-

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Active Investing courses notes with Alan Hull

1 × $6.00

Active Investing courses notes with Alan Hull

1 × $6.00 -

×

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00 -

×

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00 -

×

The Way of the Turtle with Curtis Faith

1 × $6.00

The Way of the Turtle with Curtis Faith

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

FXjake Daily Trader Program

1 × $31.00

FXjake Daily Trader Program

1 × $31.00 -

×

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00 -

×

Investors Underground - Tandem Trader

1 × $5.00

Investors Underground - Tandem Trader

1 × $5.00 -

×

Filtered Waves. Basic Theory with Arthur A.Merrill

1 × $7.00

Filtered Waves. Basic Theory with Arthur A.Merrill

1 × $7.00 -

×

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00 -

×

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00 -

×

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00 -

×

Project Gorilla

1 × $5.00

Project Gorilla

1 × $5.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00 -

×

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

The Banks Code with Smart Money Trader

1 × $34.00

The Banks Code with Smart Money Trader

1 × $34.00 -

×

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00 -

×

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00 -

×

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00 -

×

Stacey Pigmentation Mentorship

1 × $17.00

Stacey Pigmentation Mentorship

1 × $17.00 -

×

New Blueprints for Gains in Stocks and Grains & One-Way Formula for Trading in Stocks and Commodities (Traders' Masterclass) - William Dunnigan

1 × $6.00

New Blueprints for Gains in Stocks and Grains & One-Way Formula for Trading in Stocks and Commodities (Traders' Masterclass) - William Dunnigan

1 × $6.00 -

×

The New Multi-10x on Steroids Pro Package

1 × $78.00

The New Multi-10x on Steroids Pro Package

1 × $78.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

Textbook Trading DVD with InvestorsLive

1 × $6.00

Textbook Trading DVD with InvestorsLive

1 × $6.00 -

×

Live Online Masterclass with XSPY Trader

1 × $5.00

Live Online Masterclass with XSPY Trader

1 × $5.00 -

×

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00 -

×

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00 -

×

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00 -

×

Lifespan Investing with Clifford Pistolese

1 × $6.00

Lifespan Investing with Clifford Pistolese

1 × $6.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00 -

×

AM Trader - Strategy Training Course

1 × $23.00

AM Trader - Strategy Training Course

1 × $23.00 -

×

All Time High Trading Course with TRADEVERSITY

1 × $5.00

All Time High Trading Course with TRADEVERSITY

1 × $5.00 -

×

Lazy Gap Trader Course with David Frost

1 × $6.00

Lazy Gap Trader Course with David Frost

1 × $6.00 -

×

Analysis of Equity Investments: Valuation with John Stowe, Thomas Robinson, Jerald Pinto & Dennis McLeavey

1 × $6.00

Analysis of Equity Investments: Valuation with John Stowe, Thomas Robinson, Jerald Pinto & Dennis McLeavey

1 × $6.00 -

×

The Trader's Mindset Course with Chris Mathews

1 × $6.00

The Trader's Mindset Course with Chris Mathews

1 × $6.00 -

×

Street-Smart Chart Reading – Volume 1 – The Rudiments with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 1 – The Rudiments with Donald G.Worden

1 × $6.00 -

×

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00 -

×

The Inner Circle Seminar

1 × $15.00

The Inner Circle Seminar

1 × $15.00 -

×

Numbers: Their Occult Power and Mystic Virtues

1 × $4.00

Numbers: Their Occult Power and Mystic Virtues

1 × $4.00 -

×

Options For Gold, Oil and Other Commodities

1 × $6.00

Options For Gold, Oil and Other Commodities

1 × $6.00 -

×

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

Diary of an Internet Trader with Alpesh Patel

1 × $6.00

Diary of an Internet Trader with Alpesh Patel

1 × $6.00 -

×

Trading Academy 2024 with Tradeciety

1 × $5.00

Trading Academy 2024 with Tradeciety

1 × $5.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

News Profiteer System Manual & Members Area Videos with Henry Liu

1 × $6.00

News Profiteer System Manual & Members Area Videos with Henry Liu

1 × $6.00 -

×

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00 -

×

High Reward Low Risk Forex Trading with Jarratt Davis and Vic Noble

1 × $6.00

High Reward Low Risk Forex Trading with Jarratt Davis and Vic Noble

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

My Trading Strategy with Evolved Traders

1 × $5.00

My Trading Strategy with Evolved Traders

1 × $5.00 -

×

Advanced Trading System 2020

1 × $179.00

Advanced Trading System 2020

1 × $179.00 -

×

ICT Mentorship – 2019

1 × $13.00

ICT Mentorship – 2019

1 × $13.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00 -

×

Fractal Markets FX (SMC)

