-

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The 1st TradingMarkets Trend Following Summit

1 × $54.00

The 1st TradingMarkets Trend Following Summit

1 × $54.00 -

×

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00 -

×

MTI - Scalping Course

1 × $15.00

MTI - Scalping Course

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Folio Management Phenomenon with Gene Walden

1 × $6.00

The Folio Management Phenomenon with Gene Walden

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00 -

×

Workshop Metals Mastery

1 × $23.00

Workshop Metals Mastery

1 × $23.00 -

×

Option Screening. Finding Profitable Trades with Lawrence Gavanagh

1 × $6.00

Option Screening. Finding Profitable Trades with Lawrence Gavanagh

1 × $6.00 -

×

The Conscious Investor: Profiting from the Timeless Value Approach with John Price

1 × $6.00

The Conscious Investor: Profiting from the Timeless Value Approach with John Price

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Iron Condor - Advanced

1 × $31.00

Iron Condor - Advanced

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

TTM Slingshot & Value Charts Indicators

1 × $6.00

TTM Slingshot & Value Charts Indicators

1 × $6.00 -

×

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Ultimate Gann Trading

1 × $15.00

Ultimate Gann Trading

1 × $15.00 -

×

Level 3 - AlgoX Trading Tactics

1 × $31.00

Level 3 - AlgoX Trading Tactics

1 × $31.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Essays of Waren Buffet. Lessons for Corporate America with Lawrence A.Cunningham

1 × $6.00

The Essays of Waren Buffet. Lessons for Corporate America with Lawrence A.Cunningham

1 × $6.00 -

×

Trading Options for Dummies with George Fontanills

1 × $6.00

Trading Options for Dummies with George Fontanills

1 × $6.00 -

×

TrendFund.com – 11 DVDs

1 × $69.00

TrendFund.com – 11 DVDs

1 × $69.00 -

×

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00 -

×

Trends & Trendlines with Albert Yang

1 × $4.00

Trends & Trendlines with Albert Yang

1 × $4.00 -

×

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00 -

×

Big Morning Profits with Base Camp Trading

1 × $4.00

Big Morning Profits with Base Camp Trading

1 × $4.00 -

×

Winter 2016 Ignite Trading Conference (2016)

1 × $23.00

Winter 2016 Ignite Trading Conference (2016)

1 × $23.00 -

×

Elder-disk 1.01 for NinjaTrader7

1 × $6.00

Elder-disk 1.01 for NinjaTrader7

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Encyclopedia Trading Strategies

1 × $6.00

The Encyclopedia Trading Strategies

1 × $6.00 -

×

Beginner Options Trading Class with Bill Johnson

1 × $6.00

Beginner Options Trading Class with Bill Johnson

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

WinXgo + Manual (moneytide.com)

1 × $6.00

WinXgo + Manual (moneytide.com)

1 × $6.00 -

×

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00 -

×

TTW TradeFinder and Bookmap Course with Trading To Win

1 × $10.00

TTW TradeFinder and Bookmap Course with Trading To Win

1 × $10.00 -

×

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Trading on Momentum with Ken Wolff

1 × $6.00

Trading on Momentum with Ken Wolff

1 × $6.00 -

×

Hit & Run Trading II with Jeff Cooper

1 × $4.00

Hit & Run Trading II with Jeff Cooper

1 × $4.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Two Simple Setups For All Markets (Parts 1, 2, 3) with Rob Hoffman

1 × $31.00

Two Simple Setups For All Markets (Parts 1, 2, 3) with Rob Hoffman

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Essential Technical Analysis with Leigh Stevens

1 × $6.00

Essential Technical Analysis with Leigh Stevens

1 × $6.00 -

×

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00 -

×

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00 -

×

Intermediate Options Trading Course

1 × $39.00

Intermediate Options Trading Course

1 × $39.00 -

×

Options University - FX Options Trading Course 2008

1 × $6.00

Options University - FX Options Trading Course 2008

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Winning with Options with Michael Thomsett

