-

×

Harmonic Multi-Patterns with Scan Watchlist for Thinkorswim and Mobile

1 × $6.00

Harmonic Multi-Patterns with Scan Watchlist for Thinkorswim and Mobile

1 × $6.00 -

×

Options Masterclass with WallStreet Trapper

1 × $13.00

Options Masterclass with WallStreet Trapper

1 × $13.00 -

×

Instant Profits System with Bill Poulos

1 × $6.00

Instant Profits System with Bill Poulos

1 × $6.00 -

×

Robotic trading interactive

1 × $31.00

Robotic trading interactive

1 × $31.00 -

×

Trading in the Shadow of the Smart Money with Gavin Holmes

1 × $6.00

Trading in the Shadow of the Smart Money with Gavin Holmes

1 × $6.00 -

×

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

New Generation Market Profile (May 2014)

1 × $15.00

New Generation Market Profile (May 2014)

1 × $15.00 -

×

Three Point Reversal Method of Point & Figure Stock Market Trading with A.W.Cohen

1 × $6.00

Three Point Reversal Method of Point & Figure Stock Market Trading with A.W.Cohen

1 × $6.00 -

×

Open Trader Pro Training

1 × $23.00

Open Trader Pro Training

1 × $23.00 -

×

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

1 × $6.00

Hamzei Analytics Indicators for eSignal (hamzeianalytics.com)

1 × $6.00 -

×

GMB Master Academy

1 × $31.00

GMB Master Academy

1 × $31.00 -

×

Trading on the Edge with Guido J.Deboeck

1 × $6.00

Trading on the Edge with Guido J.Deboeck

1 × $6.00 -

×

Managing Your Goals with Alec MacKenzie

1 × $6.00

Managing Your Goals with Alec MacKenzie

1 × $6.00 -

×

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00 -

×

The Econometrics of Macroeconomic Modelling with Gunnar Bardsen

1 × $6.00

The Econometrics of Macroeconomic Modelling with Gunnar Bardsen

1 × $6.00 -

×

Options Trading Training – The Blend Dc with Charles Cottle

1 × $4.00

Options Trading Training – The Blend Dc with Charles Cottle

1 × $4.00 -

×

Trading Protege / Inner Circle Course - 9 DVDs + Manual 2004

1 × $6.00

Trading Protege / Inner Circle Course - 9 DVDs + Manual 2004

1 × $6.00 -

×

Multi-Squeeze Indicator For TOS

1 × $31.00

Multi-Squeeze Indicator For TOS

1 × $31.00 -

×

The New Reality Of Wall Street with Donald Coxe

1 × $6.00

The New Reality Of Wall Street with Donald Coxe

1 × $6.00 -

×

Bodhi, Lighthouse, Truckin by Brian James Sklenka

1 × $6.00

Bodhi, Lighthouse, Truckin by Brian James Sklenka

1 × $6.00 -

×

The Dick Davis Dividend: Straight Talk on Making Money from 40 Years on Wall Street with Dick Davis

1 × $6.00

The Dick Davis Dividend: Straight Talk on Making Money from 40 Years on Wall Street with Dick Davis

