-

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

Dynamite TNT Forex System with Clarence Chee

1 × $6.00

Dynamite TNT Forex System with Clarence Chee

1 × $6.00 -

×

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

Measuring & Controlling Interest Rate & Credit Risk (2nd Ed.) with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00

Measuring & Controlling Interest Rate & Credit Risk (2nd Ed.) with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00 -

×

Mastering Candlestick Charts II with Greg Capra

1 × $6.00

Mastering Candlestick Charts II with Greg Capra

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00 -

×

Investment Illusions with Martin S.Fridson

1 × $6.00

Investment Illusions with Martin S.Fridson

1 × $6.00 -

×

The Market Masters: Wall Street's Top Investment Pros Reveal How to Make Money in Both Bull and Bear Markets - Kirk Kazanjian

1 × $6.00

The Market Masters: Wall Street's Top Investment Pros Reveal How to Make Money in Both Bull and Bear Markets - Kirk Kazanjian

1 × $6.00 -

×

Master Time Factor & Forecasting with Mathematical Rules

1 × $6.00

Master Time Factor & Forecasting with Mathematical Rules

1 × $6.00 -

×

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00 -

×

Simpler Options - Double Diagonals Class

1 × $6.00

Simpler Options - Double Diagonals Class

1 × $6.00 -

×

The M21 Strategy

1 × $15.00

The M21 Strategy

1 × $15.00 -

×

Market Profile Video with FutexLive

1 × $6.00

Market Profile Video with FutexLive

1 × $6.00 -

×

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00 -

×

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00 -

×

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00 -

×

Money Miracle: Use Other Peoples Money to Make You Rich with George Angell

1 × $6.00

Money Miracle: Use Other Peoples Money to Make You Rich with George Angell

1 × $6.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00 -

×

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Flux Investor Package v2.2.1, (Jan 2016) with Back To The Future Trading

1 × $85.00

Flux Investor Package v2.2.1, (Jan 2016) with Back To The Future Trading

1 × $85.00 -

×

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00 -

×

How I Trade Options with Jon Najarian

1 × $4.00

How I Trade Options with Jon Najarian

1 × $4.00 -

×

Practical Approach to Amibroker Backtesting with Rajandran R

1 × $6.00

Practical Approach to Amibroker Backtesting with Rajandran R

1 × $6.00 -

×

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00 -

×

Price Action Trading with Bill Eykyn

1 × $6.00

Price Action Trading with Bill Eykyn

1 × $6.00 -

×

Mastering High Probability Chart Reading Methods with John Murphy

1 × $6.00

Mastering High Probability Chart Reading Methods with John Murphy

1 × $6.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Scalpathon by Trading Research Group

1 × $23.00

Scalpathon by Trading Research Group

1 × $23.00 -

×

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00 -

×

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00 -

×

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00 -

×

Path to Profits By Scott Redler - T3 Live

1 × $6.00

Path to Profits By Scott Redler - T3 Live

1 × $6.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

Master Trader - Advander Management Strategies

1 × $39.00

Master Trader - Advander Management Strategies

1 × $39.00 -

×

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00 -

×

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00 -

×

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00 -

×

Harmonic Vibrations with Larry Pesavento

1 × $6.00

Harmonic Vibrations with Larry Pesavento

1 × $6.00 -

×

How to Trade in Stocks

1 × $6.00

How to Trade in Stocks

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The Basics of the Wave Principle with Wayne Gorman

1 × $15.00

The Basics of the Wave Principle with Wayne Gorman

1 × $15.00 -

×

System Building Masterclass

1 × $31.00

System Building Masterclass

1 × $31.00 -

×

Forex Power Strategy Course with Jason Steele

1 × $6.00

Forex Power Strategy Course with Jason Steele

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00 -

×

Becoming Rich with Mark Tier

1 × $6.00

Becoming Rich with Mark Tier

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Cyber Trading University - Power Trading 7 CD

1 × $8.00

Cyber Trading University - Power Trading 7 CD

1 × $8.00 -

×

Global Equity Investing By Alberto Vivanti & Perry Kaufman

1 × $6.00

Global Equity Investing By Alberto Vivanti & Perry Kaufman

1 × $6.00 -

×

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00 -

×

Learn To Trade with Tori Trades

1 × $8.00

Learn To Trade with Tori Trades

1 × $8.00 -

×

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00 -

×

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00 -

×

Investment Psychology. Explained Classic Strategies to Beat the Markets with Martin Pring

1 × $6.00

Investment Psychology. Explained Classic Strategies to Beat the Markets with Martin Pring

1 × $6.00 -

×

DaVinci FX Course

1 × $6.00

DaVinci FX Course

1 × $6.00 -

×

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00 -

×

Investment Philosophies

1 × $6.00

Investment Philosophies

1 × $6.00 -

×

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00 -

×

Investing Under Fire with Alan R.Ackerman

1 × $6.00

Investing Under Fire with Alan R.Ackerman

1 × $6.00 -

×

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00 -

×

Investors Underground - Tandem Trader

1 × $5.00

Investors Underground - Tandem Trader

1 × $5.00 -

×

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00 -

×

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00 -

×

Futures Trading (German)

1 × $6.00

Futures Trading (German)

1 × $6.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Trading by the Book (tradingeducators.com)

1 × $6.00

Trading by the Book (tradingeducators.com)