1 × $5.00

Fractal Markets FX (SMC)

1 × $5.00 -

×

Crypto Trading Cyber Security for Bitcoin & Altcoin Holders with Zlatin Georgiev

1 × $5.00

Crypto Trading Cyber Security for Bitcoin & Altcoin Holders with Zlatin Georgiev

1 × $5.00 -

×

Shawn Sharma Mentorship Program

1 × $34.00

Shawn Sharma Mentorship Program

1 × $34.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00 -

×

Ichimokutrade - Ichimoku 101

1 × $15.00

Ichimokutrade - Ichimoku 101

1 × $15.00 -

×

Market Expectations & Option Prices with Martin Mandler

1 × $6.00

Market Expectations & Option Prices with Martin Mandler

1 × $6.00 -

×

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00 -

×

A- Z Educational Trading Course with InvestiTrade

1 × $39.00

A- Z Educational Trading Course with InvestiTrade

1 × $39.00 -

×

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00 -

×

Master Commodities Course

1 × $6.00

Master Commodities Course

1 × $6.00 -

×

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00 -

×

The Litle Book of Bulletproof Investing

1 × $6.00

The Litle Book of Bulletproof Investing

1 × $6.00 -

×

Learn To Profit From The Forex Market with FX Hustle

1 × $6.00

Learn To Profit From The Forex Market with FX Hustle

1 × $6.00 -

×

What Works in Online Trading with Mark Etzkorn

1 × $6.00

What Works in Online Trading with Mark Etzkorn

1 × $6.00 -

×

Professional Approaches to Directional Option Trading with Option Pit

1 × $23.00

Professional Approaches to Directional Option Trading with Option Pit

1 × $23.00 -

×

How to Value & Sell your Business with Andrew Heslop

1 × $6.00

How to Value & Sell your Business with Andrew Heslop

1 × $6.00 -

×

Technical Analysis & The Nasdaq with Alan Rich

1 × $6.00

Technical Analysis & The Nasdaq with Alan Rich

1 × $6.00 -

×

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00 -

×

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00 -

×

Mao, Marx & the Market: Capitalist Adventures in Russia and China with Dean LeBaro

1 × $6.00

Mao, Marx & the Market: Capitalist Adventures in Russia and China with Dean LeBaro

1 × $6.00 -

×

Speculating with Futures and Traditional Commodities with Liverpool Group

1 × $6.00

Speculating with Futures and Traditional Commodities with Liverpool Group

1 × $6.00 -

×

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00 -

×

The Complete Turtle Trader with Michael Covel

1 × $6.00

The Complete Turtle Trader with Michael Covel

1 × $6.00 -

×

FXJake Webinars with Walter Peters

1 × $6.00

FXJake Webinars with Walter Peters

1 × $6.00 -

×

Measuring & Controlling Interest Rate & Credit Risk (2nd Ed.) with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00

Measuring & Controlling Interest Rate & Credit Risk (2nd Ed.) with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00 -