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00 -

×

Astrology At Work & Others

1 × $6.00

Astrology At Work & Others

1 × $6.00 -

×

Trading Options Using Auction Market Principles with Alexander Trading

1 × $54.00

Trading Options Using Auction Market Principles with Alexander Trading

1 × $54.00 -

×

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00 -

×

Best & Simple Forex day trading strategy with Forex day trading

1 × $5.00

Best & Simple Forex day trading strategy with Forex day trading

1 × $5.00 -

×

MOJO TOOLBOX with ProTrader Mike

1 × $23.00

MOJO TOOLBOX with ProTrader Mike

1 × $23.00 -

×

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00 -

×

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00 -

×

Earnings Power Play with Dave Aquino

1 × $15.00

Earnings Power Play with Dave Aquino

1 × $15.00 -

×

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00 -

×

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00 -

×

The Stock Investor's Pocket Calculator with Michael Thomsett

1 × $6.00

The Stock Investor's Pocket Calculator with Michael Thomsett

1 × $6.00 -

×

TechnicalProsperity - Red Package

1 × $15.00

TechnicalProsperity - Red Package

1 × $15.00 -

×

Momentum Signals Training Course with Fulcum Trader

1 × $5.00

Momentum Signals Training Course with Fulcum Trader

1 × $5.00 -

×

Tomorrow Hot New Indicators (Video) with Thomas Demark

1 × $6.00

Tomorrow Hot New Indicators (Video) with Thomas Demark

1 × $6.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

Real Options in Practice with Marion A.Brach

1 × $6.00

Real Options in Practice with Marion A.Brach

1 × $6.00 -

×

Mastering The Markets

1 × $4.00

Mastering The Markets

1 × $4.00 -

×

BGFX Trading Academy

1 × $5.00

BGFX Trading Academy

1 × $5.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

Price Action and Orderflow Course with Young Tilopa

1 × $17.00

Price Action and Orderflow Course with Young Tilopa

1 × $17.00 -

×

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00 -

×

eASCTrend Pro 6.0 Video Tutorials with Ablesys

1 × $6.00

eASCTrend Pro 6.0 Video Tutorials with Ablesys

1 × $6.00 -

×

VXX Made Easy By Option Pit

1 × $62.00

VXX Made Easy By Option Pit

1 × $62.00 -

×

Investors Live Textbook Trading DVD

1 × $15.00

Investors Live Textbook Trading DVD

1 × $15.00 -

×

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00 -

×

High Probability Continuation and Reversal Patterns

1 × $23.00

High Probability Continuation and Reversal Patterns

1 × $23.00 -

×

Options Foundations Class

1 × $23.00

Options Foundations Class

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Trader’s Book of Volume with Mark Leibovit

1 × $6.00

The Trader’s Book of Volume with Mark Leibovit

1 × $6.00 -

×

Ron Ianieri – Advanced Options Strategies

1 × $6.00

Ron Ianieri – Advanced Options Strategies

1 × $6.00 -

×

Option Buying Course

1 × $5.00

Option Buying Course

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00 -

×

ICT Charter 2020 with Inner Circle Trader

1 × $13.00

ICT Charter 2020 with Inner Circle Trader

1 × $13.00 -

×

Tape Reading - Learn how to read the tape for day trading with Jose Casanova

1 × $15.00

Tape Reading - Learn how to read the tape for day trading with Jose Casanova

1 × $15.00 -

×

Tradeonix Trading System

1 × $31.00

Tradeonix Trading System

1 × $31.00 -

×

SnD SMC Course

1 × $10.00

SnD SMC Course

1 × $10.00 -

×

Onyx Trade House

1 × $7.00

Onyx Trade House

1 × $7.00 -

×

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Forex 800k Workshop with Spartan Trader

1 × $23.00

Forex 800k Workshop with Spartan Trader

1 × $23.00 -

×

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00 -

×

Market Wizards with Jack Schwager

1 × $6.00

Market Wizards with Jack Schwager

1 × $6.00 -

×

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00 -

×

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00 -

×

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00 -

×

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00 -

×

Trading Forecasts Manual with Yuri Shramenko

1 × $4.00

Trading Forecasts Manual with Yuri Shramenko

1 × $4.00 -

×

Fast Track Forex Course

1 × $62.00

Fast Track Forex Course

1 × $62.00 -

×

Essentials Home Study Kit with J.L.Lord - Random Walk Trading

1 × $23.00

Essentials Home Study Kit with J.L.Lord - Random Walk Trading

1 × $23.00 -

×

Quantum Swing Trader

1 × $6.00

Quantum Swing Trader

1 × $6.00 -

×

Trading Forex With Market Profile

1 × $15.00

Trading Forex With Market Profile

1 × $15.00 -

×

DOM Trading Boot Camp with MasterClass Trader

1 × $5.00

DOM Trading Boot Camp with MasterClass Trader

1 × $5.00 -

×

Harmonic Pattern Detection Indicator

1 × $6.00

Harmonic Pattern Detection Indicator

1 × $6.00 -

×

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00 -

×

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Advanced Trading Course with John Person

1 × $6.00

Advanced Trading Course with John Person

1 × $6.00 -

×

Timing Solution Advanced Build February 2014

1 × $15.00

Timing Solution Advanced Build February 2014

1 × $15.00 -

×

The Realistic Trader - Crypto Currencies

1 × $31.00

The Realistic Trader - Crypto Currencies

1 × $31.00 -

×

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00 -

×

Position Dissection with Charles Cottle

1 × $4.00

Position Dissection with Charles Cottle

1 × $4.00 -

×

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00 -

×

Ultimate Guide to Stock Investing

1 × $6.00

Ultimate Guide to Stock Investing

1 × $6.00 -

×

The RIMS Strategy 2023

1 × $5.00

The RIMS Strategy 2023

1 × $5.00 -

×

The WallStreet Waltz with Ken Fisher

1 × $6.00

The WallStreet Waltz with Ken Fisher

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00 -

×

The WWA Core Concepts Bootcamp

1 × $6.00

The WWA Core Concepts Bootcamp

1 × $6.00 -

×

Forex Trading Course 101 & 201

1 × $54.00

Forex Trading Course 101 & 201

1 × $54.00 -

×

The BULLFx Forex Trading Course

1 × $5.00

The BULLFx Forex Trading Course

1 × $5.00 -

×

DayTrading the S&P Futures Market with Constance Brown

1 × $6.00

DayTrading the S&P Futures Market with Constance Brown

1 × $6.00 -

×

Boiler Room Trading

1 × $15.00

Boiler Room Trading

1 × $15.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Trading Indicators for the 21th Century