1 × $6.00

Winning with Options with Michael Thomsett

1 × $6.00 -

×

Ultimate Breakout

1 × $54.00

Ultimate Breakout

1 × $54.00 -

×

Vertical Spreads. Strategy Intensive

1 × $4.00

Vertical Spreads. Strategy Intensive

1 × $4.00 -

×

TTM Squeeze Clone for eSignal

1 × $6.00

TTM Squeeze Clone for eSignal

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00 -

×

Yuri Shamenko Videos

1 × $5.00

Yuri Shamenko Videos

1 × $5.00 -

×

Bitcoin - Trading – Watch me manage my own account

1 × $8.00

Bitcoin - Trading – Watch me manage my own account

1 × $8.00 -

×

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00 -

×

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00 -

×

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

Unedited Superconference 2010

1 × $15.00

Unedited Superconference 2010

1 × $15.00 -

×

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

Trading NQ At The US Open with TradeSmart

1 × $10.00

Trading NQ At The US Open with TradeSmart

1 × $10.00 -

×

The Ultimate Trading Guide & Code with George Pruitt, John R.Hill

1 × $6.00

The Ultimate Trading Guide & Code with George Pruitt, John R.Hill

1 × $6.00 -

×

Tradeciety Online Forex Trading MasterClass

1 × $5.00

Tradeciety Online Forex Trading MasterClass

1 × $5.00 -

×

Turtle Trading Concepts with Russell Sands

1 × $6.00

Turtle Trading Concepts with Russell Sands

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Trend Trading Course

1 × $15.00

Trend Trading Course

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Video Course with Trading Template

1 × $54.00

Video Course with Trading Template

1 × $54.00 -

×

Tape Reading Small Caps with Jtrader

1 × $23.00

Tape Reading Small Caps with Jtrader

1 × $23.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

Trampoline Trading with Claytrader

1 × $6.00

Trampoline Trading with Claytrader

1 × $6.00 -

×

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00 -

×

Investing Courses Bundle

1 × $31.00

Investing Courses Bundle

1 × $31.00 -

×

The Silver Edge Forex Training Program with T3 Live

1 × $5.00

The Silver Edge Forex Training Program with T3 Live

1 × $5.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

With All Odds Forex System I & II with Barry Thornton

1 × $6.00

With All Odds Forex System I & II with Barry Thornton

1 × $6.00 -

×

ADVANCED Swing Trading Strategy - Forex Trading Stock Trading

1 × $15.00

ADVANCED Swing Trading Strategy - Forex Trading Stock Trading

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00 -

×

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Forex Knight Mentoring Program with Hector Deville

1 × $5.00

Forex Knight Mentoring Program with Hector Deville

1 × $5.00 -

×

Buy the Fear Sell the Greed

1 × $6.00

Buy the Fear Sell the Greed

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Pro Trend Trader 2017 with James Orr

1 × $31.00

Pro Trend Trader 2017 with James Orr

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

Kaizen Pipsology: Forex Mentorship

1 × $8.00

Kaizen Pipsology: Forex Mentorship

1 × $8.00 -

×

The Winning Secret

1 × $23.00

The Winning Secret

1 × $23.00 -

×

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00 -

×

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00 -

×

Zm Capitals Full course + Ebook with Zain Mokhles - ZmCapitals

1 × $31.00

Zm Capitals Full course + Ebook with Zain Mokhles - ZmCapitals

1 × $31.00 -

×

Things You Need To Know About Full Time Trading with Rajandran R

1 × $4.00

Things You Need To Know About Full Time Trading with Rajandran R

1 × $4.00 -

×

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00 -

×

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00 -

×

Trading the Eclipses

1 × $6.00

Trading the Eclipses

1 × $6.00 -

×

Course (Video, PDF, MT4 Indicators)

1 × $6.00

Course (Video, PDF, MT4 Indicators)

1 × $6.00 -

×

The Secret to Extraordinary Wealth in the Options Market - 4 DVDs

1 × $31.00

The Secret to Extraordinary Wealth in the Options Market - 4 DVDs

1 × $31.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00 -

×

The Econometrics of Macroeconomic Modelling with Gunnar Bardsen

1 × $6.00

The Econometrics of Macroeconomic Modelling with Gunnar Bardsen

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

BGFX Trading Academy

1 × $5.00

BGFX Trading Academy

1 × $5.00 -

×

Channel Surfing Video Course

1 × $23.00

Channel Surfing Video Course

1 × $23.00 -

×

TotalTheo 12 Month Mentorship

1 × $54.00

TotalTheo 12 Month Mentorship

1 × $54.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Greatest Trading Tools

1 × $6.00

Greatest Trading Tools

1 × $6.00 -

×

The Forex Legacy

1 × $6.00

The Forex Legacy

1 × $6.00 -

×

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00 -

×

The Fortune Strategy. An Instruction Manual

1 × $6.00

The Fortune Strategy. An Instruction Manual

1 × $6.00 -

×

Ultimate Guide To Swing Trading ETF's

1 × $23.00

Ultimate Guide To Swing Trading ETF's

1 × $23.00 -

×

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00 -

×

Trading Psychology with Barry Burns

1 × $4.00

Trading Psychology with Barry Burns

1 × $4.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00

3 Volatility Strategies with Quantified Strategies

$349.00 Original price was: $349.00.$23.00Current price is: $23.00.