×

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00 -

×

Rhythm of the Moon with Jack Gillen

1 × $4.00

Rhythm of the Moon with Jack Gillen

1 × $4.00 -

×

Be Smart, Act Fast, Get Rich with Charles Payne

1 × $6.00

Be Smart, Act Fast, Get Rich with Charles Payne

1 × $6.00 -

×

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00 -

×

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00 -

×

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

The Options Trading Body of Knowledge with Michael Thomsett

1 × $6.00

The Options Trading Body of Knowledge with Michael Thomsett

1 × $6.00 -

×

Secrets of a Winning Trader with Gareth Soloway

1 × $871.00

Secrets of a Winning Trader with Gareth Soloway

1 × $871.00 -

×

All About Technical Analysis with Constance Brown

1 × $6.00

All About Technical Analysis with Constance Brown

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

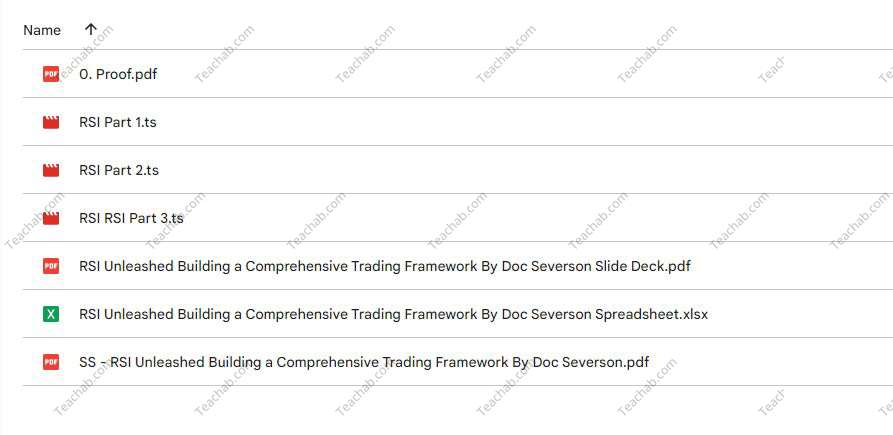

Weekly Diagonal Spreads for Consistent Income By Doc Severson

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

File Size: 962 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Weekly Diagonal Spreads for Consistent Income By Doc Severson” below:

Weekly Diagonal Spreads for Consistent Income by Doc Severson

Introduction

In the dynamic world of options trading, finding strategies that yield consistent income while managing risk is a priority for many investors. Doc Severson’s approach to using weekly diagonal spreads offers a structured path to achieving this goal.

Understanding Options Trading

Basics of Options

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

What are Diagonal Spreads?

Diagonal spreads are an options strategy involving two options of the same type but different strike prices and expiration dates.

Why Use Weekly Diagonal Spreads?

Benefits of Weekly Spreads

This section highlights the benefits of using weekly spreads such as flexibility, potential for regular income, and lower exposure to time decay.

Choosing Weekly Diagonal Spreads

Discussion on why weekly spreads can be particularly advantageous for generating consistent income.

Setting Up a Weekly Diagonal Spread

Selecting the Right Stocks

Criteria for choosing stocks that are suitable for implementing weekly diagonal spreads, focusing on volatility and liquidity.

Determining Strike Prices and Expirations

How to select appropriate strike prices and expiration dates to optimize the trade setup.

Risk Management

Managing Trade Risks

Strategies to mitigate risks associated with diagonal spreads, including adjustments based on market movements.

Importance of Exit Strategies

Developing clear exit strategies to maximize gains or cut losses.

Calculating Potential Returns

Expected Returns from Diagonal Spreads

An overview of how returns are calculated in diagonal spread setups.

Comparing Returns to Other Strategies

Comparison of potential returns from weekly diagonal spreads versus other options strategies.

Tools and Resources for Trading

Software for Options Trading

Recommendations for the best software tools that can aid in trading diagonal spreads.

Educational Resources

Pointing to educational materials and resources that can help deepen understanding of options trading.

Advanced Techniques in Diagonal Spreads

Adjusting Spreads for Market Conditions

How to adjust your spreads in response to changing market conditions to maintain profitability.

Using Greeks in Diagonal Spreads

How options ‘Greeks’ can be used to fine-tune the strategy for better results.

Live Trading Examples

Case Studies from Doc Severson

Sharing real-life examples from Doc Severson’s own trading to illustrate the effectiveness of the strategy.

Weekly Trading Routine

Outline of a typical weekly routine for setting up, managing, and reviewing diagonal spreads.

Common Mistakes and How to Avoid Them

Pitfalls in Diagonal Spread Trading

Discussing common errors traders make when using diagonal spreads and tips on how to avoid them.

Learning from Losses

How to learn effectively from unsuccessful trades to improve future strategy.

Conclusion

Doc Severson’s method of using weekly diagonal spreads for consistent income is a nuanced strategy that balances risk with the potential for regular returns. By understanding and applying the principles of diagonal spread trading, investors can enhance their trading repertoire significantly.

FAQs

1. Who should consider using weekly diagonal spreads?

Traders with an intermediate understanding of options who seek regular income and have the ability to monitor and adjust their positions frequently.

2. What is the minimum investment required for trading diagonal spreads?

While the investment can vary, traders should be prepared to invest enough to cover the potential margin requirements and manage risk effectively.

3. How time-consuming is this strategy?

Weekly diagonal spreads require regular monitoring and adjustment, making it somewhat time-consuming compared to more passive strategies.

4. Can weekly diagonal spreads be automated?

Certain aspects of trade management can be automated with sophisticated trading software, though manual oversight is still recommended.

5. What are the key factors for success with diagonal spreads?

Success with diagonal spreads often depends on choosing the right underlying stocks, managing risks effectively, and staying adaptable to market changes.

Be the first to review “Weekly Diagonal Spreads for Consistent Income By Doc Severson” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.