1 × $6.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

1 × $6.00

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

1 × $6.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00 -

×

Supply and Demand Video Course with JamesFXS

1 × $13.00

Supply and Demand Video Course with JamesFXS

1 × $13.00 -

×

Predicting Next Weeks’s Range with Charles Drummond

1 × $6.00

Predicting Next Weeks’s Range with Charles Drummond

1 × $6.00 -

×

How To Invest Better

1 × $6.00

How To Invest Better

1 × $6.00 -

×

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00 -

×

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 962 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

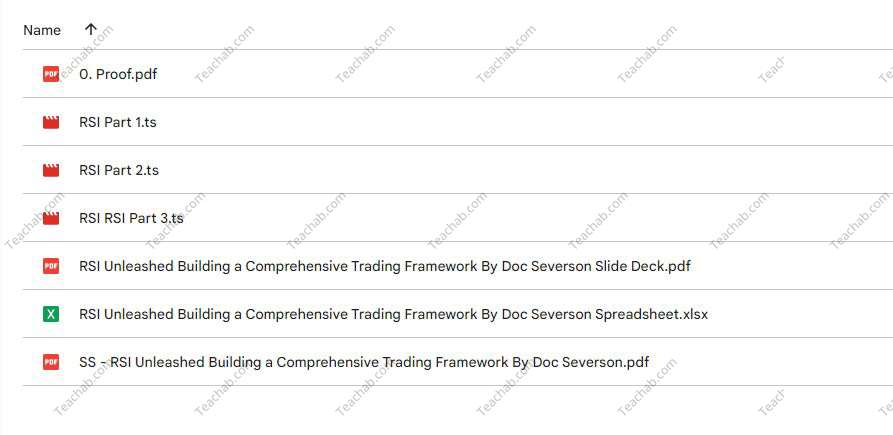

You may check content proof of “Weekly Diagonal Spreads for Consistent Income By Doc Severson” below:

Weekly Diagonal Spreads for Consistent Income by Doc Severson

Introduction

In the dynamic world of options trading, finding strategies that yield consistent income while managing risk is a priority for many investors. Doc Severson’s approach to using weekly diagonal spreads offers a structured path to achieving this goal.

Understanding Options Trading

Basics of Options

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

What are Diagonal Spreads?

Diagonal spreads are an options strategy involving two options of the same type but different strike prices and expiration dates.

Why Use Weekly Diagonal Spreads?

Benefits of Weekly Spreads

This section highlights the benefits of using weekly spreads such as flexibility, potential for regular income, and lower exposure to time decay.

Choosing Weekly Diagonal Spreads

Discussion on why weekly spreads can be particularly advantageous for generating consistent income.

Setting Up a Weekly Diagonal Spread

Selecting the Right Stocks

Criteria for choosing stocks that are suitable for implementing weekly diagonal spreads, focusing on volatility and liquidity.

Determining Strike Prices and Expirations

How to select appropriate strike prices and expiration dates to optimize the trade setup.

Risk Management

Managing Trade Risks

Strategies to mitigate risks associated with diagonal spreads, including adjustments based on market movements.

Importance of Exit Strategies

Developing clear exit strategies to maximize gains or cut losses.

Calculating Potential Returns

Expected Returns from Diagonal Spreads

An overview of how returns are calculated in diagonal spread setups.

Comparing Returns to Other Strategies

Comparison of potential returns from weekly diagonal spreads versus other options strategies.

Tools and Resources for Trading

Software for Options Trading

Recommendations for the best software tools that can aid in trading diagonal spreads.

Educational Resources

Pointing to educational materials and resources that can help deepen understanding of options trading.

Advanced Techniques in Diagonal Spreads

Adjusting Spreads for Market Conditions

How to adjust your spreads in response to changing market conditions to maintain profitability.

Using Greeks in Diagonal Spreads

How options ‘Greeks’ can be used to fine-tune the strategy for better results.

Live Trading Examples

Case Studies from Doc Severson

Sharing real-life examples from Doc Severson’s own trading to illustrate the effectiveness of the strategy.

Weekly Trading Routine

Outline of a typical weekly routine for setting up, managing, and reviewing diagonal spreads.

Common Mistakes and How to Avoid Them

Pitfalls in Diagonal Spread Trading

Discussing common errors traders make when using diagonal spreads and tips on how to avoid them.

Learning from Losses

How to learn effectively from unsuccessful trades to improve future strategy.

Conclusion

Doc Severson’s method of using weekly diagonal spreads for consistent income is a nuanced strategy that balances risk with the potential for regular returns. By understanding and applying the principles of diagonal spread trading, investors can enhance their trading repertoire significantly.

FAQs

1. Who should consider using weekly diagonal spreads?

Traders with an intermediate understanding of options who seek regular income and have the ability to monitor and adjust their positions frequently.

2. What is the minimum investment required for trading diagonal spreads?

While the investment can vary, traders should be prepared to invest enough to cover the potential margin requirements and manage risk effectively.

3. How time-consuming is this strategy?

Weekly diagonal spreads require regular monitoring and adjustment, making it somewhat time-consuming compared to more passive strategies.

4. Can weekly diagonal spreads be automated?

Certain aspects of trade management can be automated with sophisticated trading software, though manual oversight is still recommended.

5. What are the key factors for success with diagonal spreads?

Success with diagonal spreads often depends on choosing the right underlying stocks, managing risks effectively, and staying adaptable to market changes.

Be the first to review “Weekly Diagonal Spreads for Consistent Income By Doc Severson” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.