File Size: 5.01 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

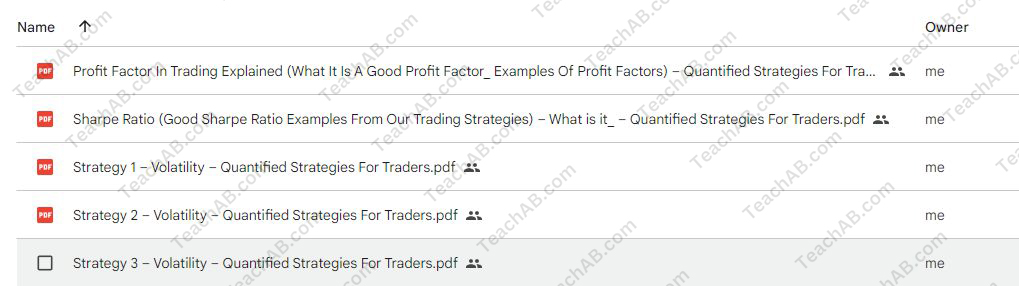

You may check content proof of “3 Volatility Strategies with Quantified Strategies” below:

3 Volatility Strategies with Quantified Strategies

Introduction

In the dynamic world of trading, understanding and leveraging volatility can lead to significant gains. We explore three quantified strategies designed to help traders not just survive but thrive in volatile markets. Each strategy is backed by data-driven insights, providing a robust foundation for making informed trading decisions.

Understanding Market Volatility

Before diving into the strategies, it’s crucial to grasp what market volatility is and why it matters. Volatility refers to the rate at which the price of a security increases or decreases for a given set of returns. High volatility means that a security’s price can change dramatically over a short period in either direction, which can be both an opportunity and a risk.

Why Trade Volatility?

Trading volatility offers the potential for high returns, especially when markets are unpredictable. By mastering volatility trading strategies, we can capitalize on market inefficiencies.

Strategy 1: The Mean Reversion Setup

The mean reversion theory is based on the premise that prices and returns eventually move back towards the mean or average. This strategy is particularly effective in volatile markets.

How to Implement the Mean Reversion Strategy

- Identify Overextended Prices: Look for prices that have moved significantly away from their historical averages.

- Setup Entry and Exit Points: Use technical indicators to determine when to enter and exit trades.

- Risk Management: Set stop-loss orders to manage potential losses effectively.

Tools and Indicators

- Bollinger Bands

- Moving Average Convergence Divergence (MACD)

- Relative Strength Index (RSI)

Strategy 2: The Breakout Strategy

This strategy capitalizes on moments when the price breaks out from its existing range or pattern, often due to increased volatility.

Implementing the Breakout Strategy

- Identify Key Levels: Focus on levels of support and resistance.

- Wait for the Breakout: Enter the trade when the price moves beyond these levels.

- Follow Through: Ensure the breakout is supported by high volume, indicating strength.

Key Considerations

- False breakouts can occur, so it’s important to confirm breakouts with additional signals.

Strategy 3: The Momentum Ignition Strategy

Momentum ignition strategies aim to capitalize on the acceleration of an asset’s price movement in a particular direction.

Steps to Execute the Momentum Ignition Strategy

- Identify Momentum Build-Up: Look for signs that the price is about to make a big move.

- Entry Strategy: Enter the trade after confirming the momentum direction.

- Monitoring and Exit: Monitor the trade closely and exit at pre-defined profit targets.

Effective Tools for Momentum Trading

- Stochastic Oscillator

- Average Directional Index (ADI)

Integrating Advanced Technology

Leveraging advanced technology such as algorithmic trading can enhance the effectiveness of these strategies by increasing execution speed and minimizing errors.

Algorithmic Trading and Its Benefits

- Speed: Faster order execution.

- Precision: Accurate entry and exit points.

- Consistency: Reduces human emotional involvement.

Conclusion

Understanding and implementing these three volatility trading strategies can significantly enhance your trading performance. Whether it’s the mean reversion, the breakout strategy, or momentum ignition, each has its unique approach to capitalizing on market movements. With the right tools and a disciplined approach, these strategies offer a pathway to potential profitability in volatile markets.

FAQs

- What is market volatility? Market volatility refers to the fluctuation in the price of securities within a short period.

- Which volatility strategy is best for beginners? The mean reversion strategy is often recommended for beginners due to its straightforward approach.

- How important is risk management in volatility trading? Extremely important; it helps mitigate potential losses during unexpected market movements.

- Can these strategies be automated? Yes, all three strategies can be automated using algorithmic trading systems.

- How do I test these strategies without risking capital? Simulated trading or paper trading platforms allow for risk-free strategy testing.

Be the first to review “3 Volatility Strategies with Quantified Strategies” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.