-

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Collection of Articles and Webinars with Sunil Mangwani [9 Videos (FLVs) + 14 eBooks

1 × $6.00

Collection of Articles and Webinars with Sunil Mangwani [9 Videos (FLVs) + 14 eBooks

1 × $6.00 -

×

Technical Analysis for Short-Term Traders

1 × $6.00

Technical Analysis for Short-Term Traders

1 × $6.00 -

×

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00 -

×

Trading Non-Farm Payroll Report

1 × $6.00

Trading Non-Farm Payroll Report

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00 -

×

Edge Trading Group with Edge Elite

1 × $6.00

Edge Trading Group with Edge Elite

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

How to Trade Stock Options Course

1 × $6.00

How to Trade Stock Options Course

1 × $6.00 -

×

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00 -

×

Options Made Easy with Optionpit

1 × $62.00

Options Made Easy with Optionpit

1 × $62.00 -

×

How To Read The Trend (Recorded Session) with TradeSmart

1 × $31.00

How To Read The Trend (Recorded Session) with TradeSmart

1 × $31.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

STERLING SUHR’S ADVANCED FOREX BANK TRADING COURSE (DAYTRADING FOREX LIVE COURSE) 2017

1 × $15.00

STERLING SUHR’S ADVANCED FOREX BANK TRADING COURSE (DAYTRADING FOREX LIVE COURSE) 2017

1 × $15.00 -

×

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00

Master Moving Averages - Profit Multiplying Techniques with Nick Santiago - InTheMoneyStocks

1 × $54.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Advanced Breakthroughs in Day Trading DVD course with George Angell

1 × $6.00

Advanced Breakthroughs in Day Trading DVD course with George Angell

1 × $6.00 -

×

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00 -

×

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00 -

×

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00 -

×

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00 -

×

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00 -

×

Option, Futures and Other Derivates 9th Edition

1 × $6.00

Option, Futures and Other Derivates 9th Edition

1 × $6.00 -

×

SWING TRADING WITH CONFIDENCE

1 × $31.00

SWING TRADING WITH CONFIDENCE

1 × $31.00 -

×

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

Trading MasterMind Course

1 × $23.00

Trading MasterMind Course

1 × $23.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00 -

×

DaVinci FX Course

1 × $6.00

DaVinci FX Course

1 × $6.00 -

×

The Bull Hunter with Dan Denning

1 × $6.00

The Bull Hunter with Dan Denning

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Forex Master Method Evolution with Russ Horn

1 × $6.00

Forex Master Method Evolution with Russ Horn

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Consistently Profitable Trader with Pollinate Trading

1 × $13.00

Consistently Profitable Trader with Pollinate Trading

1 × $13.00 -

×

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00 -

×

CFA Level 2 - Sample Item Sets 2003

1 × $6.00

CFA Level 2 - Sample Item Sets 2003

1 × $6.00 -

×

D5 Render Course with Nuno Silva

1 × $27.00

D5 Render Course with Nuno Silva

1 × $27.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Pring on Price Patterns with Martin Pring

1 × $6.00

Pring on Price Patterns with Martin Pring

1 × $6.00 -

×

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00 -

×

Acme

1 × $6.00

Acme

1 × $6.00 -

×

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00 -

×

Evolve MasterClass with Irek Piekarski

1 × $13.00

Evolve MasterClass with Irek Piekarski

1 × $13.00 -

×

Pentagonal Time Cycle Theory

1 × $6.00

Pentagonal Time Cycle Theory

1 × $6.00 -

×

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00 -

×

Fractal Energy Trading with Doc Severson

1 × $6.00

Fractal Energy Trading with Doc Severson

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00 -

×

Forex Trading with Ed Ponsi

1 × $6.00

Forex Trading with Ed Ponsi

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

Game-Maker Forex Trading System

1 × $6.00

Game-Maker Forex Trading System

1 × $6.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00 -

×

Kicker Signals with Stephen W.Bigalow

1 × $6.00

Kicker Signals with Stephen W.Bigalow

1 × $6.00 -

×

Practical Approach to Trend Following By Rajandran R

1 × $15.00

Practical Approach to Trend Following By Rajandran R

1 × $15.00 -

×

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00 -

×

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00 -

×

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00 -

×

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00 -

×

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00 -

×

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00 -

×

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Global Product with John Stark

