-

×

How to Day Trade Micro Eminis with Dr Stoxx

1 × $5.00

How to Day Trade Micro Eminis with Dr Stoxx

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Making The Leap Learning To Trade With Robots with Scott Welsh

1 × $15.00

Making The Leap Learning To Trade With Robots with Scott Welsh

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Tutorials in Applied Technical Analysis with Daryl Guppy

1 × $4.00

Tutorials in Applied Technical Analysis with Daryl Guppy

1 × $4.00 -

×

Level 3 - AlgoX Trading Tactics

1 × $31.00

Level 3 - AlgoX Trading Tactics

1 × $31.00 -

×

Mike McMahon Extended Learning Track XLT Stock Mastery Course

1 × $31.00

Mike McMahon Extended Learning Track XLT Stock Mastery Course

1 × $31.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00 -

×

Learning KST

1 × $6.00

Learning KST

1 × $6.00 -

×

Ultimate Options Trading with Cash Flow Academy

1 × $34.00

Ultimate Options Trading with Cash Flow Academy

1 × $34.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

TTM Squeeze Clone for eSignal

1 × $6.00

TTM Squeeze Clone for eSignal

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Ultimate Professional Trader Plus CD Library

1 × $31.00

The Ultimate Professional Trader Plus CD Library

1 × $31.00 -

×

The Forex Trading Academy with Steve Luke

1 × $5.00

The Forex Trading Academy with Steve Luke

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The Viper Advanced Program

1 × $13.00

The Viper Advanced Program

1 × $13.00 -

×

Elder-disk 1.01 for NinjaTrader7

1 × $6.00

Elder-disk 1.01 for NinjaTrader7

1 × $6.00 -

×

The Essentials of Trading Course & Book with John Forman

1 × $6.00

The Essentials of Trading Course & Book with John Forman

1 × $6.00 -

×

Kash-FX Elite Course

1 × $10.00

Kash-FX Elite Course

1 × $10.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Using Intermarket Analysis to Make Smarter Traders with Murray Ruggiero

1 × $4.00

Using Intermarket Analysis to Make Smarter Traders with Murray Ruggiero

1 × $4.00 -

×

Two Simple Setups For All Markets (Parts 1, 2, 3) with Rob Hoffman

1 × $31.00

Two Simple Setups For All Markets (Parts 1, 2, 3) with Rob Hoffman

1 × $31.00 -

×

The Forex Scalper

1 × $5.00

The Forex Scalper

1 × $5.00 -

×

The Forex Equinox

1 × $54.00

The Forex Equinox

1 × $54.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Trends & Trendlines with Albert Yang

1 × $4.00

Trends & Trendlines with Albert Yang

1 × $4.00 -

×

Credit Spread Plan to Generate 5% Weekly

1 × $31.00

Credit Spread Plan to Generate 5% Weekly

1 × $31.00 -

×

Cycles – Gann and Fibonnacci 1997 with Stan Harley

1 × $6.00

Cycles – Gann and Fibonnacci 1997 with Stan Harley

1 × $6.00 -

×

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00 -

×

Bitcoin - Trading – Watch me manage my own account

1 × $8.00

Bitcoin - Trading – Watch me manage my own account

1 × $8.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

TRADING WITH TIME with Frank Barillaro

1 × $8.00

TRADING WITH TIME with Frank Barillaro

1 × $8.00 -

×

TTM Directional Day Filter System for TS

1 × $6.00

TTM Directional Day Filter System for TS

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

TTM Trading with the Anchor Indicators Video

1 × $6.00

TTM Trading with the Anchor Indicators Video

1 × $6.00 -

×

The Forex On Fire System

1 × $6.00

The Forex On Fire System

1 × $6.00 -

×

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00 -

×

University Tutorial

1 × $6.00

University Tutorial

1 × $6.00

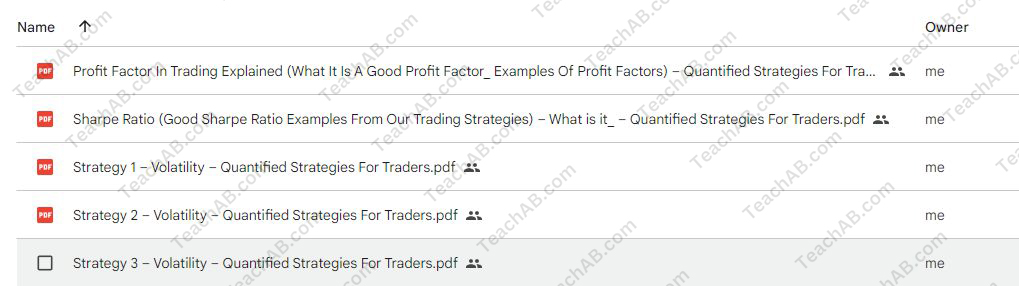

3 Volatility Strategies with Quantified Strategies

$349.00 Original price was: $349.00.$23.00Current price is: $23.00.