1 × $15.00

Trading Indicators for the 21th Century

1 × $15.00

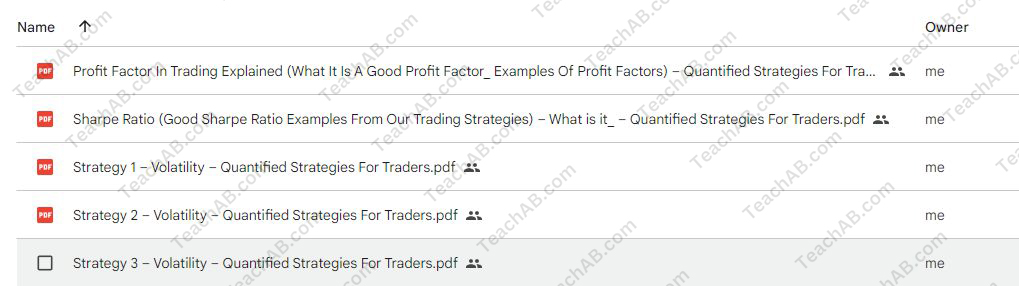

3 Volatility Strategies with Quantified Strategies

$349.00 Original price was: $349.00.$23.00Current price is: $23.00.

File Size: 5.01 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “3 Volatility Strategies with Quantified Strategies” below:

3 Volatility Strategies with Quantified Strategies

Introduction

In the dynamic world of trading, understanding and leveraging volatility can lead to significant gains. We explore three quantified strategies designed to help traders not just survive but thrive in volatile markets. Each strategy is backed by data-driven insights, providing a robust foundation for making informed trading decisions.

Understanding Market Volatility

Before diving into the strategies, it’s crucial to grasp what market volatility is and why it matters. Volatility refers to the rate at which the price of a security increases or decreases for a given set of returns. High volatility means that a security’s price can change dramatically over a short period in either direction, which can be both an opportunity and a risk.

Why Trade Volatility?

Trading volatility offers the potential for high returns, especially when markets are unpredictable. By mastering volatility trading strategies, we can capitalize on market inefficiencies.

Strategy 1: The Mean Reversion Setup

The mean reversion theory is based on the premise that prices and returns eventually move back towards the mean or average. This strategy is particularly effective in volatile markets.

How to Implement the Mean Reversion Strategy

- Identify Overextended Prices: Look for prices that have moved significantly away from their historical averages.

- Setup Entry and Exit Points: Use technical indicators to determine when to enter and exit trades.

- Risk Management: Set stop-loss orders to manage potential losses effectively.

Tools and Indicators

- Bollinger Bands

- Moving Average Convergence Divergence (MACD)

- Relative Strength Index (RSI)

Strategy 2: The Breakout Strategy

This strategy capitalizes on moments when the price breaks out from its existing range or pattern, often due to increased volatility.

Implementing the Breakout Strategy

- Identify Key Levels: Focus on levels of support and resistance.

- Wait for the Breakout: Enter the trade when the price moves beyond these levels.

- Follow Through: Ensure the breakout is supported by high volume, indicating strength.

Key Considerations

- False breakouts can occur, so it’s important to confirm breakouts with additional signals.

Strategy 3: The Momentum Ignition Strategy

Momentum ignition strategies aim to capitalize on the acceleration of an asset’s price movement in a particular direction.

Steps to Execute the Momentum Ignition Strategy

- Identify Momentum Build-Up: Look for signs that the price is about to make a big move.

- Entry Strategy: Enter the trade after confirming the momentum direction.

- Monitoring and Exit: Monitor the trade closely and exit at pre-defined profit targets.

Effective Tools for Momentum Trading

- Stochastic Oscillator

- Average Directional Index (ADI)

Integrating Advanced Technology

Leveraging advanced technology such as algorithmic trading can enhance the effectiveness of these strategies by increasing execution speed and minimizing errors.

Algorithmic Trading and Its Benefits

- Speed: Faster order execution.

- Precision: Accurate entry and exit points.

- Consistency: Reduces human emotional involvement.

Conclusion

Understanding and implementing these three volatility trading strategies can significantly enhance your trading performance. Whether it’s the mean reversion, the breakout strategy, or momentum ignition, each has its unique approach to capitalizing on market movements. With the right tools and a disciplined approach, these strategies offer a pathway to potential profitability in volatile markets.

FAQs

- What is market volatility? Market volatility refers to the fluctuation in the price of securities within a short period.

- Which volatility strategy is best for beginners? The mean reversion strategy is often recommended for beginners due to its straightforward approach.

- How important is risk management in volatility trading? Extremely important; it helps mitigate potential losses during unexpected market movements.

- Can these strategies be automated? Yes, all three strategies can be automated using algorithmic trading systems.

- How do I test these strategies without risking capital? Simulated trading or paper trading platforms allow for risk-free strategy testing.

Be the first to review “3 Volatility Strategies with Quantified Strategies” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.