emini Day Trading Boot Camp - Base Camp Trading

1 × $6.00

Emini Day Trading Boot Camp - Base Camp Trading

1 × $6.00 -

×

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00 -

×

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

Complete Portfolio and Stock Comparison Spreadsheet with Joseph Hogue

1 × $6.00

Complete Portfolio and Stock Comparison Spreadsheet with Joseph Hogue

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00 -

×

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00 -

×

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00 -

×

Confessions of a Street Addict with James Cramer

1 × $6.00

Confessions of a Street Addict with James Cramer

1 × $6.00 -

×

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00 -

×

Profit Before Work System with John Piper

1 × $6.00

Profit Before Work System with John Piper

1 × $6.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Inner Circle Course with Darius Fx

1 × $24.00

Inner Circle Course with Darius Fx

1 × $24.00 -

×

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00 -

×

How To Trade Forex Using Support & Resistance Levels with Vic Noble

1 × $6.00

How To Trade Forex Using Support & Resistance Levels with Vic Noble

1 × $6.00 -

×

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00 -

×

Futures Commodity Trading with G. Scott Martin

1 × $6.00

Futures Commodity Trading with G. Scott Martin

1 × $6.00 -

×

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00 -

×

Stock Trader`s Almanac 2012 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Trader`s Almanac 2012 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

The Jupiter Effect with John Gribbin & Stephen Plagemann

1 × $6.00

The Jupiter Effect with John Gribbin & Stephen Plagemann

1 × $6.00 -

×

Developing a Forex Trading Plan Webinar

1 × $6.00

Developing a Forex Trading Plan Webinar

1 × $6.00 -

×

Options Trading with Adam Grimes - MarketLife

1 × $5.00

Options Trading with Adam Grimes - MarketLife

1 × $5.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

Guide to Getting Short and Collecting Income with Don Kaufman

1 × $6.00

Guide to Getting Short and Collecting Income with Don Kaufman

1 × $6.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00 -

×

Active Beta Indexes with Khalid Ghayur

1 × $6.00

Active Beta Indexes with Khalid Ghayur

1 × $6.00 -

×

MorningSwing Method with Austin Passamonte

1 × $6.00

MorningSwing Method with Austin Passamonte

1 × $6.00 -

×

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00 -

×

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00 -

×

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00 -

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

Evolution Course with Kevin Trades

1 × $15.00

Evolution Course with Kevin Trades

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Options, Futures, and Other Derivative Securities

1 × $6.00

Options, Futures, and Other Derivative Securities

1 × $6.00 -

×

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00 -

×

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00 -

×

The Traders Mindset Course (the-traders-mindset.com) with Chris Mathews

1 × $6.00

The Traders Mindset Course (the-traders-mindset.com) with Chris Mathews

1 × $6.00 -

×

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00 -

×

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00 -

×

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

Master Trader - Advander Management Strategies

1 × $39.00

Master Trader - Advander Management Strategies

1 × $39.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

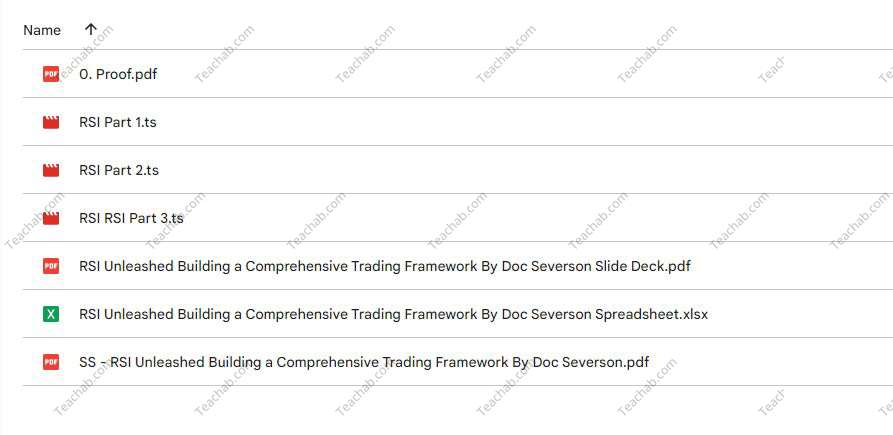

File Size: 962 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Weekly Diagonal Spreads for Consistent Income By Doc Severson” below:

Weekly Diagonal Spreads for Consistent Income by Doc Severson

Introduction

In the dynamic world of options trading, finding strategies that yield consistent income while managing risk is a priority for many investors. Doc Severson’s approach to using weekly diagonal spreads offers a structured path to achieving this goal.

Understanding Options Trading

Basics of Options

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

What are Diagonal Spreads?

Diagonal spreads are an options strategy involving two options of the same type but different strike prices and expiration dates.

Why Use Weekly Diagonal Spreads?

Benefits of Weekly Spreads

This section highlights the benefits of using weekly spreads such as flexibility, potential for regular income, and lower exposure to time decay.

Choosing Weekly Diagonal Spreads

Discussion on why weekly spreads can be particularly advantageous for generating consistent income.

Setting Up a Weekly Diagonal Spread

Selecting the Right Stocks

Criteria for choosing stocks that are suitable for implementing weekly diagonal spreads, focusing on volatility and liquidity.

Determining Strike Prices and Expirations

How to select appropriate strike prices and expiration dates to optimize the trade setup.

Risk Management

Managing Trade Risks

Strategies to mitigate risks associated with diagonal spreads, including adjustments based on market movements.

Importance of Exit Strategies

Developing clear exit strategies to maximize gains or cut losses.

Calculating Potential Returns

Expected Returns from Diagonal Spreads

An overview of how returns are calculated in diagonal spread setups.

Comparing Returns to Other Strategies

Comparison of potential returns from weekly diagonal spreads versus other options strategies.

Tools and Resources for Trading

Software for Options Trading

Recommendations for the best software tools that can aid in trading diagonal spreads.

Educational Resources

Pointing to educational materials and resources that can help deepen understanding of options trading.

Advanced Techniques in Diagonal Spreads

Adjusting Spreads for Market Conditions

How to adjust your spreads in response to changing market conditions to maintain profitability.

Using Greeks in Diagonal Spreads

How options ‘Greeks’ can be used to fine-tune the strategy for better results.

Live Trading Examples

Case Studies from Doc Severson

Sharing real-life examples from Doc Severson’s own trading to illustrate the effectiveness of the strategy.

Weekly Trading Routine

Outline of a typical weekly routine for setting up, managing, and reviewing diagonal spreads.

Common Mistakes and How to Avoid Them

Pitfalls in Diagonal Spread Trading

Discussing common errors traders make when using diagonal spreads and tips on how to avoid them.

Learning from Losses

How to learn effectively from unsuccessful trades to improve future strategy.

Conclusion

Doc Severson’s method of using weekly diagonal spreads for consistent income is a nuanced strategy that balances risk with the potential for regular returns. By understanding and applying the principles of diagonal spread trading, investors can enhance their trading repertoire significantly.

FAQs

1. Who should consider using weekly diagonal spreads?

Traders with an intermediate understanding of options who seek regular income and have the ability to monitor and adjust their positions frequently.

2. What is the minimum investment required for trading diagonal spreads?

While the investment can vary, traders should be prepared to invest enough to cover the potential margin requirements and manage risk effectively.

3. How time-consuming is this strategy?

Weekly diagonal spreads require regular monitoring and adjustment, making it somewhat time-consuming compared to more passive strategies.

4. Can weekly diagonal spreads be automated?

Certain aspects of trade management can be automated with sophisticated trading software, though manual oversight is still recommended.

5. What are the key factors for success with diagonal spreads?

Success with diagonal spreads often depends on choosing the right underlying stocks, managing risks effectively, and staying adaptable to market changes.

Be the first to review “Weekly Diagonal Spreads for Consistent Income By Doc Severson” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.