File Size: 5.01 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “3 Volatility Strategies with Quantified Strategies” below:

3 Volatility Strategies with Quantified Strategies

Introduction

In the dynamic world of trading, understanding and leveraging volatility can lead to significant gains. We explore three quantified strategies designed to help traders not just survive but thrive in volatile markets. Each strategy is backed by data-driven insights, providing a robust foundation for making informed trading decisions.

Understanding Market Volatility

Before diving into the strategies, it’s crucial to grasp what market volatility is and why it matters. Volatility refers to the rate at which the price of a security increases or decreases for a given set of returns. High volatility means that a security’s price can change dramatically over a short period in either direction, which can be both an opportunity and a risk.

Why Trade Volatility?

Trading volatility offers the potential for high returns, especially when markets are unpredictable. By mastering volatility trading strategies, we can capitalize on market inefficiencies.

Strategy 1: The Mean Reversion Setup

The mean reversion theory is based on the premise that prices and returns eventually move back towards the mean or average. This strategy is particularly effective in volatile markets.

How to Implement the Mean Reversion Strategy

- Identify Overextended Prices: Look for prices that have moved significantly away from their historical averages.

- Setup Entry and Exit Points: Use technical indicators to determine when to enter and exit trades.

- Risk Management: Set stop-loss orders to manage potential losses effectively.

Tools and Indicators

- Bollinger Bands

- Moving Average Convergence Divergence (MACD)

- Relative Strength Index (RSI)

Strategy 2: The Breakout Strategy

This strategy capitalizes on moments when the price breaks out from its existing range or pattern, often due to increased volatility.

Implementing the Breakout Strategy

- Identify Key Levels: Focus on levels of support and resistance.

- Wait for the Breakout: Enter the trade when the price moves beyond these levels.

- Follow Through: Ensure the breakout is supported by high volume, indicating strength.

Key Considerations

- False breakouts can occur, so it’s important to confirm breakouts with additional signals.

Strategy 3: The Momentum Ignition Strategy

Momentum ignition strategies aim to capitalize on the acceleration of an asset’s price movement in a particular direction.

Steps to Execute the Momentum Ignition Strategy

- Identify Momentum Build-Up: Look for signs that the price is about to make a big move.

- Entry Strategy: Enter the trade after confirming the momentum direction.

- Monitoring and Exit: Monitor the trade closely and exit at pre-defined profit targets.

Effective Tools for Momentum Trading

- Stochastic Oscillator

- Average Directional Index (ADI)

Integrating Advanced Technology

Leveraging advanced technology such as algorithmic trading can enhance the effectiveness of these strategies by increasing execution speed and minimizing errors.

Algorithmic Trading and Its Benefits

- Speed: Faster order execution.

- Precision: Accurate entry and exit points.

- Consistency: Reduces human emotional involvement.

Conclusion

Understanding and implementing these three volatility trading strategies can significantly enhance your trading performance. Whether it’s the mean reversion, the breakout strategy, or momentum ignition, each has its unique approach to capitalizing on market movements. With the right tools and a disciplined approach, these strategies offer a pathway to potential profitability in volatile markets.

FAQs

- What is market volatility? Market volatility refers to the fluctuation in the price of securities within a short period.

- Which volatility strategy is best for beginners? The mean reversion strategy is often recommended for beginners due to its straightforward approach.

- How important is risk management in volatility trading? Extremely important; it helps mitigate potential losses during unexpected market movements.

- Can these strategies be automated? Yes, all three strategies can be automated using algorithmic trading systems.

- How do I test these strategies without risking capital? Simulated trading or paper trading platforms allow for risk-free strategy testing.

Be the first to review “3 Volatility Strategies with Quantified Strategies” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.