1 × $6.00

Global Product with John Stark

1 × $6.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

High Probability Continuation and Reversal Patterns

1 × $23.00

High Probability Continuation and Reversal Patterns

1 × $23.00 -

×

Basecamptrading - Naked Trading Part 2

1 × $6.00

Basecamptrading - Naked Trading Part 2

1 × $6.00 -

×

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00 -

×

Storehouse Tutorial Group Videos

1 × $23.00

Storehouse Tutorial Group Videos

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

The Aime Workshop with Clay Marafiote

1 × $6.00

The Aime Workshop with Clay Marafiote

1 × $6.00 -

×

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00 -

×

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00

Four Dimensional Stock Market Structures & Cycles with Bradley Cowan

1 × $6.00 -

×

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00 -

×

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 962 MB

Delivery Time: 1–12 hours

Media Type: Online Course

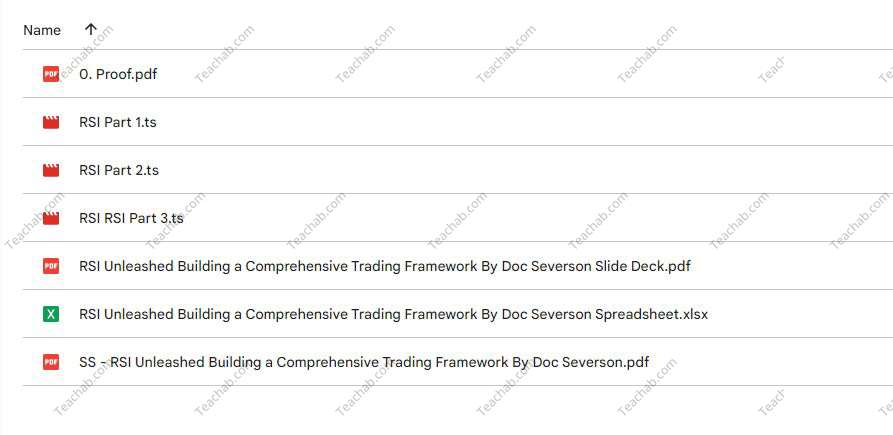

Content Proof: Watch Here!

You may check content proof of “Weekly Diagonal Spreads for Consistent Income By Doc Severson” below:

Weekly Diagonal Spreads for Consistent Income by Doc Severson

Introduction

In the dynamic world of options trading, finding strategies that yield consistent income while managing risk is a priority for many investors. Doc Severson’s approach to using weekly diagonal spreads offers a structured path to achieving this goal.

Understanding Options Trading

Basics of Options

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

What are Diagonal Spreads?

Diagonal spreads are an options strategy involving two options of the same type but different strike prices and expiration dates.

Why Use Weekly Diagonal Spreads?

Benefits of Weekly Spreads

This section highlights the benefits of using weekly spreads such as flexibility, potential for regular income, and lower exposure to time decay.

Choosing Weekly Diagonal Spreads

Discussion on why weekly spreads can be particularly advantageous for generating consistent income.

Setting Up a Weekly Diagonal Spread

Selecting the Right Stocks

Criteria for choosing stocks that are suitable for implementing weekly diagonal spreads, focusing on volatility and liquidity.

Determining Strike Prices and Expirations

How to select appropriate strike prices and expiration dates to optimize the trade setup.

Risk Management

Managing Trade Risks

Strategies to mitigate risks associated with diagonal spreads, including adjustments based on market movements.

Importance of Exit Strategies

Developing clear exit strategies to maximize gains or cut losses.

Calculating Potential Returns

Expected Returns from Diagonal Spreads

An overview of how returns are calculated in diagonal spread setups.

Comparing Returns to Other Strategies

Comparison of potential returns from weekly diagonal spreads versus other options strategies.

Tools and Resources for Trading

Software for Options Trading

Recommendations for the best software tools that can aid in trading diagonal spreads.

Educational Resources

Pointing to educational materials and resources that can help deepen understanding of options trading.

Advanced Techniques in Diagonal Spreads

Adjusting Spreads for Market Conditions

How to adjust your spreads in response to changing market conditions to maintain profitability.

Using Greeks in Diagonal Spreads

How options ‘Greeks’ can be used to fine-tune the strategy for better results.

Live Trading Examples

Case Studies from Doc Severson

Sharing real-life examples from Doc Severson’s own trading to illustrate the effectiveness of the strategy.

Weekly Trading Routine

Outline of a typical weekly routine for setting up, managing, and reviewing diagonal spreads.

Common Mistakes and How to Avoid Them

Pitfalls in Diagonal Spread Trading

Discussing common errors traders make when using diagonal spreads and tips on how to avoid them.

Learning from Losses

How to learn effectively from unsuccessful trades to improve future strategy.

Conclusion

Doc Severson’s method of using weekly diagonal spreads for consistent income is a nuanced strategy that balances risk with the potential for regular returns. By understanding and applying the principles of diagonal spread trading, investors can enhance their trading repertoire significantly.

FAQs

1. Who should consider using weekly diagonal spreads?

Traders with an intermediate understanding of options who seek regular income and have the ability to monitor and adjust their positions frequently.

2. What is the minimum investment required for trading diagonal spreads?

While the investment can vary, traders should be prepared to invest enough to cover the potential margin requirements and manage risk effectively.

3. How time-consuming is this strategy?

Weekly diagonal spreads require regular monitoring and adjustment, making it somewhat time-consuming compared to more passive strategies.

4. Can weekly diagonal spreads be automated?

Certain aspects of trade management can be automated with sophisticated trading software, though manual oversight is still recommended.

5. What are the key factors for success with diagonal spreads?

Success with diagonal spreads often depends on choosing the right underlying stocks, managing risks effectively, and staying adaptable to market changes.

Be the first to review “Weekly Diagonal Spreads for Consistent Income By Doc Severson” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.